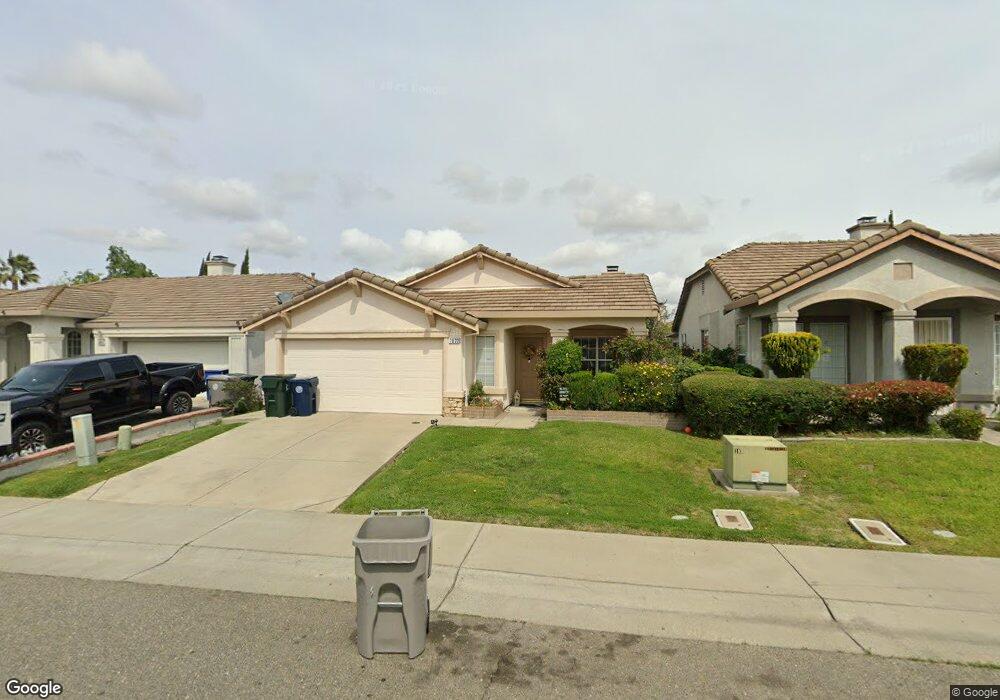

7833 Calzada Way Elk Grove, CA 95758

North Laguna NeighborhoodEstimated Value: $468,896 - $530,000

3

Beds

2

Baths

1,329

Sq Ft

$376/Sq Ft

Est. Value

About This Home

This home is located at 7833 Calzada Way, Elk Grove, CA 95758 and is currently estimated at $499,474, approximately $375 per square foot. 7833 Calzada Way is a home located in Sacramento County with nearby schools including Irene B. West Elementary School, Edward Harris Jr. Middle School, and Monterey Trail High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 28, 2003

Sold by

Ralls Ernest J

Bought by

Murphy Ronald D and Murphy Christine D

Current Estimated Value

Purchase Details

Closed on

Nov 20, 2000

Sold by

Mata Raul M and Mata Nila C

Bought by

Ralls Ernest J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,000

Interest Rate

7.86%

Purchase Details

Closed on

Oct 21, 1999

Sold by

J & L Properties

Bought by

Mata Raul M and Mata Nila C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$77,950

Interest Rate

7.75%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Murphy Ronald D | $240,000 | First American Title Company | |

| Ralls Ernest J | -- | First American Title Company | |

| Ralls Ernest J | $175,000 | First American Title Ins Co | |

| Mata Raul M | $156,000 | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ralls Ernest J | $110,000 | |

| Previous Owner | Mata Raul M | $77,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,879 | $347,577 | $57,921 | $289,656 |

| 2024 | $3,879 | $340,763 | $56,786 | $283,977 |

| 2023 | $3,779 | $334,082 | $55,673 | $278,409 |

| 2022 | $3,713 | $327,532 | $54,582 | $272,950 |

| 2021 | $3,669 | $321,111 | $53,512 | $267,599 |

| 2020 | $3,617 | $317,820 | $52,964 | $264,856 |

| 2019 | $3,551 | $311,589 | $51,926 | $259,663 |

| 2018 | $3,454 | $305,480 | $50,908 | $254,572 |

| 2017 | $3,392 | $299,491 | $49,910 | $249,581 |

| 2016 | $3,220 | $293,620 | $48,932 | $244,688 |

| 2015 | $3,044 | $278,038 | $46,335 | $231,703 |

| 2014 | $2,892 | $262,300 | $43,712 | $218,588 |

Source: Public Records

Map

Nearby Homes

- 7400 Shasta Ave

- 0 Shasta Ave

- 8465 Viborg Ln

- 8461 Viborg Ln

- 8457 Viborg Ln

- 8464 Viborg Ln

- 8460 Viborg Ln

- 8456 Viborg Ln

- Plan 3 at Camellia Place

- Plan 1 at Camellia Place

- Plan 2 at Camellia Place

- Plan 1 at Courtyards at Cotton - Courtyards at Cotton Lane

- 7715 Cotton Ln

- 220 Cicero Cir

- 130 Bywell Bridge Cir

- 7481 Splendid Way

- 6880 Calvine Rd

- 6892 Calvine Rd

- 6856 Calvine Rd

- 18 Seasmoke Place

- 7837 Calzada Way

- 7829 Calzada Way

- 7825 Calzada Way

- 7841 Calzada Way

- 8539 Tambor Way

- 8543 Tambor Way

- 8535 Tambor Way

- 8547 Tambor Way

- 7832 Calzada Way

- 7845 Calzada Way

- 7821 Calzada Way

- 7828 Calzada Way

- 8531 Tambor Way

- 7836 Calzada Way

- 7824 Calzada Way

- 8551 Tambor Way

- 7840 Calzada Way

- 8525 Tambor Way

- 7849 Calzada Way

- 7820 Calzada Way