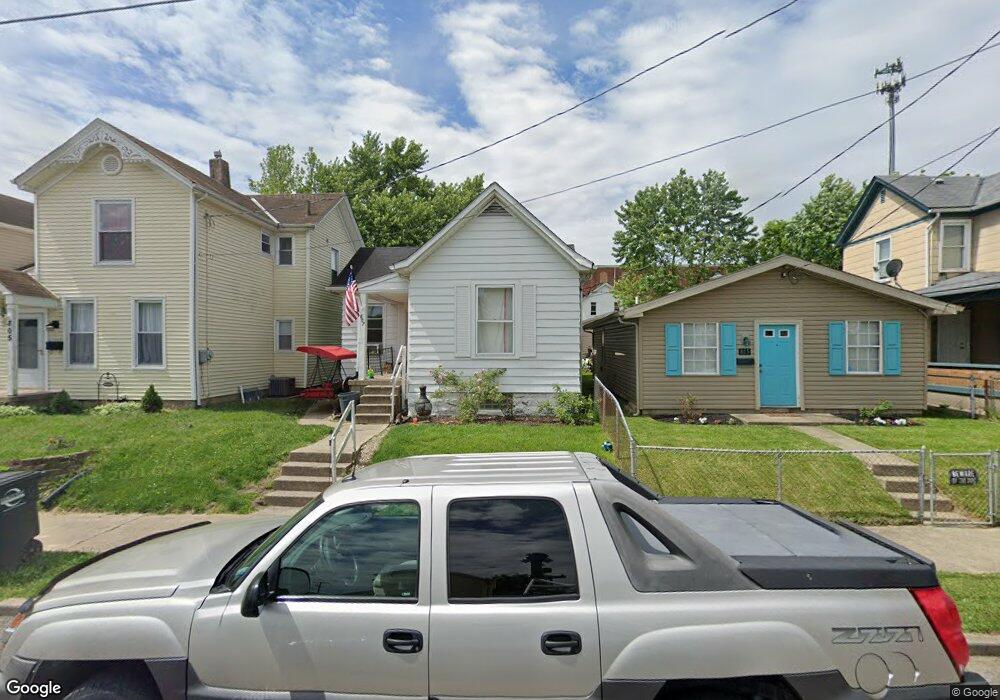

807 Franklin St Hamilton, OH 45013

Estimated Value: $123,000 - $135,000

3

Beds

1

Bath

994

Sq Ft

$128/Sq Ft

Est. Value

About This Home

This home is located at 807 Franklin St, Hamilton, OH 45013 and is currently estimated at $126,765, approximately $127 per square foot. 807 Franklin St is a home located in Butler County with nearby schools including Highland Elementary School, Wilson Middle School, and Hamilton High School Main Campus.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 10, 2003

Sold by

Hud

Bought by

Payne Roy R and Payne Barbara G

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$41,200

Interest Rate

5.37%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 17, 2003

Sold by

Crosby Delon and Crosby Delon A

Bought by

Hud

Purchase Details

Closed on

Sep 30, 1999

Sold by

Sullivan Vicki L

Bought by

Crosby Delon A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$49,580

Interest Rate

7.93%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 1, 1992

Purchase Details

Closed on

May 1, 1988

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Payne Roy R | $51,500 | Lakeside Title & Escrow Agen | |

| Hud | $40,000 | -- | |

| Crosby Delon A | $49,900 | Midland Title Security Inc | |

| -- | $43,900 | -- | |

| -- | $38,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Payne Roy R | $41,200 | |

| Previous Owner | Crosby Delon A | $49,580 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,031 | $25,030 | $4,060 | $20,970 |

| 2024 | $1,031 | $25,030 | $4,060 | $20,970 |

| 2023 | $1,079 | $25,030 | $4,060 | $20,970 |

| 2022 | $1,422 | $17,740 | $4,060 | $13,680 |

| 2021 | $798 | $17,160 | $4,060 | $13,100 |

| 2020 | $1,081 | $17,160 | $4,060 | $13,100 |

| 2019 | $1,181 | $16,130 | $4,520 | $11,610 |

| 2018 | $771 | $16,130 | $4,520 | $11,610 |

| 2017 | $778 | $16,130 | $4,520 | $11,610 |

| 2016 | $759 | $15,010 | $4,520 | $10,490 |

| 2015 | $755 | $15,010 | $4,520 | $10,490 |

| 2014 | $885 | $15,010 | $4,520 | $10,490 |

| 2013 | $885 | $18,720 | $4,520 | $14,200 |

Source: Public Records

Map

Nearby Homes

- 5 Commerce St

- 451 Millville Ave

- 839 Millikin St

- 1103 Hunt Ave

- 618 Main St

- 540 Harrison Ave

- 1607 Cereal Ave

- 422 S G St

- 346 Hyde Park Dr

- 226 Sherman Ave

- 1116 Azel Ave

- 504 Ridgewood Ave

- 430 Elvin Ave

- 444 N Dick Ave

- 324 Sherman Ave

- 491 S Washington Blvd

- 704 Liberty Ave

- 1263 Park Ave

- 309 N F St

- 260 N F St

- 815 Franklin St

- 805 Franklin St

- 803 Franklin St

- 817 Franklin St

- 3 S Edgewood Ave

- 4 Commerce St

- 821 Franklin St

- 12 Commerce St

- 793 Franklin St

- 825 Franklin St

- 791 Franklin St

- 812 Franklin St

- 800 Franklin St

- 816 Franklin St

- 827 Franklin St

- 794 Franklin St

- 822 Franklin St

- 831 Franklin St

- 789 Franklin St

- 239 S Edgewood Ave