8 Hillside Ct N Unit Lt37 Easton, PA 18045

Estimated Value: $295,634 - $321,000

3

Beds

3

Baths

1,639

Sq Ft

$188/Sq Ft

Est. Value

About This Home

This home is located at 8 Hillside Ct N Unit Lt37, Easton, PA 18045 and is currently estimated at $308,317, approximately $188 per square foot. 8 Hillside Ct N Unit Lt37 is a home located in Northampton County with nearby schools including Tracy Elementary School, Easton Area Middle School, and Easton Area High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 24, 2021

Sold by

Ruby Real Estate Development Llc

Bought by

Aborde Mina and Aborde Joel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$218,500

Outstanding Balance

$197,825

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$110,492

Purchase Details

Closed on

May 9, 2019

Sold by

Skyview Llc

Bought by

Ruby Real Estate Development Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,980,000

Interest Rate

4%

Mortgage Type

Commercial

Purchase Details

Closed on

Aug 28, 2013

Sold by

Cardinal Llc

Bought by

Skyview Llc

Purchase Details

Closed on

Jun 13, 2012

Sold by

Zawarski Taras W and Zawarski Alison J

Bought by

Cardinal Llc

Purchase Details

Closed on

Jun 24, 2011

Sold by

Nic Zawarski & Sons Builders Inc

Bought by

Zawarski Taras W

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Aborde Mina | $230,000 | Associated Abstract Svcs Llc | |

| Ruby Real Estate Development Llc | $1,980,000 | Associated Abstract Svcs Llc | |

| Skyview Llc | $195,000 | None Available | |

| Cardinal Llc | $150,000 | None Available | |

| Zawarski Taras W | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Aborde Mina | $218,500 | |

| Previous Owner | Ruby Real Estate Development Llc | $1,980,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $644 | $59,600 | $0 | $59,600 |

| 2024 | $5,282 | $59,600 | $0 | $59,600 |

| 2023 | $5,188 | $59,600 | $0 | $59,600 |

| 2022 | $5,110 | $59,600 | $0 | $59,600 |

| 2021 | $5,093 | $59,600 | $0 | $59,600 |

| 2020 | $5,090 | $59,600 | $0 | $59,600 |

| 2019 | $7,055 | $83,800 | $0 | $83,800 |

| 2018 | $6,935 | $83,800 | $0 | $83,800 |

| 2017 | $6,771 | $83,800 | $0 | $83,800 |

| 2016 | -- | $83,800 | $0 | $83,800 |

| 2015 | -- | $83,800 | $0 | $83,800 |

| 2014 | -- | $83,800 | $0 | $83,800 |

Source: Public Records

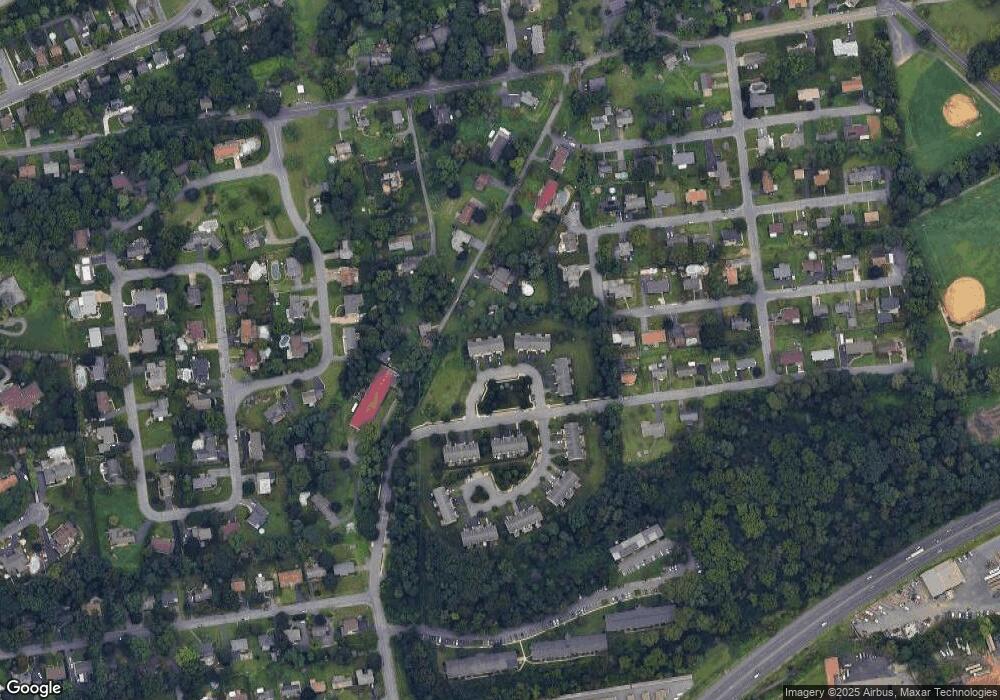

Map

Nearby Homes

- 2221 Kings Ave

- 2215 Kings Ave

- 4 Stonecroft Dr

- 2206 Park Ave

- 2339 Park Ave

- 2400 Lawnherst Ave

- 2247 Fairview Ave

- 60 Clairmont Ave

- 2 Creek View Ct

- 0 Nazareth Rd Unit 698416

- 2860 Old Nazareth Rd

- 42 Clairmont Ave

- 2058 Arndt Rd

- 2850 John St

- 1935 Washington Blvd

- 223 N 16th St

- 43 Saddle Ln

- 2132 Butler St

- 0 Tatamy Rd

- 1906 Hay Terrace

- 6 Hillside Ct N Unit Lt38

- 6 Hillside Ct N

- 4 Hillside Ct N Unit Lt39

- 10 Hillside Ct N

- 2 Hillside Ct N Unit Lt40

- 2 Hillside Ct N

- 12 Hillside Ct N Unit Lt35

- 12 Hillside Ct N

- 14 Hillside Ct N Unit Lt34

- 14 Hillside Ct N

- 16 Hillside Ct N Unit Lt33

- 614 Haymont St

- 18 Hillside Ct N Unit Lt32

- 18 Hillside Ct N

- 1 Haymont St

- 20 Hillside Ct N

- 20 Hillside Ct N Unit Lt31

- 22 Hillside Ct N

- 24 Hillside Ct N

- 13 Kings Ave