7769 W Q Ave Kalamazoo, MI 49009

Estimated Value: $530,000 - $865,000

6

Beds

6

Baths

5,233

Sq Ft

$140/Sq Ft

Est. Value

About This Home

This home is located at 7769 W Q Ave, Kalamazoo, MI 49009 and is currently estimated at $733,128, approximately $140 per square foot. 7769 W Q Ave is a home located in Kalamazoo County with nearby schools including Mattawan Early Elementary School, Mattawan Early Childhood Education Center, and Mattawan Later Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 14, 2018

Sold by

King Anthony

Bought by

King Anthony and King Joanne M

Current Estimated Value

Purchase Details

Closed on

Dec 15, 2009

Sold by

Zealter Fouad H and Awada Zealter Andrea H

Bought by

King Anthony

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$311,600

Outstanding Balance

$201,988

Interest Rate

4.78%

Mortgage Type

New Conventional

Estimated Equity

$531,140

Purchase Details

Closed on

May 16, 2008

Sold by

Zeaiter Fouad H and Zeaiter Margaret L

Bought by

Zeaiter Fouad H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$187,000

Interest Rate

6.3%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| King Anthony | -- | None Available | |

| King Anthony | $389,500 | Chicago Title | |

| Zeaiter Fouad H | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | King Anthony | $311,600 | |

| Previous Owner | Zeaiter Fouad H | $187,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,258 | $294,300 | $0 | $0 |

| 2024 | $2,319 | $265,100 | $0 | $0 |

| 2023 | $2,211 | $237,000 | $0 | $0 |

| 2022 | $6,593 | $211,600 | $0 | $0 |

| 2021 | $6,405 | $202,800 | $0 | $0 |

| 2020 | $6,200 | $206,600 | $0 | $0 |

| 2019 | $5,659 | $186,200 | $0 | $0 |

| 2018 | $3,871 | $190,100 | $0 | $0 |

| 2017 | -- | $196,200 | $0 | $0 |

| 2016 | -- | $192,100 | $0 | $0 |

| 2015 | -- | $180,700 | $26,700 | $154,000 |

| 2014 | -- | $180,700 | $0 | $0 |

Source: Public Records

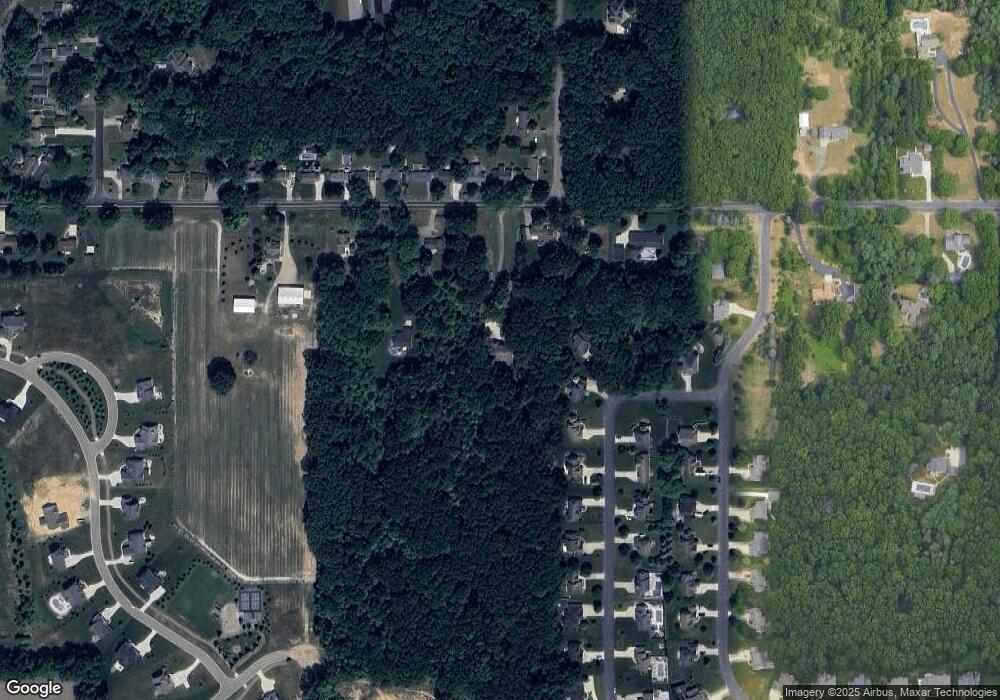

Map

Nearby Homes

- 7876 Turning Stone

- 8020 Turning Stone

- 8155 Interlochen St

- 7899 Turning Stone

- 7426 Texas Heights Ave

- 8167 Turning Stone

- 8197 Turning Stone

- 8114 Turning Stone

- 7542 Northport Ave Unit 38

- 8244 W Q Ave

- 8272 Bainbridge Dr

- 7875 Port Hope Dr Unit 13

- 7207 Coreopsis Cove

- 7414 Field Bay Ave Unit 12

- 7148 Texas Heights Ave

- 429 W Crooked Lake Dr

- 8450 W Pq Ave

- 7721 5th St

- 7331 Bentwood Trail

- 8532 Brighten Trail