8039 Jonathan Dr Unit 10 Ooltewah, TN 37363

Estimated Value: $1,497,000 - $1,657,000

--

Bed

2

Baths

7,491

Sq Ft

$211/Sq Ft

Est. Value

About This Home

This home is located at 8039 Jonathan Dr Unit 10, Ooltewah, TN 37363 and is currently estimated at $1,579,129, approximately $210 per square foot. 8039 Jonathan Dr Unit 10 is a home located in Hamilton County with nearby schools including Ooltewah Elementary School, Hunter Middle School, and Ooltewah High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 24, 2024

Sold by

Durham Stefanie Frost

Bought by

Stefanie Frost Durham Family Trust and Daniel

Current Estimated Value

Purchase Details

Closed on

Mar 15, 2023

Sold by

Durham Gunnar R

Bought by

Durham Stefanie Frost

Purchase Details

Closed on

Jul 30, 2010

Sold by

Frost Durham Stefanie Frost and Frost Durham Stephanie

Bought by

Durham Gunnar R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$212,500

Interest Rate

4.7%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 2, 2008

Sold by

Frost James A

Bought by

Durham Stephanie Frost

Purchase Details

Closed on

Mar 3, 2008

Sold by

Durham Stephanie and Durham Gunnar

Bought by

Frost James A

Purchase Details

Closed on

Aug 31, 2006

Sold by

E & S Properties Llc

Bought by

Durham Stefanie and Durham Gunnar

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stefanie Frost Durham Family Trust | -- | None Listed On Document | |

| Durham Stefanie Frost | -- | -- | |

| Durham Gunnar R | -- | Century Title & Escrow Inc | |

| Durham Stephanie Frost | -- | None Available | |

| Frost James A | -- | Century Title & Escrow Inc | |

| Durham Stefanie | $103,900 | Century Title & Escrow Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Durham Gunnar R | $212,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,156 | $275,150 | $0 | $0 |

| 2023 | $6,165 | $275,150 | $0 | $0 |

| 2022 | $6,165 | $275,150 | $0 | $0 |

| 2021 | $6,165 | $275,150 | $0 | $0 |

| 2020 | $6,882 | $248,550 | $0 | $0 |

| 2019 | $6,882 | $248,550 | $0 | $0 |

| 2018 | $6,882 | $248,550 | $0 | $0 |

| 2017 | $6,882 | $248,550 | $0 | $0 |

| 2016 | $6,360 | $0 | $0 | $0 |

| 2015 | $6,360 | $229,675 | $0 | $0 |

| 2014 | $6,360 | $0 | $0 | $0 |

Source: Public Records

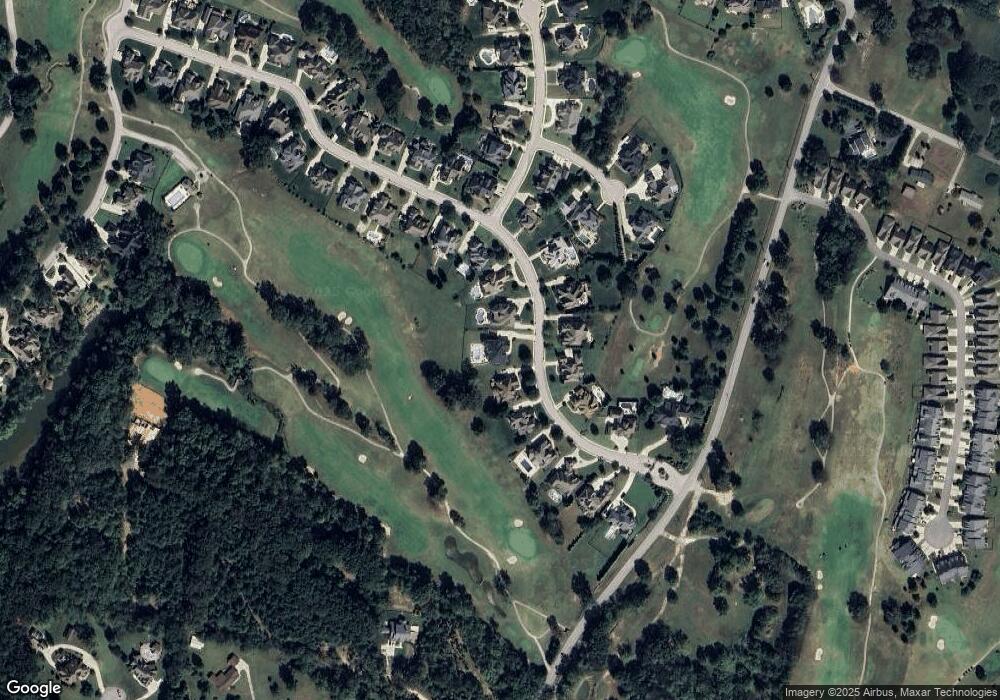

Map

Nearby Homes

- 7878 Lexsaturno Ln

- 8282 Double Eagle Ct

- 8233 Double Eagle Ct

- 7912 Snow Hill Rd

- 8020 Hodges Way

- 7502 Snow Hill Rd

- 8646 Rambling Rose Dr

- 7705 Royal Harbour Cir

- 8659 Rambling Rose Dr

- 7424 Miss Madison Way

- 8756 Grey Reed Dr

- 7142 Tailgate Loop

- 8396 River Birch Loop

- 7183 Tailgate Loop

- 8636 Winter Refuge Way

- 8797 Meadowvale Ct

- 8801 Meadowvale Ct

- 7371 Artisan Cir

- 8812 Meadowvale Ct

- 8805 Meadowvale Ct

- 8039 Jonathan Dr

- 8027 Jonathan Dr

- 8027 Jonathan Dr Unit 11

- 8045 Jonathan Dr

- 8045 Jonathan Dr Unit 9

- 7903 Jonathan Dr

- 7903 Jonathan Dr Unit 25

- 8015 Jonathan Dr

- 8015 Jonathan Dr Unit 12

- 8042 Jonathan Dr

- 8042 Jonathan Dr Unit 83

- 8057 Jonathan Dr

- 8057 Jonathan Dr Unit 8

- 8034 Jonathan Dr

- 8034 Jonathan Dr Unit 82

- 8003 Jonathan Dr

- 8003 Jonathan Dr Unit 13

- 8064 Jonathan Dr

- 8064 Jonathan Dr Unit 84

- 8020 Jonathan Dr