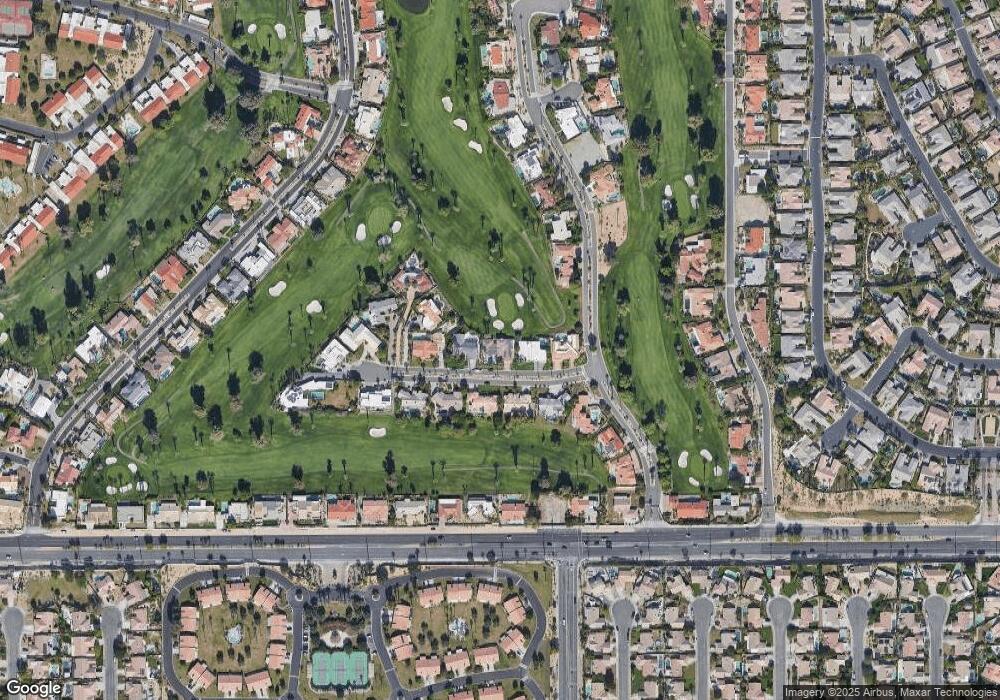

79420 4 Paths Ln Bermuda Dunes, CA 92203

Bermuda Dunes Country Club NeighborhoodEstimated Value: $762,000 - $967,000

2

Beds

3

Baths

3,498

Sq Ft

$256/Sq Ft

Est. Value

About This Home

This home is located at 79420 4 Paths Ln, Bermuda Dunes, CA 92203 and is currently estimated at $893,934, approximately $255 per square foot. 79420 4 Paths Ln is a home located in Riverside County with nearby schools including James Monroe Elementary School, Colonel Mitchell Paige Middle School, and Palm Desert High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 15, 2024

Sold by

Ahlstrom Wayne and Ahlstrom Amy

Bought by

Ahlstrom Wayne and Ahlstrom Amy

Current Estimated Value

Purchase Details

Closed on

May 27, 2020

Sold by

Usco Llc

Bought by

Ahistrom Wayne and Ahistrom Amy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$450,000

Interest Rate

3.2%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 1, 2001

Sold by

Leggett Henry H and Leggett Dawn B

Bought by

Usco Llc

Purchase Details

Closed on

Jun 8, 1999

Sold by

Adams Norma C

Bought by

Leggett Henry and Leggett Dawn

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ahlstrom Wayne | -- | None Listed On Document | |

| Ahistrom Wayne | $500,000 | Fidelity National Title | |

| Usco Llc | -- | -- | |

| Leggett Henry | $385,000 | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ahistrom Wayne | $450,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,529 | $541,212 | $37,886 | $503,326 |

| 2023 | $6,529 | $520,200 | $36,414 | $483,786 |

| 2022 | $6,277 | $510,000 | $35,700 | $474,300 |

| 2021 | $6,155 | $500,000 | $35,000 | $465,000 |

| 2020 | $7,304 | $599,328 | $199,773 | $399,555 |

| 2019 | $7,162 | $587,577 | $195,856 | $391,721 |

| 2018 | $7,023 | $576,057 | $192,016 | $384,041 |

| 2017 | $6,877 | $564,762 | $188,251 | $376,511 |

| 2016 | $6,706 | $553,689 | $184,560 | $369,129 |

| 2015 | $6,732 | $545,375 | $181,789 | $363,586 |

| 2014 | $6,617 | $534,694 | $178,229 | $356,465 |

Source: Public Records

Map

Nearby Homes

- 79371 Four Paths Ln

- 79321 4 Paths Ln

- 43651 Port Maria Rd

- 43721 Port Maria Rd

- 43761 Port Maria Rd

- 43460 Old Harbour Dr

- 43761 Chapelton Dr

- 79738 Parkway Esplanade S

- 43309 Parkway Esplanade W

- 79422 Montego Bay Dr

- 43337 Lacovia Dr

- 79397 Horizon Palms Cir

- 79818 Parkway Esplanade S

- 43265 Lacovia Dr

- 43229 Lacovia Dr

- 44555 Marguerite Ct

- 79336 Montego Bay Dr

- 43539 Corte Del Oro

- 79140 Fred Waring Dr

- 79294 Montego Bay Dr Unit 9

- 79420 Four Paths Ln

- 79360 4 Paths Ln

- 79400 Four Paths Ln

- 79440 Four Paths Ln

- 79411 Four Paths Ln

- 79431 Four Paths Ln

- 79380 Four Paths Ln

- 43705 Old Harbour Dr

- 79391 Four Paths Ln

- 79370 Four Paths Ln

- 79451 Four Paths Ln

- 0 Four Paths Ln

- 0 Four Paths Ln Unit 214003693

- 0 Four Path

- 0 4 Paths Ln

- 79360 Four Paths Ln

- 43651 Old Harbour Dr

- 43751 Old Harbour Dr

- 0 Old Harbour Dr Unit 218029740

- 0 Old Harbour Dr Unit 215026696

Your Personal Tour Guide

Ask me questions while you tour the home.