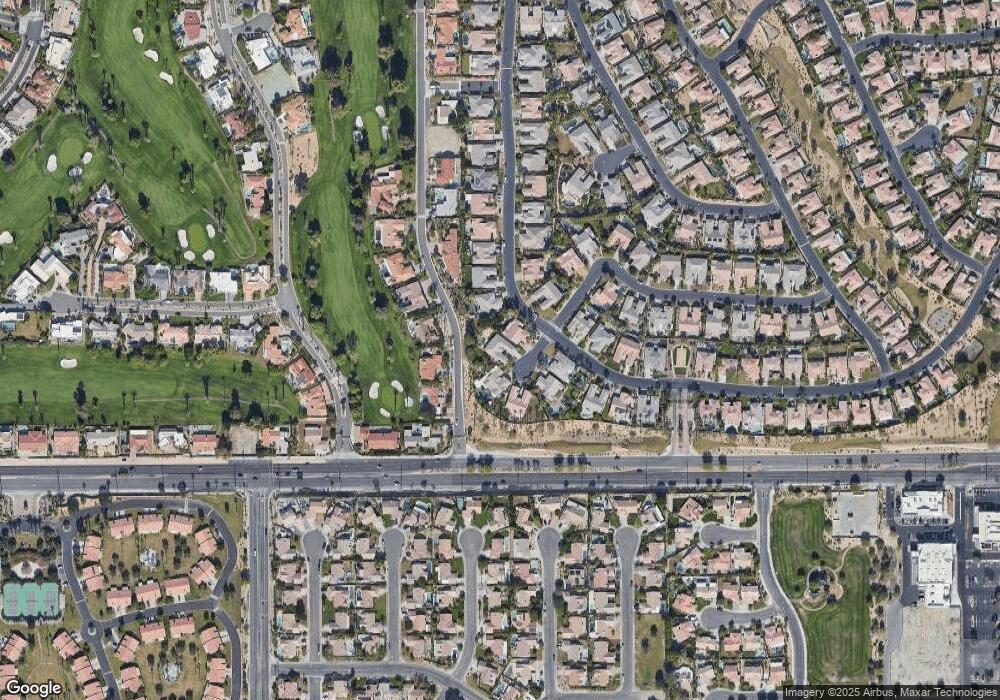

79640 Corte Bella La Quinta, CA 92253

Bermuda Dunes Country Club NeighborhoodEstimated Value: $834,094 - $940,000

4

Beds

3

Baths

3,067

Sq Ft

$292/Sq Ft

Est. Value

About This Home

This home is located at 79640 Corte Bella, La Quinta, CA 92253 and is currently estimated at $894,524, approximately $291 per square foot. 79640 Corte Bella is a home located in Riverside County with nearby schools including James Monroe Elementary School, Colonel Mitchell Paige Middle School, and Palm Desert High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 5, 2010

Sold by

Reo Properties Two Lp

Bought by

Campbell Colin E and Campbell Brenda J

Current Estimated Value

Purchase Details

Closed on

Nov 24, 2009

Sold by

Stagner Mark and Stagner Kim

Bought by

Reo Properties Two Lp

Purchase Details

Closed on

Jun 13, 2005

Sold by

Rakipi Rexhep and Rakipi Nexhmije

Bought by

Stagner Mark and Stagner Kim

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$554,900

Interest Rate

5.25%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 8, 2003

Sold by

Ponderosa Homes Ii Inc

Bought by

Rakipi Rexhep and Rakipi Nexhmije

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

4.62%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Campbell Colin E | $420,000 | Investors Title Company | |

| Reo Properties Two Lp | $329,328 | Accommodation | |

| Stagner Mark | $700,000 | Orange Coast Title Company | |

| Rakipi Rexhep | $402,500 | Stewart Title Of Ca Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Stagner Mark | $554,900 | |

| Previous Owner | Rakipi Rexhep | $150,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,263 | $542,125 | $135,526 | $406,599 |

| 2023 | $7,263 | $521,075 | $130,264 | $390,811 |

| 2022 | $6,870 | $510,859 | $127,710 | $383,149 |

| 2021 | $6,711 | $500,843 | $125,206 | $375,637 |

| 2020 | $6,589 | $495,709 | $123,923 | $371,786 |

| 2019 | $6,459 | $485,991 | $121,494 | $364,497 |

| 2018 | $6,326 | $476,462 | $119,113 | $357,349 |

| 2017 | $6,211 | $467,121 | $116,778 | $350,343 |

| 2016 | $6,075 | $457,963 | $114,489 | $343,474 |

| 2015 | $6,096 | $451,086 | $112,770 | $338,316 |

| 2014 | $5,998 | $442,252 | $110,562 | $331,690 |

Source: Public Records

Map

Nearby Homes

- 43761 Port Maria Rd

- 44150 Sweet Bush Ln

- 79725 Corte Nuevo

- 44215 Goldenrod Cir

- 43501 Parkway Esplanade W

- 44345 Willow Cir

- 43539 Corte Del Oro

- 79321 Four Paths Ln

- 79925 Corte Calero

- 79846 Amora Dr

- 43251 Corte Del Oro

- 79752 Morris Ave

- 79825 Independence Way

- 79843 Castille Dr

- 79859 Castille Dr

- 79624 Morning Glory Ct

- 79528 Morning Glory Ct

- 79835 Parkway Esplanade N

- 44800 Calle Santa Barbara

- 79541 Morning Glory Ct

- 79650 Corte Bella

- 79630 Corte Bella

- 43821 Parkway Esplanade W

- 43821 Parkway Esplanade S

- 79635 Corte Bella

- 43801 Port Maria Rd

- 43789 Parkway Esplanade W

- 79655 Corte Bella

- 43840 Parkway Esplanade W

- 79645 Corte Bella

- 43841 Port Maria Rd

- 43790 Parkway Esplanade W

- 79690 Parkway Esplanade S

- 43721 Port Maria Rd

- 43757 Parkway Esplanade W

- 43690 Port Maria Rd

- 79706 Parkway Esplanade S

- 79703 Parkway Esplanade S

- 43955 Port Maria Rd

- 79680 Amalfi Dr