7897 Red Fox Trail Unit 39 Morrow, OH 45152

Hamilton Township NeighborhoodEstimated Value: $801,000 - $984,000

4

Beds

3

Baths

4,059

Sq Ft

$215/Sq Ft

Est. Value

About This Home

This home is located at 7897 Red Fox Trail Unit 39, Morrow, OH 45152 and is currently estimated at $871,041, approximately $214 per square foot. 7897 Red Fox Trail Unit 39 is a home located in Warren County with nearby schools including Little Miami Early Childhood Center, Little Miami Intermediate Middle School, and Little Miami Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 17, 2002

Sold by

Craft David

Bought by

Mills Bruce W and Mills Bridgette A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$367,800

Outstanding Balance

$157,818

Interest Rate

7.16%

Mortgage Type

New Conventional

Estimated Equity

$713,223

Purchase Details

Closed on

Dec 14, 2000

Sold by

Slate Timothy

Bought by

Craft David D and Craft Elena M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$386,400

Interest Rate

7.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 28, 1998

Sold by

Original Inc

Bought by

Slate Timothy W and Slate Teresa M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$227,150

Interest Rate

6.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 5, 1997

Sold by

Bairnsfather Michael

Bought by

Original Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$750,000

Interest Rate

7.93%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mills Bruce W | $459,750 | -- | |

| Craft David D | $483,000 | -- | |

| Slate Timothy W | $59,900 | -- | |

| Original Inc | $239,197 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mills Bruce W | $367,800 | |

| Previous Owner | Craft David D | $386,400 | |

| Previous Owner | Slate Timothy W | $227,150 | |

| Previous Owner | Original Inc | $750,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $10,102 | $227,350 | $55,760 | $171,590 |

| 2023 | $8,986 | $180,575 | $28,532 | $152,043 |

| 2022 | $8,886 | $180,576 | $28,532 | $152,044 |

| 2021 | $8,470 | $180,576 | $28,532 | $152,044 |

| 2020 | $8,066 | $146,811 | $23,198 | $123,613 |

| 2019 | $8,201 | $146,811 | $23,198 | $123,613 |

| 2018 | $8,011 | $146,811 | $23,198 | $123,613 |

| 2017 | $7,400 | $135,860 | $21,487 | $114,373 |

| 2016 | $7,579 | $135,860 | $21,487 | $114,373 |

| 2015 | $7,574 | $135,860 | $21,487 | $114,373 |

| 2014 | $7,848 | $124,340 | $20,370 | $103,970 |

| 2013 | $7,693 | $153,500 | $23,200 | $130,300 |

Source: Public Records

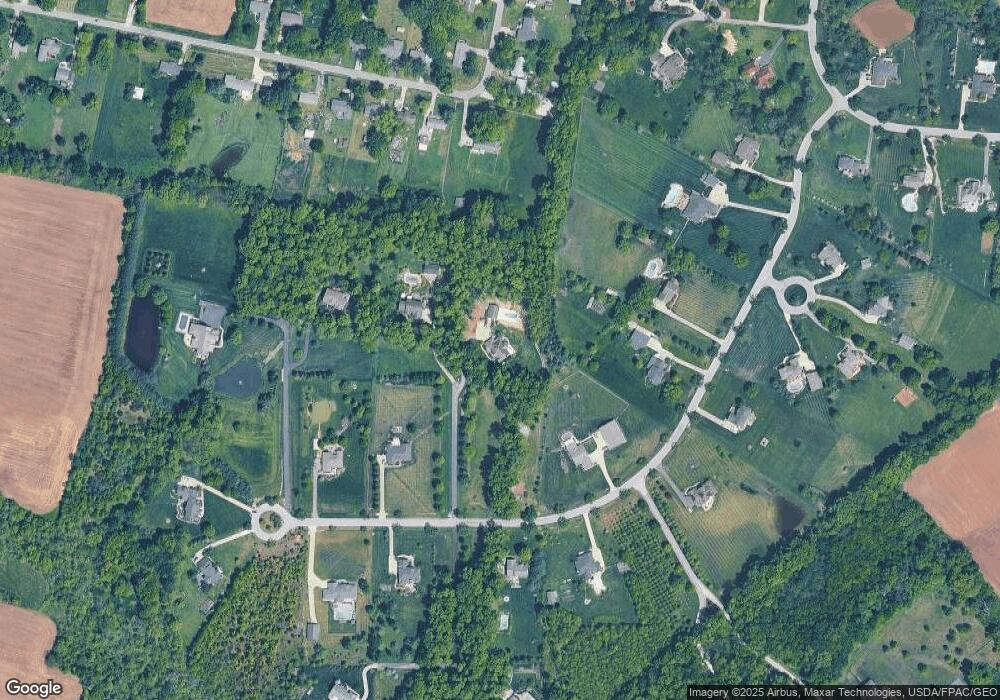

Map

Nearby Homes

- Lot 3003 Morrow-Cozaddale Rd

- Lot 3001 Morrow-Cozaddale Rd

- 3797 E Foster-Maineville Rd

- 4054 E Foster Maineville Rd

- 2594 Ireland Rd

- 0 Morrow Cozaddale Rd Unit 1857301

- DaVinci Plan at Salt Run Preserve - Maple Street Collection

- Charles Plan at Salt Run Preserve - Designer Collection

- Yosemite Plan at Salt Run Preserve - Maple Street Collection

- Emmett Plan at Salt Run Preserve - Designer Collection

- Breckenridge Plan at Salt Run Preserve - Maple Street Collection

- Carrington Plan at Salt Run Preserve - Designer Collection

- Grandin Plan at Salt Run Preserve - Designer Collection

- Cumberland Plan at Salt Run Preserve - Maple Street Collection

- Harper Plan at Salt Run Preserve - Maple Street Collection

- Winston Plan at Salt Run Preserve - Designer Collection

- Magnolia Plan at Salt Run Preserve - Designer Collection

- Wyatt Plan at Salt Run Preserve - Designer Collection

- Blair Plan at Salt Run Preserve - Designer Collection

- Calvin Plan at Salt Run Preserve - Designer Collection

- 7897 Red Fox Trail

- 7897 Red Fox Trail

- 7899 Red Fox Trail

- 2.6ac Red Fox Trail

- 0 Red Fox Trail Unit 49 1098751

- 0 Red Fox Trail Unit 903237

- 7919 Red Fox Trail

- 7763 Red Fox Trail

- 7973 Red Fox Trail

- 7735 Red Fox Trail

- 3243 Shamrock Dr

- 7949 Red Fox Trail

- 3223 Shamrock Dr

- 7898 Red Fox Trail

- 7848 Red Fox Trail

- 3205 Shamrock Dr

- 7689 Red Fox Trail

- 7876 Red Fox Trail

- 3187 Shamrock Dr

- 7920 Red Fox Trail