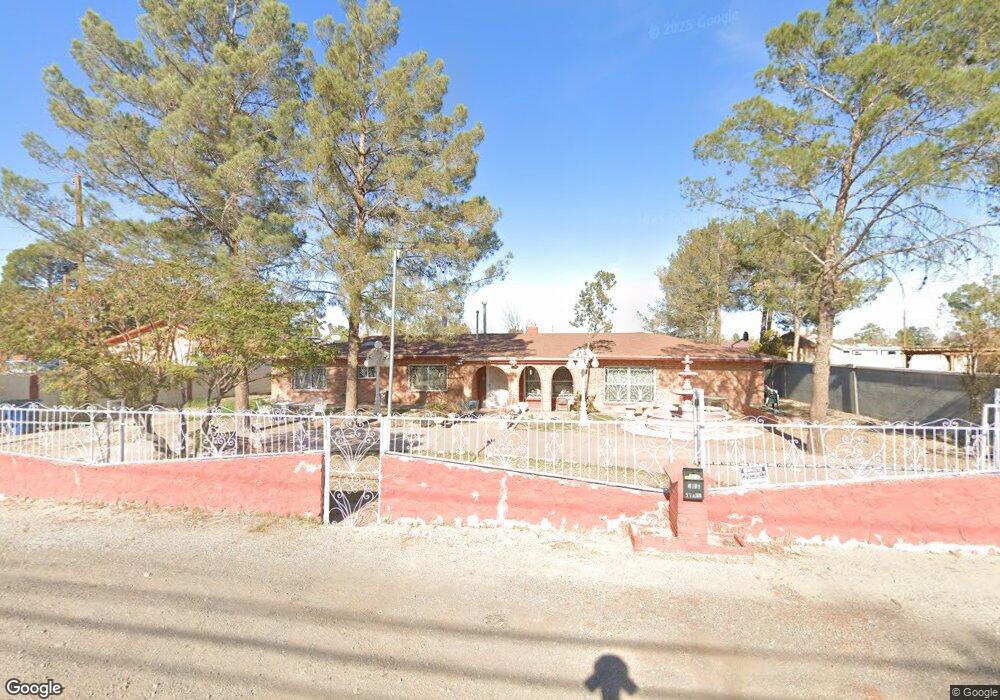

8103 Starr Ave El Paso, TX 79907

Shawver Park NeighborhoodEstimated Value: $208,000 - $230,000

--

Bed

2

Baths

2,061

Sq Ft

$106/Sq Ft

Est. Value

About This Home

This home is located at 8103 Starr Ave, El Paso, TX 79907 and is currently estimated at $218,671, approximately $106 per square foot. 8103 Starr Ave is a home located in El Paso County with nearby schools including Pasodale Elementary School, Rio Bravo Middle School, and Ysleta Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 31, 2014

Sold by

Serrano Mario

Bought by

Serrano Mario and Serrano Socorro

Current Estimated Value

Purchase Details

Closed on

May 1, 2012

Sold by

Serrano Socorro

Bought by

Serrano Mario J

Purchase Details

Closed on

Nov 25, 2005

Sold by

Serrano Mario

Bought by

Serrano Socorro

Purchase Details

Closed on

Nov 22, 1996

Sold by

Serrano Rosa Isela

Bought by

Serrano Mario Jesus and Serrano Socorro

Purchase Details

Closed on

Jan 4, 1995

Sold by

Carrillo Bernarda

Bought by

Serrano Mario

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$30,846

Interest Rate

9.14%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Serrano Mario | -- | None Available | |

| Serrano Mario J | -- | None Available | |

| Serrano Socorro | -- | None Available | |

| Serrano Mario Jesus | -- | -- | |

| Serrano Mario | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Serrano Mario | $30,846 | |

| Closed | Serrano Mario | $10,145 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,688 | $236,999 | $29,293 | $207,706 |

| 2024 | $4,688 | $170,673 | $9,510 | $161,163 |

| 2023 | $4,688 | $170,673 | $9,510 | $161,163 |

| 2022 | $3,404 | $109,611 | $0 | $0 |

| 2021 | $3,239 | $150,560 | $9,510 | $141,050 |

| 2020 | $2,861 | $90,587 | $9,510 | $81,077 |

| 2018 | $2,839 | $91,305 | $9,510 | $81,795 |

| 2017 | $2,615 | $85,554 | $9,510 | $76,044 |

| 2016 | $2,615 | $85,554 | $9,510 | $76,044 |

| 2015 | $1,999 | $85,554 | $9,510 | $76,044 |

| 2014 | $1,999 | $85,554 | $9,510 | $76,044 |

Source: Public Records

Map

Nearby Homes

- 8141 Lowd Ave

- 578 Cora Place

- 8250 Mc Elroy Ave

- 8162 Josephine Cir

- 8165 Josephine Cir

- 261 Columbia Ave

- 227 Galvan Place

- 7840 Mansfield Ave

- 8405 Pinon St

- 228 Harvard Ave

- 8041 Broadway Dr

- 7920 Porche St

- 7925 Broadway Dr

- 7952 Broadway Dr

- 8339 White Rd

- 8434 Villanova Dr

- 7907 Alameda Ave

- 7860 Porche St

- 8433 Independence Dr

- 7874 Broadway Dr

- 462 Fresno Dr

- 8107 Starr Ave

- 460 Fresno Dr

- 0 Fresno Unit 511541

- 0 Fresno Unit 577861

- 8109 Starr Ave

- 8106 Starr Ave

- 8106 Starr Ave

- 8089 Starr Ave

- 8104 Starr Ave

- 8125 Starr Ave

- 8081 Starr Ave

- 485 Fresno Dr

- 8084 Starr Ave

- 8124 Starr Ave

- 8127 Starr Ave

- 436 Fresno Dr

- 481 Fresno Dr

- 8073 8073 Ave

- 8133 Starr Ave