77882 Woodhaven Dr S Unit 427 Palm Desert, CA 92211

Palm Desert Country NeighborhoodEstimated Value: $492,000 - $511,000

2

Beds

3

Baths

1,808

Sq Ft

$278/Sq Ft

Est. Value

About This Home

This home is located at 77882 Woodhaven Dr S Unit 427, Palm Desert, CA 92211 and is currently estimated at $503,051, approximately $278 per square foot. 77882 Woodhaven Dr S Unit 427 is a home located in Riverside County with nearby schools including Ronald Reagan Elementary School, Colonel Mitchell Paige Middle School, and Palm Desert High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 8, 2017

Sold by

Trachtenbarg Mark Edward and Trachtenbarg Christine Jo

Bought by

Trachtenbarg Christine A and Edward Trachtenbarg M

Current Estimated Value

Purchase Details

Closed on

Apr 16, 2004

Sold by

Stevenson Robert W

Bought by

Trachtenbarg Mark Edward and Trachtenbarg Christine Jo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$257,600

Outstanding Balance

$107,066

Interest Rate

4%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$395,985

Purchase Details

Closed on

Jun 16, 2000

Sold by

Sorensen Stephen L and Sorensen Judith L

Bought by

Stevenson Robert W and Stevenson Diane R

Purchase Details

Closed on

Nov 3, 1999

Sold by

Rosenblum Seymour A and Rosenblum Demetra

Bought by

Sorensen Stephen L and Sorensen Judith L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,400

Interest Rate

3.45%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Trachtenbarg Christine A | -- | Lawyers Title | |

| Trachtenbarg Mark Edward | $322,000 | Chicago Title Co | |

| Stevenson Robert W | $230,000 | Chicago Title Co | |

| Sorensen Stephen L | $163,000 | Old Republic Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Trachtenbarg Mark Edward | $257,600 | |

| Previous Owner | Sorensen Stephen L | $130,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,940 | $457,790 | $137,333 | $320,457 |

| 2023 | $5,940 | $440,015 | $132,001 | $308,014 |

| 2022 | $5,671 | $431,388 | $129,413 | $301,975 |

| 2021 | $4,651 | $349,961 | $104,870 | $245,091 |

| 2020 | $4,226 | $318,147 | $95,337 | $222,810 |

| 2019 | $4,114 | $308,880 | $92,560 | $216,320 |

| 2018 | $3,971 | $297,000 | $89,000 | $208,000 |

| 2017 | $3,779 | $280,000 | $84,000 | $196,000 |

| 2016 | $3,804 | $282,000 | $85,000 | $197,000 |

| 2015 | $3,821 | $278,000 | $83,000 | $195,000 |

| 2014 | $4,002 | $292,000 | $88,000 | $204,000 |

Source: Public Records

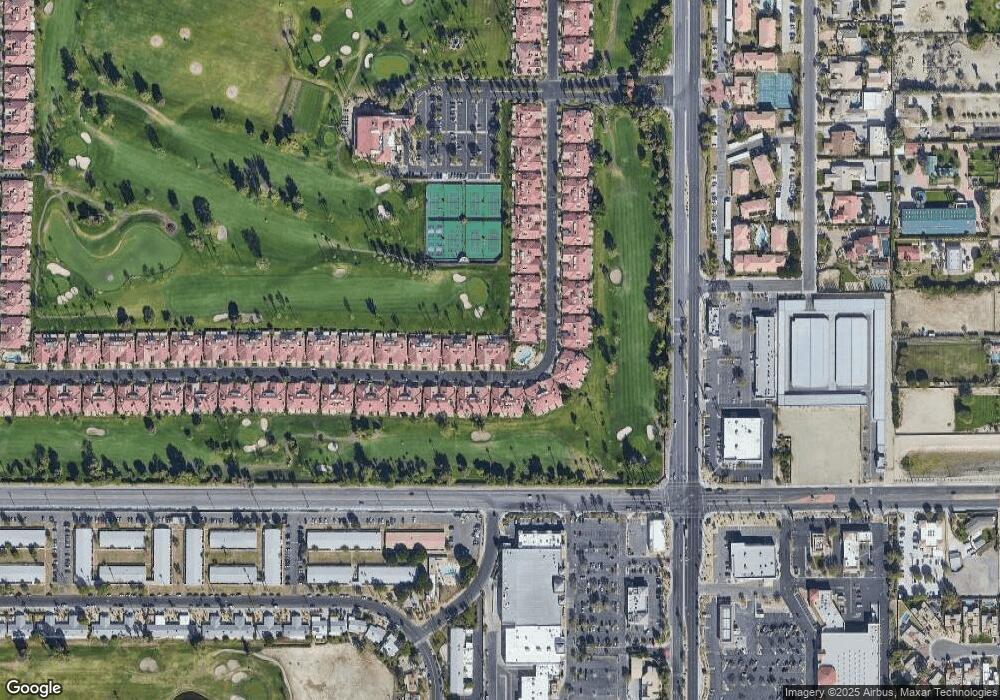

Map

Nearby Homes

- 77774 Woodhaven Dr S

- 41644 Woodhaven Dr E

- 41457 Woodhaven Dr E

- 41690 Woodhaven Dr W

- 77583 Woodhaven Dr S Unit 832

- 0 Sparkey Way

- 41525 Woodhaven Dr W

- 41410 Woodhaven Dr W Unit 715

- 77650 California Dr

- 77630 California Dr

- 41823 Preston Trail

- 78179 Sombrero Ct

- 77704 Woodhaven Dr N

- 77590 California Dr

- 78150 Calico Glen Dr

- 78135 Calico Glen Dr

- 77620 Woodhaven Dr N

- 77575 California Dr

- 41456 Resorter Blvd

- 42605 Byron Place

- 77878 Woodhaven Dr S

- 77888 Woodhaven Dr S

- 77874 Woodhaven Dr S

- 77870 Woodhaven Dr S Unit 424

- 41821 Woodhaven Dr E Unit 21

- 77866 Woodhaven Dr S

- 41807 Woodhaven Dr E

- 77866 S Woohaven S

- 41793 Woodhaven Dr E

- 77860 Woodhaven Dr S

- 41781 Woodhaven Dr E

- 77854 Woodhaven Dr S Unit 421

- 41771 Woodhaven Dr E

- 77881 Woodhaven Dr S

- 77883 Woodhaven Dr S

- 77887 Woodhaven Dr S

- 77879 Woodhaven Dr S

- 77891 Woodhaven Dr S

- 77897 Woodhaven Dr S

- 41763 Woodhaven Dr E Unit 26