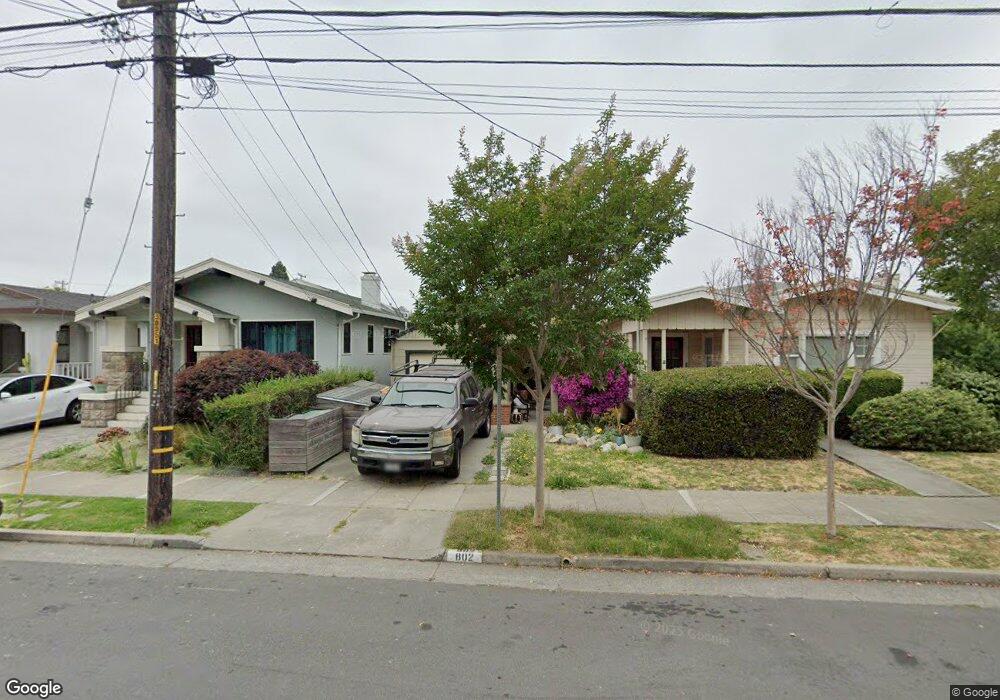

802 Pomona Ave Albany, CA 94706

Estimated Value: $1,003,000 - $1,191,000

2

Beds

1

Bath

916

Sq Ft

$1,194/Sq Ft

Est. Value

About This Home

This home is located at 802 Pomona Ave, Albany, CA 94706 and is currently estimated at $1,093,821, approximately $1,194 per square foot. 802 Pomona Ave is a home located in Alameda County with nearby schools including Albany Middle School, Albany High School, and Tehiyah Day School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 27, 2021

Sold by

Kusaba 1996 Survivors Trust

Bought by

Yamamoto Kelly and Yamamoto Christopher

Current Estimated Value

Purchase Details

Closed on

Oct 14, 2021

Sold by

Margaret Kusaba

Bought by

Kusaba 1996 Trust

Purchase Details

Closed on

Oct 17, 2019

Sold by

Kusaba Margaret I

Bought by

Kusaba Margaret I and Kusaba 1996 Exemption Trust

Purchase Details

Closed on

Jan 11, 2018

Sold by

Kusaba Margaret I and Kusaba 1996 Exemption Trust

Bought by

Kusaba Margaret I and Kusaba 1996 Exemption Trust

Purchase Details

Closed on

Oct 23, 2017

Sold by

Kusaba Margaret I and Kusaba 1996 Exemption Trust

Bought by

Kusaba Margaret I and Kusaba 1996 Survivors Trust

Purchase Details

Closed on

Dec 21, 1998

Sold by

Kusaba Margaret

Bought by

Kusaba Margaret I and Kusaba 1996 Exemption Trust

Purchase Details

Closed on

Jun 18, 1996

Sold by

Kusaba George and Kusaba Margaret

Bought by

Kusaba George and Kusaba Margaret I

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Yamamoto Kelly | -- | Kelley & Farren Llp | |

| Kusaba 1996 Trust | -- | -- | |

| Kusaba Margaret I | -- | None Available | |

| Kusaba Margaret I | -- | None Available | |

| Kusaba Margaret I | -- | None Available | |

| Kusaba Margaret I | -- | None Available | |

| Kusaba Margaret I | -- | -- | |

| Kusaba George | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $17,789 | $917,937 | $275,381 | $642,556 |

| 2024 | $17,789 | $1,092,420 | $327,726 | $764,694 |

| 2023 | $17,524 | $1,071,000 | $321,300 | $749,700 |

| 2022 | $4,345 | $1,050,000 | $315,000 | $735,000 |

| 2021 | $4,254 | $121,662 | $77,266 | $44,396 |

| 2020 | $4,091 | $120,415 | $76,474 | $43,941 |

| 2019 | $3,994 | $118,053 | $74,974 | $43,079 |

| 2018 | $3,894 | $115,738 | $73,504 | $42,234 |

| 2017 | $3,794 | $113,469 | $72,063 | $41,406 |

| 2016 | $3,627 | $111,244 | $70,650 | $40,594 |

| 2015 | $3,489 | $109,574 | $69,589 | $39,985 |

| 2014 | $3,367 | $107,428 | $68,226 | $39,202 |

Source: Public Records

Map

Nearby Homes

- 720 Key Route Blvd

- 840 Key Route Blvd

- 606 Masonic Ave

- 609 San Carlos Ave

- 848 Stannage Ave Unit 11

- 625 Stannage Ave

- 1120 Garfield Ave

- 417 Evelyn Ave Unit 205

- 1126 Brighton Ave

- 518 Kains Ave Unit 103

- 545 Colusa Ave

- 1054 Masonic Ave

- 951 Madison St

- 704 Madison St

- 1038 Cornell Ave

- 1046 Santa fe Ave

- 935 Hillside Ave

- 1050 Kains Ave Unit 3(B1)

- 800 Pomona Ave

- 804 Pomona Ave

- 808 Pomona Ave

- 801 Key Route Blvd

- 805 Key Route Blvd

- 816 Pomona Ave

- 807 Key Route Blvd

- 1317 Washington Ave

- 809 Key Route Blvd

- 818 Pomona Ave

- 811 Key Route Blvd

- 805 Pomona Ave

- 1315 Washington Ave

- 744 Pomona Ave

- 803 Pomona Ave

- 811 Pomona Ave

- 1330 Washington Ave

- 813 Pomona Ave

- 813 Key Route Blvd

- 739 Key Route Blvd