8 Driftway Rd Unit A7 Danbury, CT 06811

Estimated Value: $311,786 - $383,000

2

Beds

2

Baths

1,080

Sq Ft

$316/Sq Ft

Est. Value

About This Home

This home is located at 8 Driftway Rd Unit A7, Danbury, CT 06811 and is currently estimated at $341,697, approximately $316 per square foot. 8 Driftway Rd Unit A7 is a home located in Fairfield County with nearby schools including Mill Ridge Primary School, Rogers Park Middle School, and Danbury High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 22, 2016

Sold by

Tranto Dominick and Tranto Mary

Bought by

Taranto Stepehn

Current Estimated Value

Purchase Details

Closed on

Nov 10, 2010

Sold by

John Edward I Llc

Bought by

Taranto Stephen and Taranto Dominick

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

4.35%

Purchase Details

Closed on

Aug 3, 2010

Sold by

Chfa

Bought by

John Edward 1 Llc

Purchase Details

Closed on

Mar 16, 2010

Sold by

Morcus David J

Bought by

Bac Home Loans Svcng L

Purchase Details

Closed on

Mar 30, 2006

Sold by

Heasley Daniel B

Bought by

Morcus David

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$202,000

Interest Rate

6.32%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Taranto Stepehn | -- | -- | |

| Taranto Stephen | $220,000 | -- | |

| John Edward 1 Llc | $177,000 | -- | |

| Bac Home Loans Svcng L | -- | -- | |

| Morcus David | $253,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Morcus David | $100,000 | |

| Previous Owner | Morcus David | $202,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,882 | $155,330 | $0 | $155,330 |

| 2024 | $3,796 | $155,330 | $0 | $155,330 |

| 2023 | $3,624 | $155,330 | $0 | $155,330 |

| 2022 | $3,324 | $117,800 | $0 | $117,800 |

| 2021 | $3,251 | $117,800 | $0 | $117,800 |

| 2020 | $3,251 | $117,800 | $0 | $117,800 |

| 2019 | $3,251 | $117,800 | $0 | $117,800 |

| 2018 | $3,251 | $117,800 | $0 | $117,800 |

| 2017 | $3,766 | $130,100 | $0 | $130,100 |

| 2016 | $3,731 | $130,100 | $0 | $130,100 |

| 2015 | $3,677 | $130,100 | $0 | $130,100 |

| 2014 | $3,591 | $130,100 | $0 | $130,100 |

Source: Public Records

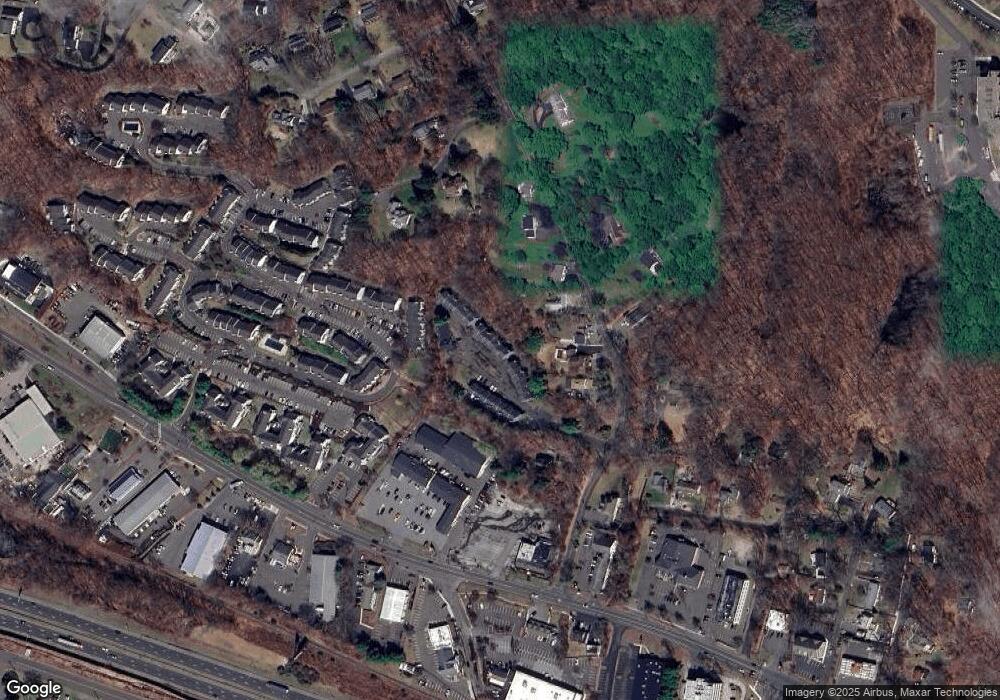

Map

Nearby Homes

- 55 Mill Plain Rd Unit 17-6

- 22 Driftway Rd

- 2 Greenlawn Dr

- 403 Larson Dr

- 12 Boulevard Dr Unit 15-104

- 12 Boulevard Dr Unit 31-172

- 1 Wilderswood Way

- 1603 Briar Woods Ln

- 11 Boulevard Dr Unit 13

- 23 Scuppo Rd Unit 5-7

- 40 Middle River Rd

- 12 Scuppo Rd Unit D4

- 46 Kenosia Ave Unit 30

- 10 Scuppo Rd Unit A13

- 57 Old Ridgebury Rd

- 2 Rolf Dr

- 36 Benson Dr

- 1025 Country View Rd Unit 1025

- 3 Thorncrest Ridge

- 3 Thorncrest Ridge Unit Lot 55

- 8 Driftway Rd Unit B1

- 8 Driftway Rd Unit A8

- 8 Driftway Rd Unit A6

- 8 Driftway Rd Unit A5

- 8 Driftway Rd Unit A4

- 8 Driftway Rd Unit A3

- 8 Driftway Rd Unit E2

- 8 Driftway Rd Unit E1

- 8 Driftway Rd Unit D6

- 8 Driftway Rd Unit D5

- 8 Driftway Rd Unit D4

- 8 Driftway Rd Unit D3

- 8 Driftway Rd Unit D2

- 8 Driftway Rd Unit D1

- 8 Driftway Rd Unit C6

- 8 Driftway Rd Unit A2

- 8 Driftway Rd Unit C5

- 8 Driftway Rd Unit C4

- 8 Driftway Rd Unit C3

- 8 Driftway Rd Unit C2

Your Personal Tour Guide

Ask me questions while you tour the home.