79770 Desert Willow St La Quinta, CA 92253

Estimated Value: $421,000 - $638,000

3

Beds

3

Baths

1,760

Sq Ft

$299/Sq Ft

Est. Value

About This Home

This home is located at 79770 Desert Willow St, La Quinta, CA 92253 and is currently estimated at $525,719, approximately $298 per square foot. 79770 Desert Willow St is a home located in Riverside County with nearby schools including Harry S. Truman Elementary School, La Quinta Middle School, and La Quinta High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 19, 2022

Sold by

Walker Shane Keith

Bought by

Shane Keith Walker Revocable Living Trust

Current Estimated Value

Purchase Details

Closed on

Sep 16, 2002

Sold by

Ziola Robert W and Ziola Tracy A

Bought by

Walker Shane and Walker April

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,948

Interest Rate

6.09%

Purchase Details

Closed on

Dec 12, 2001

Sold by

Dc & Tc Llc

Bought by

Ziola Robert W and Ziola Tracy A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,630

Interest Rate

6.73%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shane Keith Walker Revocable Living Trust | -- | -- | |

| Walker Shane | -- | -- | |

| Walker Shane | $192,000 | Fidelity National Title Co | |

| Ziola Robert W | $143,000 | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Walker Shane | $185,948 | |

| Previous Owner | Ziola Robert W | $130,630 | |

| Closed | Ziola Robert W | $8,719 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,093 | $278,050 | $72,398 | $205,652 |

| 2023 | $4,093 | $267,255 | $69,588 | $197,667 |

| 2022 | $3,737 | $262,016 | $68,224 | $193,792 |

| 2021 | $3,638 | $256,880 | $66,887 | $189,993 |

| 2020 | $3,574 | $254,247 | $66,202 | $188,045 |

| 2019 | $3,501 | $249,262 | $64,904 | $184,358 |

| 2018 | $3,423 | $244,376 | $63,632 | $180,744 |

| 2017 | $3,375 | $239,585 | $62,385 | $177,200 |

| 2016 | $3,335 | $234,888 | $61,162 | $173,726 |

| 2015 | $3,324 | $231,362 | $60,245 | $171,117 |

| 2014 | $3,272 | $226,832 | $59,066 | $167,766 |

Source: Public Records

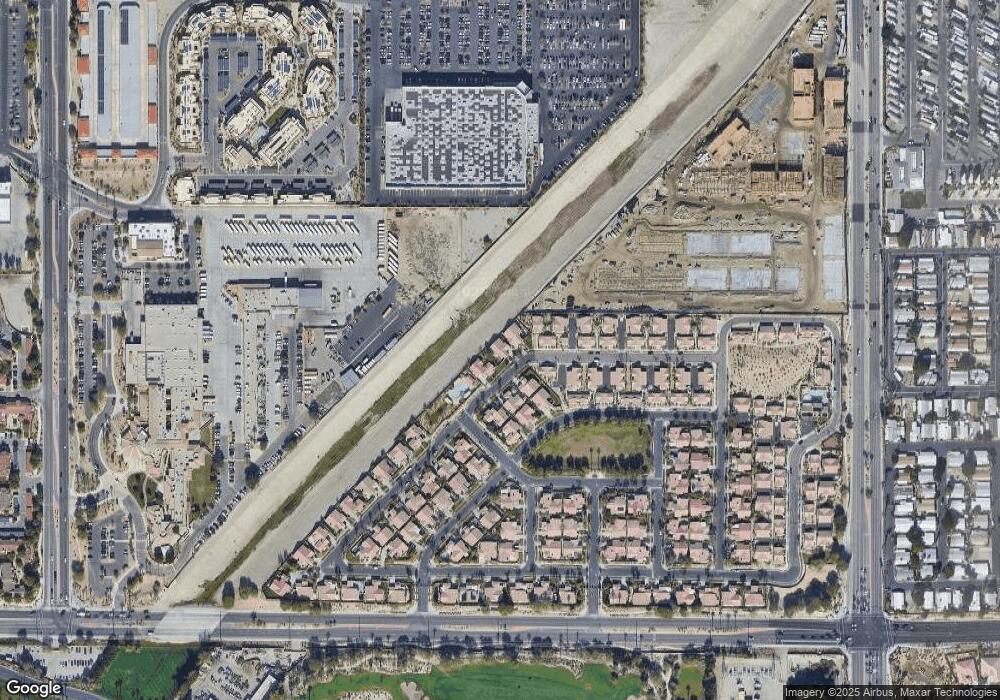

Map

Nearby Homes

- 79770 Mira Flores Blvd

- 79756 Cassia St

- 79760 Rancho la Quinta Dr

- 79840 Rancho la Quinta Dr

- 49500 Seagull

- 49480 Seagull

- 49460 Seagull

- 49400 Seagull

- 48250 Vista Calico

- 80000 Ave 48 Unit 291

- 80000 Avenue 48 Unit 58

- 80000 Ave 48 Unit 163

- 80076 Bridgeport Dr

- 47340 Jefferson St Unit 289

- 47635 Soft Moonlight

- 47615 Soft Moonlight

- 48205 Casita Dr

- 79320 Rose Dawn

- 79967 Rancho la Quinta Dr

- 80394 Avenue 48 Unit 107

- 79780 Desert Willow St

- 79760 Desert Willow St

- 79775 Desert Willow St

- 79765 Desert Willow St

- 79755 Desert Willow St

- 79790 Mira Flores Blvd

- 79780 Mira Flores Blvd

- 79715 Desert Willow St

- 79750 Mira Flores Blvd

- 79700 Desert Willow St

- 79705 Desert Willow St

- 79740 Mira Flores Blvd

- 79690 Desert Willow St

- 47845 Rosemary St

- 79695 Desert Willow St

- 47840 Rosemary St

- 79730 Mira Flores Blvd

- 79735 Mira Flores Blvd

- 79680 Desert Willow St

- 47845 Bougainvillea St