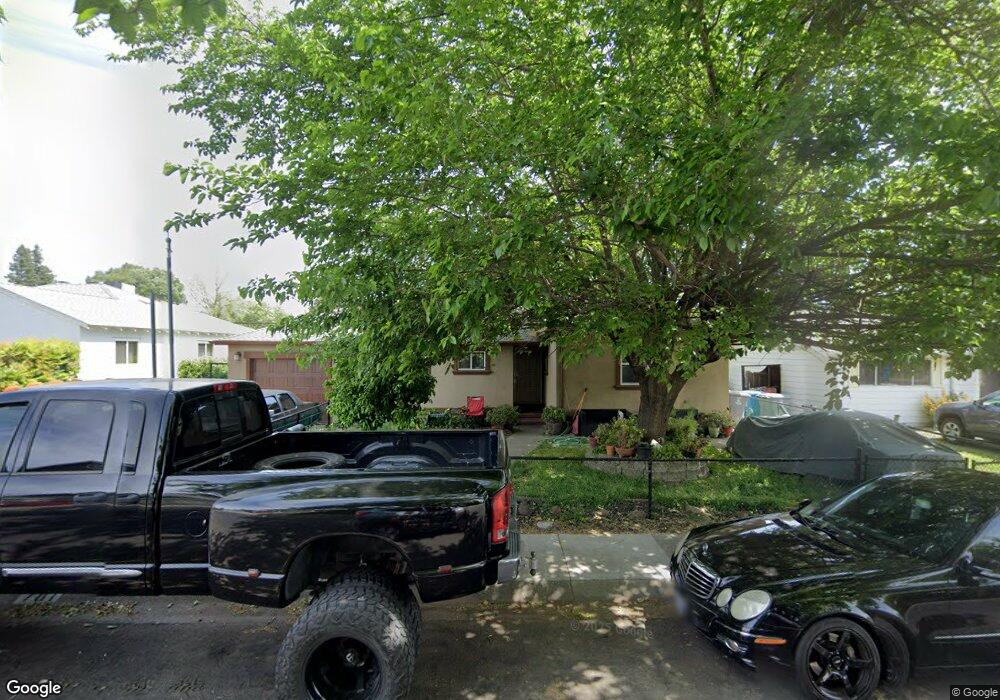

781 Azalea Way Vacaville, CA 95688

Estimated Value: $524,878 - $560,000

3

Beds

1

Bath

1,407

Sq Ft

$391/Sq Ft

Est. Value

About This Home

This home is located at 781 Azalea Way, Vacaville, CA 95688 and is currently estimated at $549,720, approximately $390 per square foot. 781 Azalea Way is a home located in Solano County with nearby schools including Alamo Elementary School, Orchard Elementary School, and Willis Jepson Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 4, 2017

Sold by

Graham Terry M

Bought by

Graham Terry Michael and Terry Michael Graham Trust

Current Estimated Value

Purchase Details

Closed on

Jul 23, 2014

Sold by

Graham Terry M

Bought by

Graham Terry M and Cefalu Michael

Purchase Details

Closed on

Jul 15, 2011

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Graham Terry M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,650

Outstanding Balance

$95,848

Interest Rate

4.46%

Mortgage Type

New Conventional

Estimated Equity

$453,872

Purchase Details

Closed on

Mar 31, 2011

Sold by

Leon Jose L and Leon Elizabeth

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Mar 8, 2004

Sold by

Overton Betty and Carson Rickie

Bought by

Leon Jose L and Leon Elizabeth

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$230,000

Interest Rate

5.5%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Graham Terry Michael | -- | None Available | |

| Graham Terry M | $550,000 | None Available | |

| Graham Terry M | $147,000 | Lsi Title Company | |

| Federal Home Loan Mortgage Corporation | $127,719 | Accommodation | |

| Leon Jose L | $287,500 | Fidelity Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Graham Terry M | $139,650 | |

| Previous Owner | Leon Jose L | $230,000 | |

| Closed | Leon Jose L | $57,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,108 | $269,860 | $88,349 | $181,511 |

| 2024 | $3,108 | $264,569 | $86,617 | $177,952 |

| 2023 | $3,035 | $259,382 | $84,919 | $174,463 |

| 2022 | $2,957 | $254,297 | $83,255 | $171,042 |

| 2021 | $2,962 | $249,312 | $81,623 | $167,689 |

| 2020 | $2,923 | $246,757 | $80,787 | $165,970 |

| 2019 | $2,838 | $238,978 | $79,203 | $159,775 |

| 2018 | $2,806 | $234,293 | $77,650 | $156,643 |

| 2017 | $2,713 | $229,700 | $76,128 | $153,572 |

| 2016 | $2,696 | $225,197 | $74,636 | $150,561 |

| 2015 | $2,992 | $221,815 | $73,515 | $148,300 |

| 2014 | $1,727 | $150,620 | $46,108 | $104,512 |

Source: Public Records

Map

Nearby Homes

- 721 Camellia Way

- 680 S Orchard Ave

- 818 Lovers Ln

- 569 Alamo Dr

- 970 El Camino Ave Unit 3

- 0 Merchant St Unit 325089259

- 149 Fairoaks Dr

- 571 Nottingham Dr

- 376 Bishop Dr

- 491 Buck Ave

- 149 Mason St

- 253 W Kendal St

- 101 Main St

- 124 Main St

- 100 Ramona St

- 0 Cernon St Unit 325065048

- 491 Rosso Ct

- 365 Acacia St

- 0 Parker St Unit 324045416

- 325 Gabiano Ct

- 771 Azalea Way

- 791 Azalea Way

- 780 Camellia Way

- 770 Camellia Way

- 761 Azalea Way

- 790 Camellia Way

- 780 Azalea Way

- 770 Azalea Way

- 760 Camellia Way

- 790 Azalea Way

- 751 Azalea Way

- 599 Albacete Dr

- 760 Azalea Way

- 800 Camellia Way

- 750 Camellia Way

- 750 Azalea Way

- 741 Azalea Way

- 781 S Orchard Ave

- 791 Camellia Way