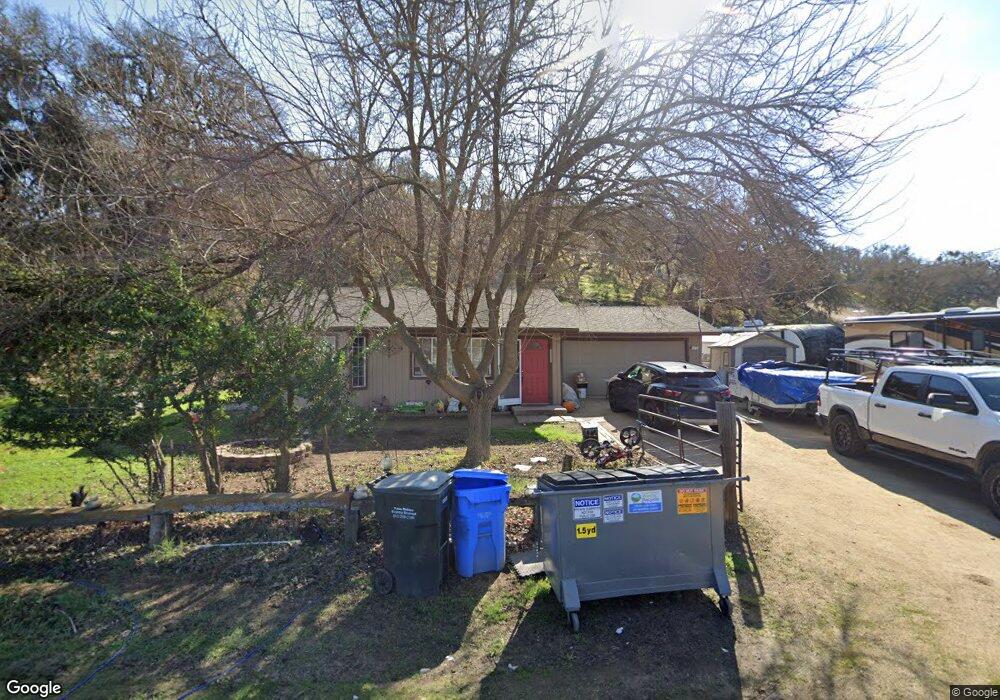

7950 Blue Moon Rd Paso Robles, CA 93446

Estimated Value: $559,927 - $770,000

2

Beds

1

Bath

900

Sq Ft

$735/Sq Ft

Est. Value

About This Home

This home is located at 7950 Blue Moon Rd, Paso Robles, CA 93446 and is currently estimated at $661,732, approximately $735 per square foot. 7950 Blue Moon Rd is a home located in San Luis Obispo County with nearby schools including Kermit King Elementary School, Daniel Lewis Middle School, and Paso Robles High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 2, 2003

Sold by

Thomas William Herbert and Thomas Paula Jean

Bought by

Lindquist Joseph D and Bugge Jan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$209,600

Outstanding Balance

$88,507

Interest Rate

5.17%

Mortgage Type

Unknown

Estimated Equity

$573,225

Purchase Details

Closed on

Jul 7, 1997

Sold by

Thor Devin R and Thor Marybeth

Bought by

Thomas William Herbert and Thomas Paula Jean

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,200

Interest Rate

7.58%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lindquist Joseph D | $262,000 | Fidelity Title Company | |

| Thomas William Herbert | $110,000 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lindquist Joseph D | $209,600 | |

| Previous Owner | Thomas William Herbert | $112,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,941 | $372,491 | $227,478 | $145,013 |

| 2024 | $3,870 | $365,188 | $223,018 | $142,170 |

| 2023 | $3,870 | $358,029 | $218,646 | $139,383 |

| 2022 | $3,804 | $351,009 | $214,359 | $136,650 |

| 2021 | $3,916 | $344,127 | $210,156 | $133,971 |

| 2020 | $3,691 | $340,600 | $208,002 | $132,598 |

| 2019 | $3,619 | $333,923 | $203,924 | $129,999 |

| 2018 | $3,548 | $327,376 | $199,926 | $127,450 |

| 2017 | $3,322 | $320,957 | $196,006 | $124,951 |

| 2016 | $3,054 | $295,000 | $180,000 | $115,000 |

| 2015 | $2,763 | $267,000 | $165,000 | $102,000 |

| 2014 | $2,611 | $257,000 | $155,000 | $102,000 |

Source: Public Records

Map

Nearby Homes

- 1175 Moon Valley Way

- 5884 Black Tail Place

- 0 Black Tail Place Unit NS25191159

- 5668 Silverado Place

- 1690 Buck Way

- 5940 Forked Horn Place

- 5930 Forked Horn Place

- 5920 Forked Horn Place

- 5645 Prancing Deer Place

- 5680 Forked Horn Place

- 888 Camino Vina

- 5385 Morning Star Place

- 2495 Maverick Way

- 5325 Morning Star Place

- 7240 Iverson Place

- 7050 Shale Rock Rd

- 0 Maverick Way Unit NS25217169

- 0 Maverick Way Unit NS25217148

- 4 Maverick Way

- 3 Maverick Way

- 7990 Blue Moon Rd

- 7915 Blue Moon Rd

- 7905 Blue Moon Rd

- 7945 Blue Moon Rd

- 7935 Blue Moon Rd

- 7985 Blue Moon Rd

- 7810 Blue Moon Rd

- 1450 Blue Oak Ln

- 7870 Blue Moon Rd

- 7910 Blue Moon Rd

- 7875 Blue Moon Rd

- 7835 Blue Moon Rd

- 1725 Geneseo Rd

- 1420 Moon Valley Way

- 7915 Whispering Trail

- 7955 Whispering Trails Place

- 7885 Whispering Trails Place

- 7995 Whispering Trails Place

- 1565 Geneseo Rd

- 7865 Whispering Trails Place