Estimated Value: $170,000 - $189,935

Studio

1

Bath

1,125

Sq Ft

$159/Sq Ft

Est. Value

About This Home

This home is located at 8063 N 2000 East Rd, Downs, IL 61736 and is currently estimated at $179,234, approximately $159 per square foot. 8063 N 2000 East Rd is a home located in McLean County with nearby schools including Tri-Valley Elementary School, Tri-Valley Middle School, and Tri-Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 28, 2020

Sold by

Graf Patricia K and Estate Of Tyler J Graf

Bought by

Hall Tristen M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$101,315

Outstanding Balance

$89,448

Interest Rate

2.5%

Mortgage Type

New Conventional

Estimated Equity

$89,786

Purchase Details

Closed on

May 25, 2012

Sold by

Reeves Craig D

Bought by

Graf Tyler

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$109,250

Interest Rate

3.92%

Purchase Details

Closed on

Dec 18, 2005

Sold by

Reeves Craig D and Wolfe Michelle

Bought by

Reeves Craig D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

6.48%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hall Tristen M | $105,000 | Mclean County Title | |

| Graf Tyler | $115,000 | Attorneys Title Guaranty Fun | |

| Reeves Craig D | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hall Tristen M | $101,315 | |

| Previous Owner | Graf Tyler | $109,250 | |

| Previous Owner | Reeves Craig D | $80,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,184 | $52,331 | $13,090 | $39,241 |

| 2022 | $3,184 | $44,198 | $10,623 | $33,575 |

| 2021 | $3,062 | $42,506 | $10,216 | $32,290 |

| 2020 | $3,066 | $42,506 | $10,216 | $32,290 |

| 2019 | $3,066 | $42,506 | $10,216 | $32,290 |

| 2018 | $3,040 | $42,173 | $10,136 | $32,037 |

| 2017 | $2,983 | $41,464 | $9,966 | $31,498 |

| 2016 | $2,961 | $41,082 | $9,874 | $31,208 |

| 2015 | $2,924 | $40,788 | $9,803 | $30,985 |

| 2014 | $2,756 | $39,945 | $9,600 | $30,345 |

| 2013 | -- | $31,245 | $2,900 | $28,345 |

Source: Public Records

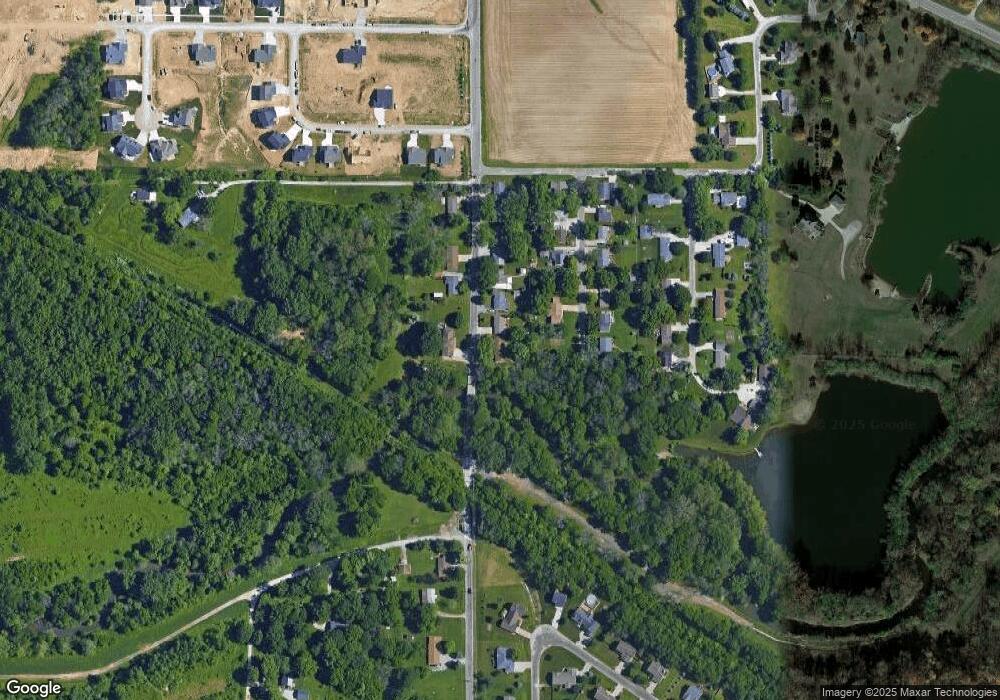

Map

Nearby Homes

- 8021 Pine Ave

- 8198 Pine Ave

- 500 Raef Rd

- 8710 N 2100 East Rd

- 19889 Jared Dr

- 9580 Janel Dr

- Lot 8 E 700 Rd N

- 19977 Jared Dr

- 19066 Woodland Trail

- 18864 Pioneer St

- Lot 7 Burr Oak Ln

- 3903 Dunloe Place

- 1922 Dunraven Rd

- 1915 Dunraven Rd

- 1906 Dunraven Rd

- 1517 Kell Ave

- 5104 Finlen Ln

- 6105 Wrigley Dr

- 5101 Londonderry Rd

- 5802 Sugarberry Ave

- 8075 N 2000 East Rd

- 8075 N 2000 East Rd

- 8095 N. 2000 Rd E

- 8095 N 2000 Rd E

- 8060 N 2000 East Rd

- 8115 N 2000 East Rd

- 8115 N 2000 East Rd

- 8100 Pine Ave

- 8601 N 2000 Rd E

- 8133 N 2000 East Rd

- 8106 N 2000 East Rd

- 8106 N 2000 East Rd

- 8021 Pine Dr

- 8043 Pine Ave

- 8130 N 2000 Rd E

- 8130 Pine Ave

- 8081 Pine Ave

- 8135 Pine Ave

- 8163 N 2000 East Rd

- 8169 Pine Ave

Your Personal Tour Guide

Ask me questions while you tour the home.