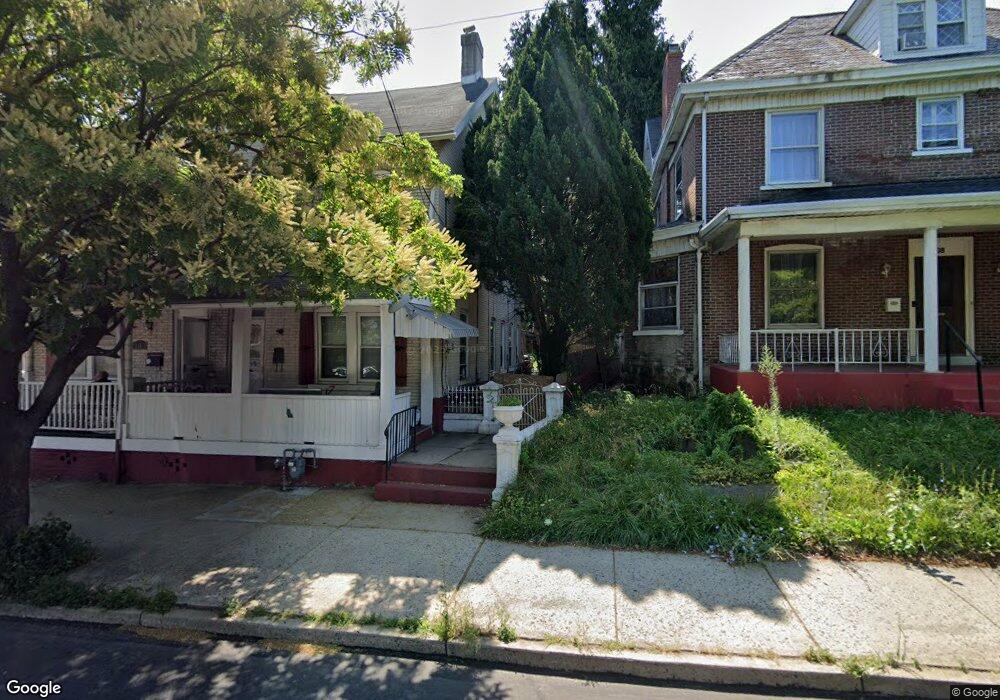

802 Broadway Bethlehem, PA 18015

Downtown Bethlehem NeighborhoodEstimated Value: $206,000 - $240,059

3

Beds

1

Bath

1,888

Sq Ft

$121/Sq Ft

Est. Value

About This Home

This home is located at 802 Broadway, Bethlehem, PA 18015 and is currently estimated at $228,515, approximately $121 per square foot. 802 Broadway is a home located in Northampton County with nearby schools including Fountain Hill Elementary School, Broughal Middle School, and Liberty High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 27, 2020

Sold by

Figueroa Cesar F

Bought by

Jimenez Marjorie L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$73,641

Outstanding Balance

$67,418

Interest Rate

5.25%

Mortgage Type

FHA

Estimated Equity

$161,097

Purchase Details

Closed on

Nov 30, 2017

Sold by

Ruiz Leticia M and Figueroa Migdalia J

Bought by

Figueroa Cesar F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$56,745

Interest Rate

3.94%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 1, 1996

Bought by

Fuentis Miguel A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jimenez Marjorie L | $75,000 | Pride Abstract & Setmnt Svcs | |

| Figueroa Cesar F | $58,500 | None Available | |

| Fuentis Miguel A | $59,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jimenez Marjorie L | $73,641 | |

| Previous Owner | Figueroa Cesar F | $56,745 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $343 | $31,800 | $8,300 | $23,500 |

| 2024 | $2,811 | $31,800 | $8,300 | $23,500 |

| 2023 | $2,811 | $31,800 | $8,300 | $23,500 |

| 2022 | $2,789 | $31,800 | $8,300 | $23,500 |

| 2021 | $2,770 | $31,800 | $8,300 | $23,500 |

| 2020 | $2,744 | $31,800 | $8,300 | $23,500 |

| 2019 | $2,734 | $31,800 | $8,300 | $23,500 |

| 2018 | $2,668 | $31,800 | $8,300 | $23,500 |

| 2017 | $2,636 | $31,800 | $8,300 | $23,500 |

| 2016 | -- | $31,800 | $8,300 | $23,500 |

| 2015 | -- | $31,800 | $8,300 | $23,500 |

| 2014 | -- | $31,800 | $8,300 | $23,500 |

Source: Public Records

Map

Nearby Homes

- 524 Fiot St

- 515 N Bishopthorpe St

- 826 Cherokee St

- 708 Cherokee St

- 731 Fiot Ave

- 431 Cherokee St

- 436 Pawnee St

- 1037 Seneca St

- 963 Wyandotte St

- 1019 Delaware Ave

- 424 W 4th St

- 305 W 8th St

- 331 Broadway

- 1106 Broadway

- 419 W 4th St

- 1014 Jeter Ave

- 463 Montclair Ave

- 445 Montclair Ave

- 3899 Route 378

- 1056 Graham St

Your Personal Tour Guide

Ask me questions while you tour the home.