819 12 1 2 Ave W West Fargo, ND 58078

Westwood NeighborhoodEstimated Value: $255,000 - $288,000

4

Beds

2

Baths

1,620

Sq Ft

$171/Sq Ft

Est. Value

About This Home

This home is located at 819 12 1 2 Ave W, West Fargo, ND 58078 and is currently estimated at $276,949, approximately $170 per square foot. 819 12 1 2 Ave W is a home located in Cass County with nearby schools including Westside Elementary School, Cheney Middle School, and West Fargo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 18, 2017

Sold by

Flanagin Teresa K and Flanagin John

Bought by

Schultz James R and Schultz Cathy A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,000

Outstanding Balance

$127,971

Interest Rate

3.94%

Mortgage Type

New Conventional

Estimated Equity

$148,978

Purchase Details

Closed on

May 16, 2014

Sold by

Gregerson Kenneth O and Gregerson Lorraine L

Bought by

Gregerson Kenneth O

Purchase Details

Closed on

Feb 8, 2014

Sold by

Flanagin Teresa K and Flanagin John

Bought by

Flanagin Teresa K

Purchase Details

Closed on

Jul 20, 2013

Sold by

Flanagin Teresa K and Timmerman Teresa K

Bought by

Flanagin Teresa K

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schultz James R | $190,000 | 16 Title Co | |

| Gregerson Kenneth O | -- | None Available | |

| Flanagin Teresa K | -- | None Available | |

| Flanagin Teresa K | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Schultz James R | $152,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $639 | $118,900 | $18,050 | $100,850 |

| 2023 | $473 | $112,300 | $18,050 | $94,250 |

| 2022 | $1,968 | $103,600 | $18,050 | $85,550 |

| 2021 | $2,916 | $94,450 | $14,400 | $80,050 |

| 2020 | $1,432 | $91,350 | $14,400 | $76,950 |

| 2019 | $1,315 | $86,900 | $14,400 | $72,500 |

| 2018 | $2,518 | $86,900 | $14,400 | $72,500 |

| 2017 | $2,299 | $82,850 | $14,400 | $68,450 |

| 2016 | $2,039 | $80,050 | $14,400 | $65,650 |

| 2015 | $2,031 | $73,200 | $5,750 | $67,450 |

| 2014 | $1,995 | $68,400 | $5,750 | $62,650 |

| 2013 | $2,029 | $68,400 | $5,750 | $62,650 |

Source: Public Records

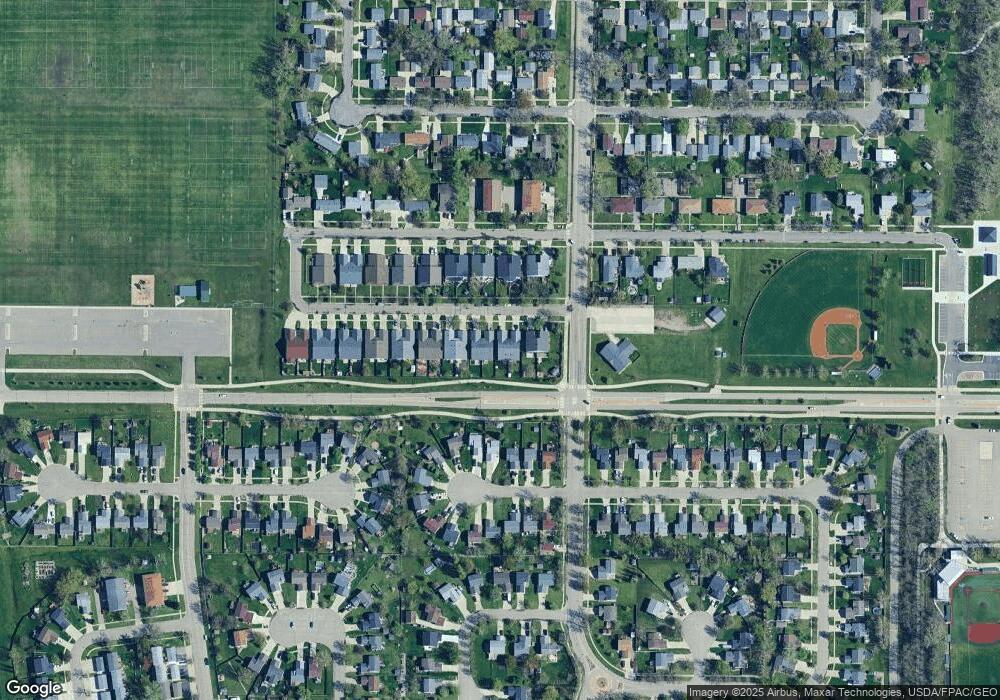

Map

Nearby Homes

- 830 12th Ave W

- 1447 Elmwood Ct

- 723 16th Ave W

- 744 Elm St

- 1165 7th Ave W

- 719 5th Ave W

- 514 7th Ave W

- 520 6th Ave W Unit 8

- 226 10 1/2 Ave W

- 232 15th Ave W

- 1633 3rd St W

- 431 Morrison St

- 109 7th Ave E

- 243 12 1 2 Ave E

- 109 5th Ave W

- 1844 1st St

- 1264 Marlys Dr W

- 237 10th Ave E

- 245 12th Ave E

- 336 13th Ave E

- 819 12 1/2 Ave W

- 823 12 1/2 Ave W

- 823 12 1 2 Ave W

- 815 12 1 2 Ave W

- 827 12 1/2 Ave W

- 815 12 1/2 Ave W

- 827 12 1 2 Ave W

- 831 12 1/2 Ave W

- 811 12 1/2 Ave W

- 831 12 1 2 Ave W

- 835 12 1/2 Ave W

- 835 12 1 2 Ave W

- 807 12 1/2 Ave W

- 839 12 1/2 Ave W

- 843 12 1/2 Ave W

- 843 12 1 2 Ave W

- 817 12th Ave W

- 821 12th Ave W

- 813 12th Ave W

- 829 12th Ave W