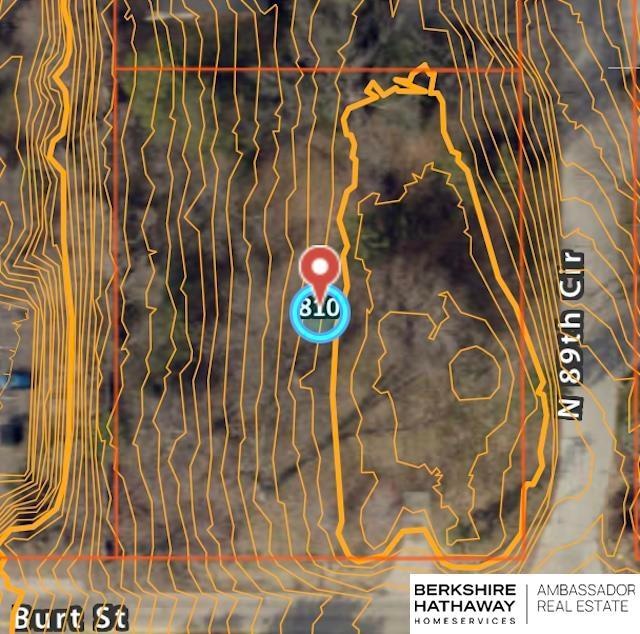

810 N 89th Cir Omaha, NE 68114

West Dodge NeighborhoodEstimated payment $2,132/month

Total Views

4,411

0.56

Acre

$714,286

Price per Acre

24,394

Sq Ft Lot

About This Lot

Opportunity is knocking! Fantastic 1/2 acre lot in Westside School District! Non builder attached. Here is the chance to build your dream home in the middle of Omaha, close to everything. East facing walkout corner lot at the entrance to cul de sac.

Property Details

Property Type

- Land

Est. Annual Taxes

- $410

Lot Details

- 0.56 Acre Lot

- Lot Dimensions are 143.5 x 172

Schools

- Westbrook Elementary School

- Westside Middle School

- Westside High School

Utilities

- Cable TV Available

Community Details

- No Home Owners Association

- Stoneham Estates Subdivision

Listing and Financial Details

- Assessor Parcel Number 2247050524

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $413 | $25,200 | $25,200 | -- |

| 2024 | $514 | $25,200 | $25,200 | -- |

| 2023 | $514 | $25,200 | $25,200 | -- |

| 2022 | $552 | $25,200 | $25,200 | $0 |

| 2021 | $559 | $25,200 | $25,200 | $0 |

| 2020 | $569 | $25,200 | $25,200 | $0 |

| 2019 | $575 | $25,200 | $25,200 | $0 |

| 2018 | $577 | $25,200 | $25,200 | $0 |

| 2017 | $564 | $25,200 | $25,200 | $0 |

| 2016 | $314 | $14,100 | $14,100 | $0 |

| 2015 | $309 | $14,100 | $14,100 | $0 |

| 2014 | $309 | $14,100 | $14,100 | $0 |

Source: Public Records

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 10/10/2025 10/10/25 | For Sale | $400,000 | -- | -- |

Source: Great Plains Regional MLS

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Warranty Deed | $90,000 | None Available | |

| Interfamily Deed Transfer | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Loan Amount | Loan Type |

|---|---|---|---|

| Open | $71,319 | Purchase Money Mortgage |

Source: Public Records

Source: Great Plains Regional MLS

MLS Number: 22529253

APN: 4705-0524-22

Nearby Homes

- 8806 Nicholas St

- 8738 Lafayette Ave

- 8549 Underwood Ave

- 8539-8545 Underwood Ave

- 8525 Lafayette Ave

- 770 N 93rd St Unit 1B4

- 8539 Hamilton St

- 8324 Webster St

- 1417 N 85th St

- 1015 N 83rd St

- 9313 Davenport St

- 8731 Douglas St

- 9530 Davenport St

- 9221 & 9223 Blondo St

- 9536 Meadow Dr

- 9406 Parker St

- 9345 Blondo St

- 728 N 77th Ave

- 437 S 90th St

- 1428 Maenner Dr

- 9006 Burt St

- 1001 N 90th St

- 9045 Burt St

- 9226 Burt St

- 9207 Western Ave

- 815 N 94th Plaza

- 9315 Western Ave

- 9405 Western Plaza

- 8215 Burt Plaza

- 8515 Indian Hills Dr

- 102 S 85th St

- 2344 N 92nd Ave

- 8240 Blondo St

- 8004 Farnam Dr

- 1911 Robertson Dr

- 7805 Harney St

- 2303 Benson Gardens Blvd

- 7722 Howard St

- 7602 Parker St

- 2924 N 83rd St