810 W 7th St Laurel, MT 59044

Estimated Value: $276,000 - $295,332

3

Beds

1

Bath

1,317

Sq Ft

$219/Sq Ft

Est. Value

About This Home

This home is located at 810 W 7th St, Laurel, MT 59044 and is currently estimated at $288,083, approximately $218 per square foot. 810 W 7th St is a home located in Yellowstone County with nearby schools including West School, Fred W. Graff School, and Laurel Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 30, 2024

Sold by

Dooley Cade and Brumwell Brianna

Bought by

Mccrary Byron and Bonner Kristina

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$274,928

Outstanding Balance

$272,176

Interest Rate

6.09%

Mortgage Type

FHA

Estimated Equity

$15,907

Purchase Details

Closed on

Nov 22, 2021

Sold by

Slothower Scott and Slothower Amy

Bought by

Dooley Cade and Brumwell Brianna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$226,262

Interest Rate

2.99%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 24, 2016

Sold by

Johnson Judith

Bought by

Slothower Scott and Slothower Amt

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,095

Interest Rate

3.79%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mccrary Byron | -- | First Montana Title | |

| Dooley Cade | -- | First American Title Company | |

| Slothower Scott | -- | American Title & Escrow |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mccrary Byron | $274,928 | |

| Previous Owner | Dooley Cade | $226,262 | |

| Previous Owner | Slothower Scott | $133,095 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,540 | $297,100 | $58,501 | $238,599 |

| 2024 | $1,540 | $231,100 | $38,046 | $193,054 |

| 2023 | $1,539 | $231,100 | $38,046 | $193,054 |

| 2022 | $1,200 | $185,900 | $0 | $0 |

| 2021 | $1,166 | $171,900 | $0 | $0 |

| 2020 | $1,100 | $159,100 | $0 | $0 |

| 2019 | $1,056 | $159,100 | $0 | $0 |

| 2018 | $1,207 | $157,000 | $0 | $0 |

| 2017 | $1,096 | $157,000 | $0 | $0 |

| 2016 | $677 | $139,300 | $0 | $0 |

| 2015 | $666 | $139,300 | $0 | $0 |

| 2014 | $466 | $73,034 | $0 | $0 |

Source: Public Records

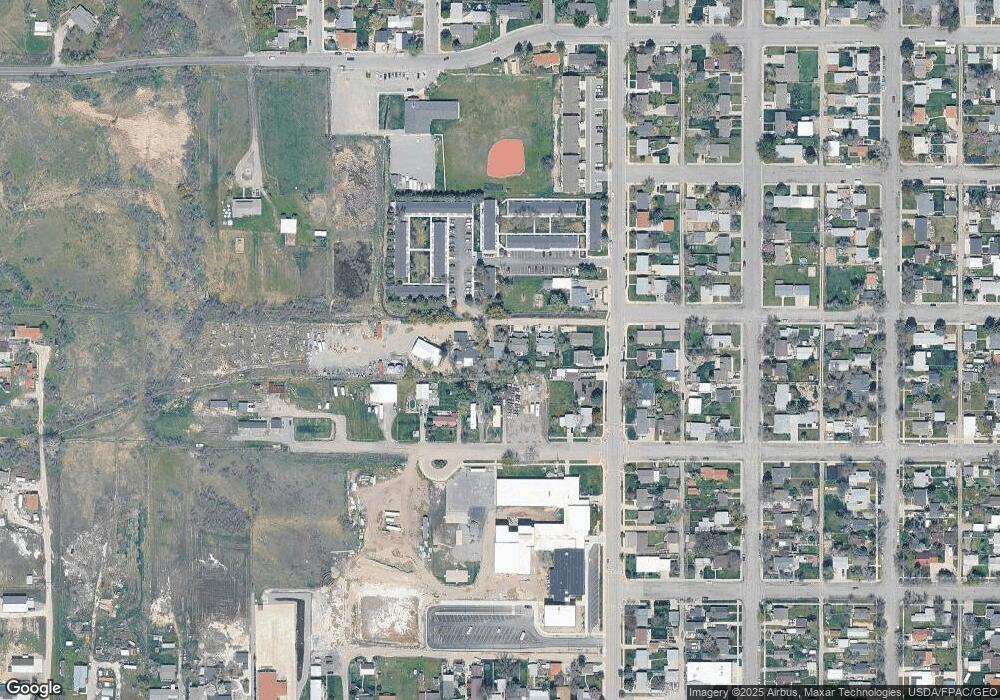

Map

Nearby Homes

- 102 8th Ave Unit B

- 1109 10th Ave

- 1107 11th Ave

- 116 4th Ave

- TBD Block 3 Lot 9

- 1106 W 12th St

- TBD Block 1 Lot 3

- TBD Block 3 Lot 4

- 1014 Rochelle Ln

- 1013 W 12th St

- TBD Block 3 Lot 6

- 110 E 5th St

- 208 West Ave

- 1003 Montana Ave

- 301 West Ave

- 516 Pennsylvania Ave

- 211 Woodland Ave

- 512 W 14th St

- 109 E 12th St

- 419 Durland Ave