8020 Jordan Ln Midlothian, TX 76065

Estimated Value: $1,381,757

4

Beds

4

Baths

3,757

Sq Ft

$368/Sq Ft

Est. Value

About This Home

This home is located at 8020 Jordan Ln, Midlothian, TX 76065 and is currently estimated at $1,381,757, approximately $367 per square foot. 8020 Jordan Ln is a home located in Ellis County with nearby schools including Mount Peak Elementary School and Frank Seale Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 15, 2015

Sold by

Jones Marilyn H and Jones Larry

Bought by

Nunes Layne and Nunes Sarah

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$205,017

Outstanding Balance

$76,243

Interest Rate

3.68%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$1,305,514

Purchase Details

Closed on

May 30, 2014

Sold by

Fannie Mae

Bought by

Nunes Layne E and Nunes Sarah F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,000

Interest Rate

4.35%

Mortgage Type

Stand Alone Second

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nunes Layne | -- | Lawyers Title | |

| Nunes Layne E | -- | Linear Title & Closing |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Nunes Layne | $205,017 | |

| Previous Owner | Nunes Layne E | $40,000 | |

| Previous Owner | Nunes Layne E | $321,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,412 | $634,023 | $61,810 | $572,213 |

| 2024 | $7,412 | $626,915 | -- | -- |

| 2023 | $7,412 | $572,025 | $0 | $0 |

| 2022 | $8,797 | $520,514 | $0 | $0 |

| 2021 | $8,387 | $867,190 | $0 | $0 |

| 2020 | $8,944 | $765,610 | $0 | $0 |

| 2019 | $8,457 | $769,960 | $0 | $0 |

| 2018 | $7,529 | $614,100 | $0 | $0 |

| 2017 | $6,990 | $584,240 | $0 | $0 |

| 2016 | $6,565 | $584,950 | $0 | $0 |

| 2015 | $8,944 | $373,830 | $0 | $0 |

| 2014 | $8,944 | $436,590 | $0 | $0 |

Source: Public Records

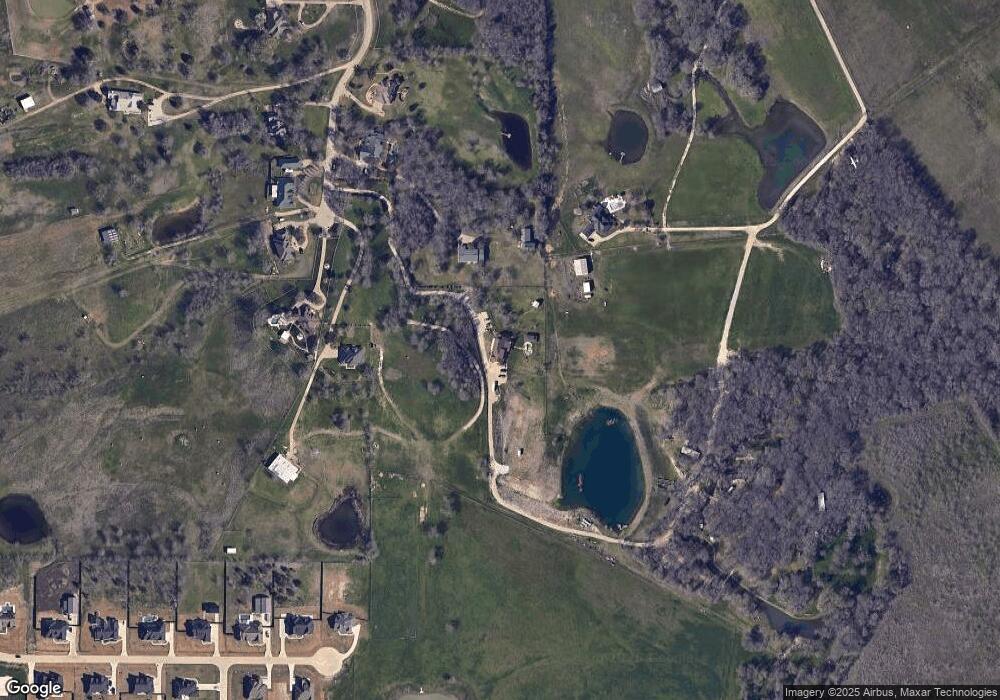

Map

Nearby Homes

- 2950 Claire Dr

- 7830 Amanda Ln

- The Landry Plan at Jordan Meadows

- The Peyton Plan at Jordan Meadows

- The Tiffany Plan at Jordan Meadows

- The Carter Plan at Jordan Meadows

- The Kellyn Plan at Jordan Meadows

- The Avery Plan at Jordan Meadows

- The Colin Plan at Jordan Meadows

- The Aubrey Plan at Jordan Meadows

- The Brazos Plan at Jordan Meadows

- The Paxton Plan at Jordan Meadows

- The Rhett Plan at Jordan Meadows

- The Macy Plan at Jordan Meadows

- The Nathan Plan at Jordan Meadows

- The Finley Plan at Jordan Meadows

- 3351 Makala Dr

- 3350 Jaycee Dr

- 3531 Makala Dr

- 7641 Drew Dr

- 8030 Jordan Ln

- 1530 Indian Creek Dr

- 8050 Jordan Ln

- 8041 Jordan Ln

- 8010 Jordan Ln

- 8031 Jordan Ln

- 7860 Jordan Ln

- 8021 Jordan Ln

- 2741 Claire Dr

- 8007 Jordan Ln

- 2740 Claire Dr

- 2751 Claire Dr

- 2750 Claire Dr

- 8011 Jordan Ln

- 7861 Jordan Ln

- 7850 Jordan Ln

- 2920 Claire Dr

- 2921 Claire Dr

- 2941 Claire Dr

- 2930 Claire Dr