814 Dingman St Sidney, OH 45365

Estimated Value: $118,000 - $146,000

2

Beds

2

Baths

1,104

Sq Ft

$122/Sq Ft

Est. Value

About This Home

This home is located at 814 Dingman St, Sidney, OH 45365 and is currently estimated at $135,107, approximately $122 per square foot. 814 Dingman St is a home located in Shelby County with nearby schools including Sidney High School, Holy Angels Catholic School, and Christian Academy Schools.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 26, 2018

Sold by

Brazeal Benjamin K and The Brazeal Keystone Preservat

Bought by

Seiber Clayde R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,750

Outstanding Balance

$59,954

Interest Rate

5.5%

Mortgage Type

FHA

Estimated Equity

$75,153

Purchase Details

Closed on

May 8, 2017

Sold by

Brazeal Jerry L and Brazeal Madelyn D

Bought by

Brazeal Benjamin K and The Brazeal Keystone Preservat

Purchase Details

Closed on

Nov 27, 2012

Sold by

Coburn Craig and Wells Fargo Bank Na

Bought by

Brazeal Jerry and Brazeal Madelyn

Purchase Details

Closed on

Aug 23, 2006

Sold by

Inderrieden Greg

Bought by

Coburn Craig

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$71,200

Interest Rate

10.35%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jan 5, 2005

Sold by

Estate Of Helen L Inderrieden

Bought by

Inderrieden Greg

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Seiber Clayde R | $69,000 | Republic Title Agency Inc | |

| Brazeal Benjamin K | -- | Attorney | |

| Brazeal Jerry | $35,500 | None Available | |

| Coburn Craig | $89,000 | Partners Land Title Agency | |

| Inderrieden Greg | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Seiber Clayde R | $67,750 | |

| Previous Owner | Coburn Craig | $71,200 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $918 | $36,160 | $9,910 | $26,250 |

| 2023 | $943 | $36,160 | $9,910 | $26,250 |

| 2022 | $1,131 | $27,190 | $8,600 | $18,590 |

| 2021 | $1,113 | $27,190 | $8,600 | $18,590 |

| 2020 | $1,113 | $27,190 | $8,600 | $18,590 |

| 2019 | $976 | $23,590 | $7,260 | $16,330 |

| 2018 | $975 | $23,590 | $7,260 | $16,330 |

| 2017 | $981 | $23,590 | $7,260 | $16,330 |

| 2016 | $840 | $20,740 | $7,260 | $13,480 |

| 2015 | $843 | $20,760 | $7,260 | $13,500 |

| 2014 | $843 | $20,760 | $7,260 | $13,500 |

| 2013 | $946 | $21,530 | $7,260 | $14,270 |

Source: Public Records

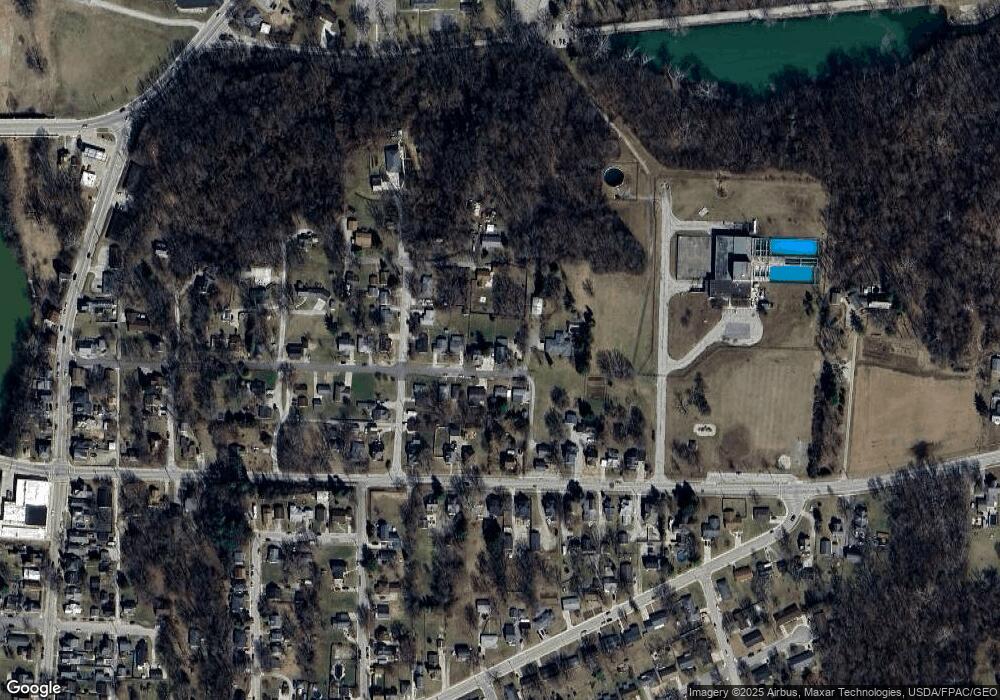

Map

Nearby Homes

- 800 Dingman St

- 115 Brooklyn Ave

- 414 & 416 E Court St

- 309 Hillcrest Ct

- 321 E South St

- 321-321.5 E South St

- 315 Washington St

- 510 S Main Ave

- 400 Jefferson St

- 109 E Water St

- 105 N Ohio Ave Unit C

- 107 N Ohio Ave Unit C

- 420 S Ohio Ave

- 620 S Ohio Ave

- 131 Mound St

- 808 N Main Ave

- 418 Kossuth St

- 209 Pike St

- 1203 Riverbend Blvd

- 828 N West Ave

- 812 Dingman St

- 820 Dingman St

- 808 Dingman St

- 815 Dingman St

- 817 Dingman St

- 815 Ferree Place

- 802 Dingman St

- 807 Ferree Place

- 114 Foster Ave

- 805 Dingman St

- 803 Dingman St

- 812 Ferree Place

- 110 Foster Ave

- 101 Foster Ave

- 818 E Court St

- 820 E Court St

- 810 E Court St

- 824 E Court St

- 740 Dingman St

- 0 Ferree Place