78 Terra Vista Dana Point, CA 92629

Dana Hills NeighborhoodEstimated Value: $896,000 - $1,290,000

2

Beds

2

Baths

1,191

Sq Ft

$866/Sq Ft

Est. Value

About This Home

This home is located at 78 Terra Vista, Dana Point, CA 92629 and is currently estimated at $1,031,609, approximately $866 per square foot. 78 Terra Vista is a home located in Orange County with nearby schools including John Malcom Elementary School, Marco Forster Middle School, and Dana Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 1, 2005

Sold by

Care Sarah Jane

Bought by

Stacy Dennis and Stacy Mary Jane

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$488,000

Interest Rate

2%

Mortgage Type

Negative Amortization

Purchase Details

Closed on

Dec 18, 2003

Sold by

Bernheisel Donald P and Bernheisel Donna P

Bought by

Care Trevor E and The Trevor E Care Living Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$315,000

Interest Rate

3.45%

Mortgage Type

Balloon

Purchase Details

Closed on

Apr 30, 2002

Sold by

Bernheisel Donald P and Bernheisel Donna P

Bought by

Bernheisel Donald P and Bernheisel Donna P

Purchase Details

Closed on

Jun 11, 1999

Sold by

Klein Wesley A and Klein Darlena S

Bought by

Bernheisel Donald P and Bernheisel Donna P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,000

Interest Rate

4.35%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stacy Dennis | $610,000 | Multiple | |

| Care Trevor E | $420,000 | First Southwestern Title Co | |

| Bernheisel Donald P | -- | -- | |

| Bernheisel Donald P | $240,000 | United Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Stacy Dennis | $488,000 | |

| Previous Owner | Care Trevor E | $315,000 | |

| Previous Owner | Bernheisel Donald P | $190,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,282 | $833,607 | $641,267 | $192,340 |

| 2024 | $8,282 | $817,262 | $628,693 | $188,569 |

| 2023 | $6,162 | $608,634 | $459,268 | $149,366 |

| 2022 | $6,045 | $596,700 | $450,262 | $146,438 |

| 2021 | $5,928 | $585,000 | $441,433 | $143,567 |

| 2020 | $5,930 | $585,000 | $441,433 | $143,567 |

| 2019 | $6,065 | $585,000 | $441,433 | $143,567 |

| 2018 | $6,225 | $585,000 | $441,433 | $143,567 |

| 2017 | $5,618 | $534,000 | $390,433 | $143,567 |

| 2016 | $4,933 | $457,000 | $313,433 | $143,567 |

| 2015 | $4,835 | $457,000 | $313,433 | $143,567 |

| 2014 | $4,859 | $457,000 | $313,433 | $143,567 |

Source: Public Records

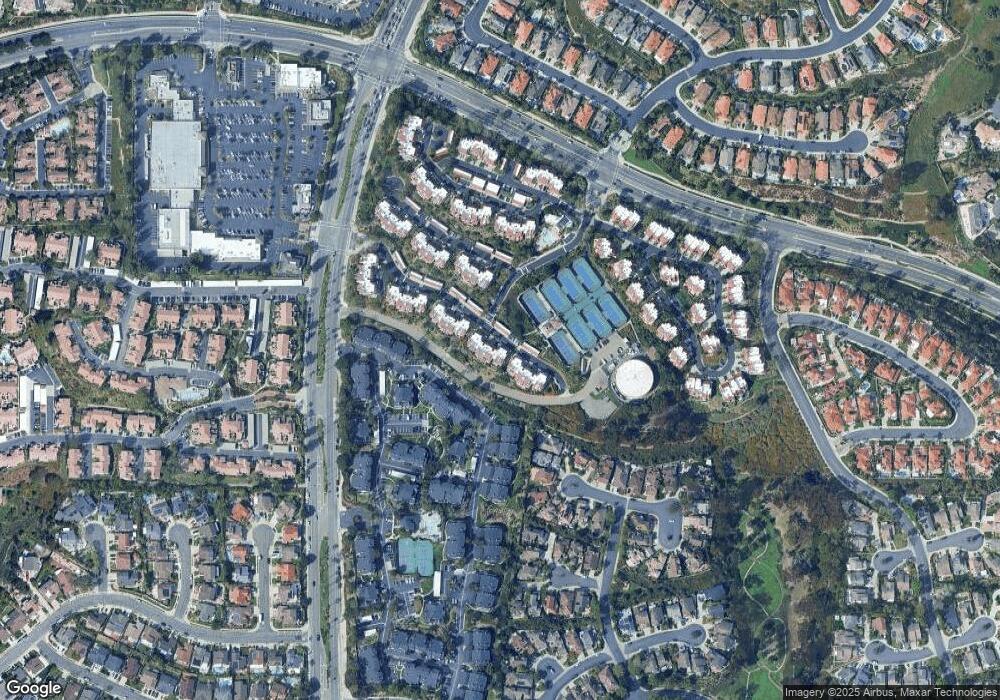

Map

Nearby Homes

- 46 Terra Vista

- 31 La Paloma

- 24 Bright Water Dr

- 15 Glastonbury Place

- 94 Shorebreaker Dr

- 24 Costa Brava

- 226 Shorebreaker Dr

- 9 Pembroke Ln

- 33072 Ocean Ridge

- 5 Old Ranch Rd

- 33121 Ocean Ridge

- 2 High Bluff

- 11 High Bluff

- 33144 Ocean Ridge

- 2 Point Catalina

- 1 Pacifico

- 32862 Bluffside Dr

- 5 Ebony Glade

- 25392 Neptune Dr

- 35 Emerald Glen

- 66 Terra Vista

- 70 Terra Vista

- 68 Terra Vista

- 60 Terra Vista Unit 113

- 64 Terra Vista Unit 129

- 62 Terra Vista

- 72 Terra Vista

- 84 Terra Vista Unit 139

- 76 Terra Vista

- 54 Terra Vista Unit 115

- 58 Terra Vista

- 56 Terra Vista

- 86 Terra Vista

- 44 Terra Vista

- 42 Terra Vista Unit 118

- 50 Terra Vista

- 48 Terra Vista

- 52 Terra Vista

- 40 Terra Vista Unit 103

- 34 Terra Vista