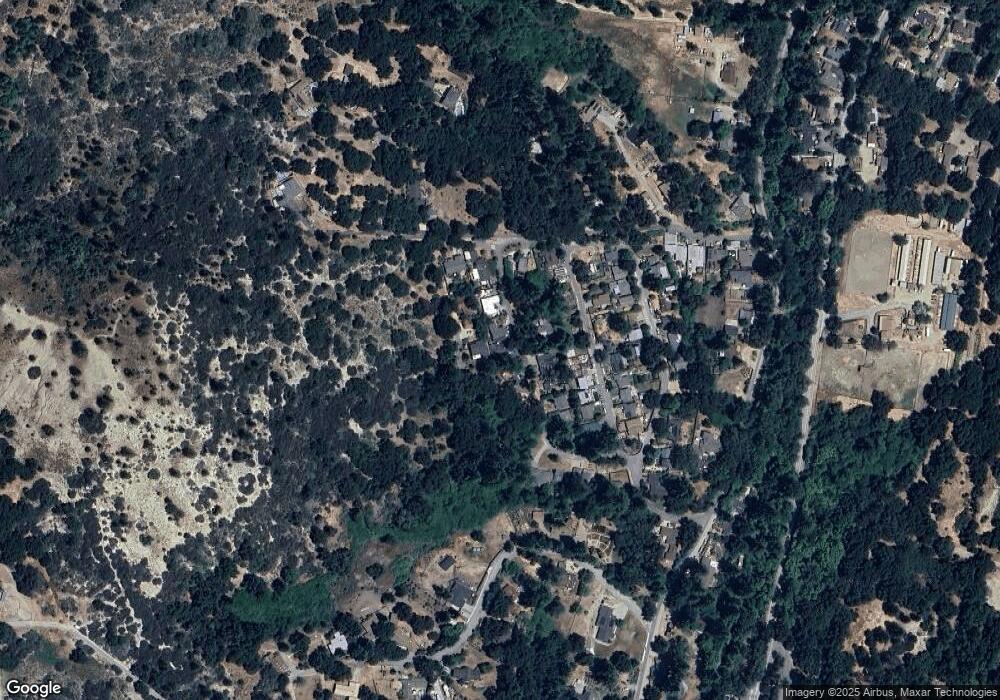

8101 Azalea Dr Felton, CA 95018

Estimated Value: $781,000 - $942,849

2

Beds

2

Baths

1,455

Sq Ft

$585/Sq Ft

Est. Value

About This Home

This home is located at 8101 Azalea Dr, Felton, CA 95018 and is currently estimated at $851,212, approximately $585 per square foot. 8101 Azalea Dr is a home located in Santa Cruz County with nearby schools including San Lorenzo Valley Elementary School, San Lorenzo Valley Middle School, and San Lorenzo Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 8, 2004

Sold by

Adams Robert Troy

Bought by

Adams Robert Troy and Adams Schatzi

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Outstanding Balance

$190,781

Interest Rate

5.12%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$660,431

Purchase Details

Closed on

Apr 14, 1998

Sold by

Mc Collum Darlene Revocable Living Trust and Julie Ann

Bought by

Adams Robert Troy and Adams Schatzi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$164,000

Interest Rate

8.99%

Purchase Details

Closed on

May 16, 1995

Sold by

Mccollum Darlene

Bought by

Mccollum Darlene and The Revocable Living Trust Of

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Adams Robert Troy | -- | -- | |

| Adams Robert Troy | -- | -- | |

| Adams Robert Troy | $205,000 | Old Republic Title Company | |

| Mccollum Darlene | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Adams Robert Troy | $400,000 | |

| Closed | Adams Robert Troy | $164,000 | |

| Closed | Adams Robert Troy | $25,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,114 | $327,340 | $183,629 | $143,711 |

| 2023 | $5,103 | $314,629 | $176,499 | $138,130 |

| 2022 | $5,002 | $308,460 | $173,038 | $135,422 |

| 2021 | $4,834 | $302,411 | $169,645 | $132,766 |

| 2020 | $4,693 | $299,311 | $167,906 | $131,405 |

| 2019 | $4,509 | $293,441 | $164,613 | $128,828 |

| 2018 | $4,497 | $287,688 | $161,386 | $126,302 |

| 2017 | $4,434 | $282,047 | $158,221 | $123,826 |

| 2016 | $4,547 | $276,517 | $155,119 | $121,398 |

| 2015 | $3,228 | $272,363 | $152,789 | $119,574 |

| 2014 | $3,180 | $267,028 | $149,796 | $117,232 |

Source: Public Records

Map

Nearby Homes

- 0 Carroll Ave

- 0 Old Mill Rd Unit OC25221127

- 000 Lompico Rd

- 155 Stanford Dr

- 7415 Hihn Rd

- 407 Webster Dr

- Lot 08 Lake Blvd and Lot 38 Lakeview

- 514 Noteware Dr

- 620 Condor Ave

- 185 Woodston Way

- 600 Cook Way

- 12 Canyon Rd

- 7470 Highway 9

- 8494 Glen Arbor Rd

- 8633 Glen Arbor Rd

- 0 Marion Ave

- 55 Hidden Meadow Ln

- 641 Marion Ave

- 655 Marion Ave

- 9540 E Zayante Rd