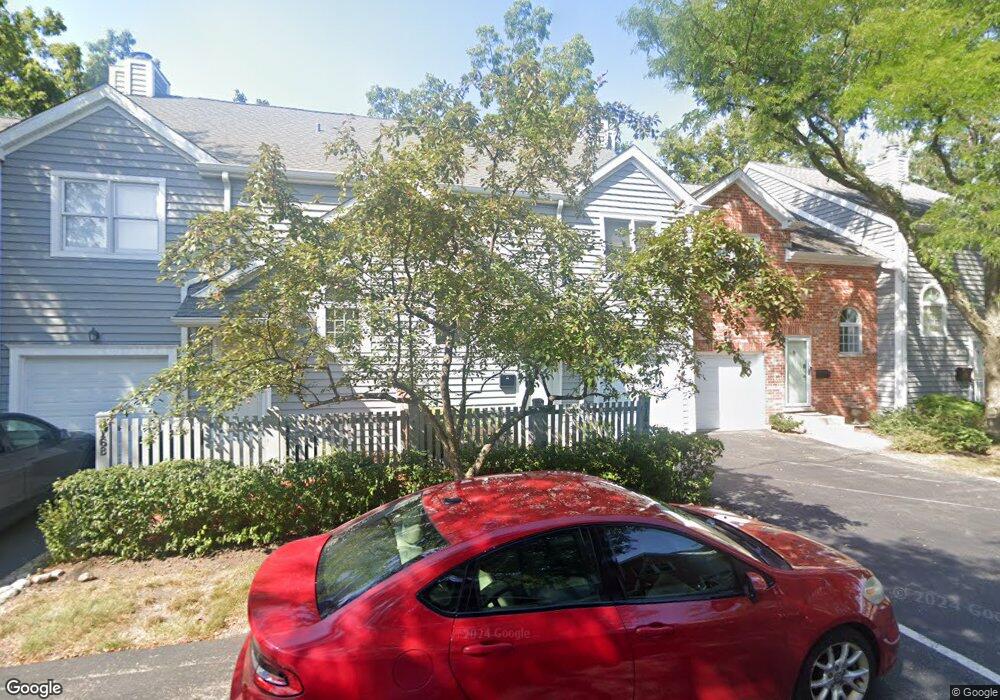

804 Chestnut St Unit 17 Deerfield, IL 60015

Estimated Value: $417,000 - $455,000

2

Beds

3

Baths

1,624

Sq Ft

$267/Sq Ft

Est. Value

About This Home

This home is located at 804 Chestnut St Unit 17, Deerfield, IL 60015 and is currently estimated at $433,827, approximately $267 per square foot. 804 Chestnut St Unit 17 is a home located in Lake County with nearby schools including Walden Elementary School, Alan B Shepard Middle School, and Deerfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 12, 2018

Sold by

Birtcher Robert and Birtcher Maureen

Bought by

Solomon Richard and Solomon Eileen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$225,000

Outstanding Balance

$198,507

Interest Rate

4.87%

Mortgage Type

New Conventional

Estimated Equity

$235,320

Purchase Details

Closed on

Apr 29, 2016

Sold by

Pondel Gregory and Pondel Virginia

Bought by

Birtcher Robert and Birtcher Maureen

Purchase Details

Closed on

Oct 30, 2009

Sold by

Liebman Maurice and Liebman Shirley

Bought by

Pondel Gregory and Pondel Virginia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$231,684

Interest Rate

4.95%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Solomon Richard | $300,000 | Proper Title Llc | |

| Birtcher Robert | $315,000 | Ct | |

| Pondel Gregory | $253,000 | First American |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Solomon Richard | $225,000 | |

| Previous Owner | Pondel Gregory | $231,684 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,788 | $113,941 | $18,648 | $95,293 |

| 2023 | $9,068 | $109,348 | $17,896 | $91,452 |

| 2022 | $9,068 | $106,684 | $18,685 | $87,999 |

| 2021 | $8,529 | $102,858 | $18,015 | $84,843 |

| 2020 | $8,204 | $103,075 | $18,053 | $85,022 |

| 2019 | $8,024 | $102,900 | $18,022 | $84,878 |

| 2018 | $8,943 | $106,831 | $19,102 | $87,729 |

| 2017 | $8,872 | $106,490 | $19,041 | $87,449 |

| 2016 | $8,133 | $102,463 | $18,321 | $84,142 |

| 2015 | $7,952 | $96,273 | $17,214 | $79,059 |

| 2014 | $6,635 | $80,278 | $17,336 | $62,942 |

| 2012 | $6,484 | $79,570 | $17,183 | $62,387 |

Source: Public Records

Map

Nearby Homes

- 904 Forest Ave

- 745 Price Ln

- 1103 Hazel Ave

- 1009 Central Ave

- 956 Brookside Ln

- 610 Robert York Ave Unit 104

- 1038 Brookside Ln

- 934 Wayne Ave

- 1045 Fairoaks Ave

- 679 Central Ave

- 441 Elm St Unit 3A

- 630 Hermitage Dr

- 677 Timber Hill Rd

- 926 Cedar St

- 505 Margate Terrace

- 860 Kenton Rd

- 970 Ivy Ln Unit C

- 757 Kipling Place

- 312 Pine St

- 372 Kelburn Rd Unit 313

- 804 Chestnut St

- 804 Chestnut St Unit 18

- 806 Chestnut St Unit 16

- 806 Chestnut St Unit 15

- 808 Chestnut St Unit 14

- 808 Chestnut St Unit 13

- 810 Chestnut St Unit 12

- 810 Chestnut St Unit 11

- 814 Chestnut St Unit 8

- 814 Chestnut St Unit 7

- 810 Chestnut St

- 806 Chestnut St

- 804 Chestnut St Unit B

- 806 Chestnut St Unit B

- 806 Chestnut St Unit A

- 808 Chestnut St Unit B

- 808 Chestnut St Unit A

- 814 Chestnut St Unit B

- 810 Chestnut St Unit B

- 814 Chestnut St Unit A