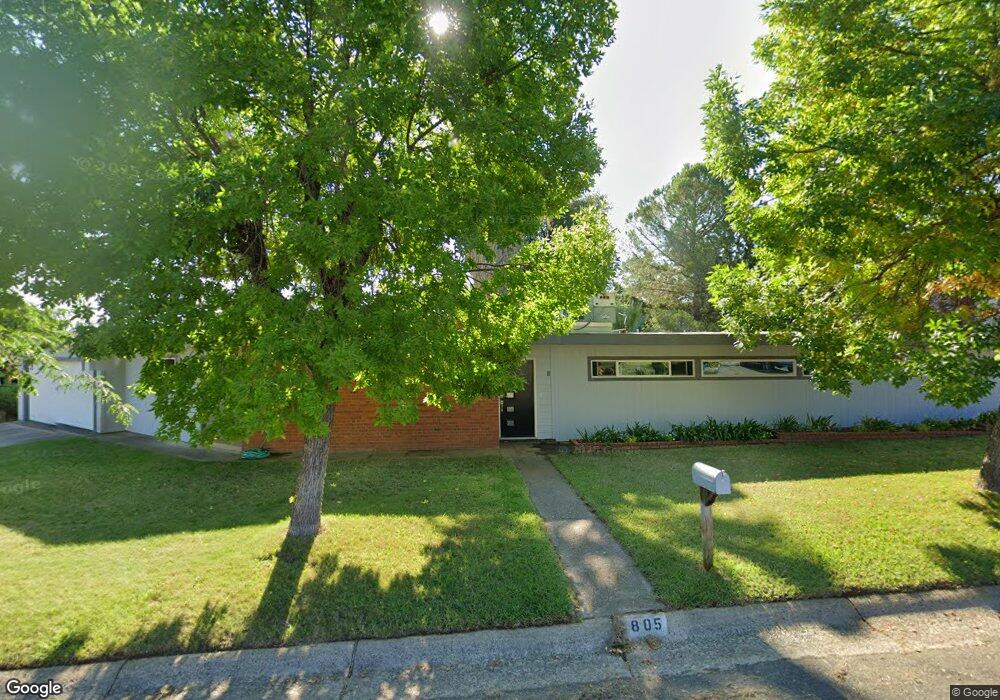

805 Overhill Dr Redding, CA 96001

Lakeview NeighborhoodEstimated Value: $348,324 - $456,000

3

Beds

2

Baths

1,800

Sq Ft

$226/Sq Ft

Est. Value

About This Home

This home is located at 805 Overhill Dr, Redding, CA 96001 and is currently estimated at $407,581, approximately $226 per square foot. 805 Overhill Dr is a home located in Shasta County with nearby schools including Manzanita Elementary School, Sequoia Middle School, and Shasta High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 19, 2020

Sold by

Westphal William F

Bought by

Westphal William F and Westphal William F

Current Estimated Value

Purchase Details

Closed on

Aug 24, 2015

Sold by

Glass Susan A

Bought by

Westphal William F

Purchase Details

Closed on

Jun 28, 2007

Sold by

Westphal William F

Bought by

Glass Susan A and Westphal William F

Purchase Details

Closed on

Apr 16, 2007

Sold by

Westphal William F

Bought by

Westphal William

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$93,999

Interest Rate

6.1%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Apr 9, 2002

Sold by

Westphal Sharon A

Bought by

Westphal William F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,000

Interest Rate

6.78%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Westphal William F | -- | None Available | |

| Westphal William F | -- | None Available | |

| Glass Susan A | -- | None Available | |

| Westphal William | -- | Chicago Title Co | |

| Westphal William F | -- | Placer Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Westphal William | $93,999 | |

| Previous Owner | Westphal William | $94,000 | |

| Previous Owner | Westphal William F | $127,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,130 | $211,466 | $60,657 | $150,809 |

| 2024 | $2,096 | $207,320 | $59,468 | $147,852 |

| 2023 | $2,096 | $203,255 | $58,302 | $144,953 |

| 2022 | $2,059 | $199,270 | $57,159 | $142,111 |

| 2021 | $2,047 | $195,364 | $56,039 | $139,325 |

| 2020 | $2,074 | $193,362 | $55,465 | $137,897 |

| 2019 | $1,967 | $189,572 | $54,378 | $135,194 |

| 2018 | $1,983 | $185,856 | $53,312 | $132,544 |

| 2017 | $1,971 | $182,213 | $52,267 | $129,946 |

| 2016 | $1,907 | $178,642 | $51,243 | $127,399 |

| 2015 | $1,882 | $175,960 | $50,474 | $125,486 |

| 2014 | $1,868 | $172,514 | $49,486 | $123,028 |

Source: Public Records

Map

Nearby Homes

- 1025 Chardonnay Walk

- 582 River Oaks Dr

- 531 Aurora Place

- 3330 Scenic Dr

- 866 Palatine Ct

- 802 Palatine Ct

- 1191 Hillcrest Place

- 3510 Eureka Way

- 2565 North St

- 1355 Bambury Ct

- 3345 Oakwood Place

- 1163 Sunriver Ln

- Lot 15 N Ridge Dr

- 920 Hallmark Dr

- 910 Hallmark Dr

- 418 Moonstone Way

- 962 Leisha Ln

- 1569 Walnut Ave

- 2315 Butte St

- 1545 Olive Ave

- 755 Cascade Ct

- 815 Overhill Dr

- 810 Overhill Dr

- 745 Cascade Ct

- 820 Overhill Dr

- 825 Overhill Dr

- 2930 Pioneer Dr

- 800 Overhill Dr

- 830 Overhill Dr

- 740 Overhill Dr

- 705 Cascade Ct

- 735 Cascade Ct

- 2910 Pioneer Dr

- 835 Overhill Dr

- 840 Overhill Dr

- 720 Overhill Dr

- 700 Overhill Dr Unit 1

- 700 Overhill Dr

- 2900 Pioneer Dr

- 725 Cascade Ct

Your Personal Tour Guide

Ask me questions while you tour the home.