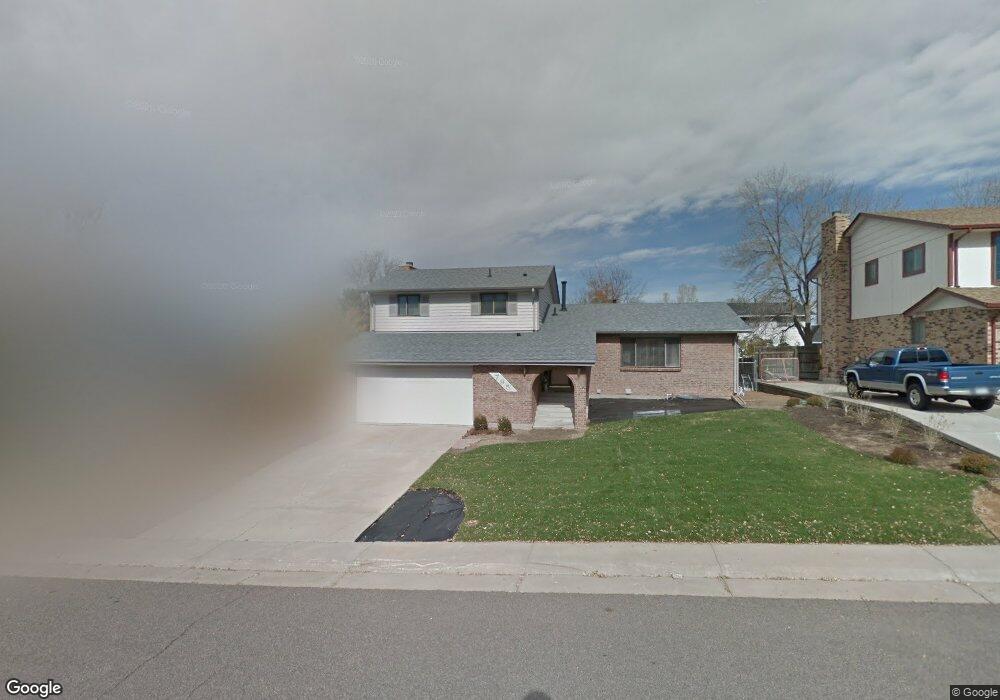

795 Mercury Cir Lone Tree, CO 80124

Estimated Value: $522,417 - $575,000

3

Beds

3

Baths

1,664

Sq Ft

$330/Sq Ft

Est. Value

About This Home

This home is located at 795 Mercury Cir, Lone Tree, CO 80124 and is currently estimated at $548,709, approximately $329 per square foot. 795 Mercury Cir is a home located in Douglas County with nearby schools including Acres Green Elementary School, Cresthill Middle School, and Highlands Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 28, 2002

Sold by

Anderson David C and Anderson Clare A

Bought by

Weinreis Sharon K

Current Estimated Value

Purchase Details

Closed on

Oct 26, 1993

Sold by

Williams Norman K and Williams Janet Rae

Bought by

Anderson David C and Anderson Clare A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,595

Interest Rate

6.83%

Purchase Details

Closed on

May 26, 1987

Sold by

Williams Norman K and Williams Janet Rae

Bought by

Williams Norman K and Williams Jan

Purchase Details

Closed on

May 9, 1980

Sold by

Unavailable

Bought by

Unavailable

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Weinreis Sharon K | $222,900 | -- | |

| Anderson David C | $115,900 | Commonwealth Land Title | |

| Williams Norman K | -- | -- | |

| Unavailable | $71,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Anderson David C | $106,595 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,570 | $34,570 | $6,780 | $27,790 |

| 2024 | $2,570 | $38,390 | $7,930 | $30,460 |

| 2023 | $2,596 | $38,390 | $7,930 | $30,460 |

| 2022 | $1,778 | $26,930 | $6,730 | $20,200 |

| 2021 | $1,851 | $26,930 | $6,730 | $20,200 |

| 2020 | $1,745 | $26,470 | $6,350 | $20,120 |

| 2019 | $1,751 | $26,470 | $6,350 | $20,120 |

| 2018 | $1,291 | $22,450 | $5,530 | $16,920 |

| 2017 | $1,312 | $22,450 | $5,530 | $16,920 |

| 2016 | $1,010 | $19,450 | $3,890 | $15,560 |

| 2015 | $1,033 | $19,450 | $3,890 | $15,560 |

| 2014 | $405 | $16,380 | $3,980 | $12,400 |

Source: Public Records

Map

Nearby Homes

- 8852 Chestnut Hill Ln

- 13134 Deneb Dr

- 7057 Chestnut Hill St

- 8159 Lodgepole Trail

- 8046 Lodgepole Trail

- 6887 Chestnut Hill St

- 357 Saturn Place

- 13617 Leo Ct

- 9308 Miles Dr Unit 5

- 9471 Burlington Ln

- 9233 Princeton St

- 6482 Silver Mesa Dr Unit B

- 9426 Princeton Cir

- 219 Dianna Dr

- 181 Dianna Dr

- 8666 Ainsdale Ct Unit 12B

- 130 Dianna Dr

- 8822 Fiesta Terrace

- 8860 Kachina Way

- 8356 Green Island Cir