8193 NW 8th Manor Plantation, FL 33324

Estimated Value: $194,574 - $276,000

3

Beds

3

Baths

1,690

Sq Ft

$129/Sq Ft

Est. Value

About This Home

This home is located at 8193 NW 8th Manor, Plantation, FL 33324 and is currently estimated at $217,394, approximately $128 per square foot. 8193 NW 8th Manor is a home located in Broward County with nearby schools including Peters Elementary School, Plantation Middle School, and Plantation High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 30, 2025

Sold by

Brodskaya Liliya

Bought by

Timul Merline

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$199,192

Outstanding Balance

$199,023

Interest Rate

6.81%

Mortgage Type

VA

Estimated Equity

$18,372

Purchase Details

Closed on

Sep 22, 2017

Sold by

Wolf Sean

Bought by

Brodskaya Liliya

Purchase Details

Closed on

Dec 11, 2014

Sold by

Wolf Sean

Bought by

Wolf Sean and Revocable Trust Agreement Of Sean Wolf

Purchase Details

Closed on

Mar 29, 2013

Sold by

Spingarn Susan J

Bought by

Wolf Sean

Purchase Details

Closed on

Jun 3, 1999

Sold by

Woltag Alice

Bought by

Spingarn Susan J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$46,400

Interest Rate

6.9%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Timul Merline | $195,000 | South Florida Title | |

| Brodskaya Liliya | $140,000 | Attorney | |

| Wolf Sean | -- | Attorney | |

| Wolf Sean | $90,000 | Capital Abstract & Title | |

| Spingarn Susan J | $100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Timul Merline | $199,192 | |

| Previous Owner | Spingarn Susan J | $46,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,509 | $230,720 | -- | -- |

| 2024 | $4,048 | $230,720 | $20,150 | $181,330 |

| 2023 | $4,048 | $190,690 | $0 | $0 |

| 2022 | $3,670 | $173,360 | $0 | $0 |

| 2021 | $3,253 | $157,600 | $15,760 | $141,840 |

| 2020 | $3,024 | $146,670 | $14,670 | $132,000 |

| 2019 | $2,837 | $136,490 | $13,650 | $122,840 |

| 2018 | $2,860 | $139,310 | $13,930 | $125,380 |

| 2017 | $2,353 | $110,190 | $0 | $0 |

| 2016 | $2,199 | $100,180 | $0 | $0 |

| 2015 | $2,176 | $91,080 | $0 | $0 |

| 2014 | $1,813 | $82,800 | $0 | $0 |

| 2013 | -- | $65,100 | $6,510 | $58,590 |

Source: Public Records

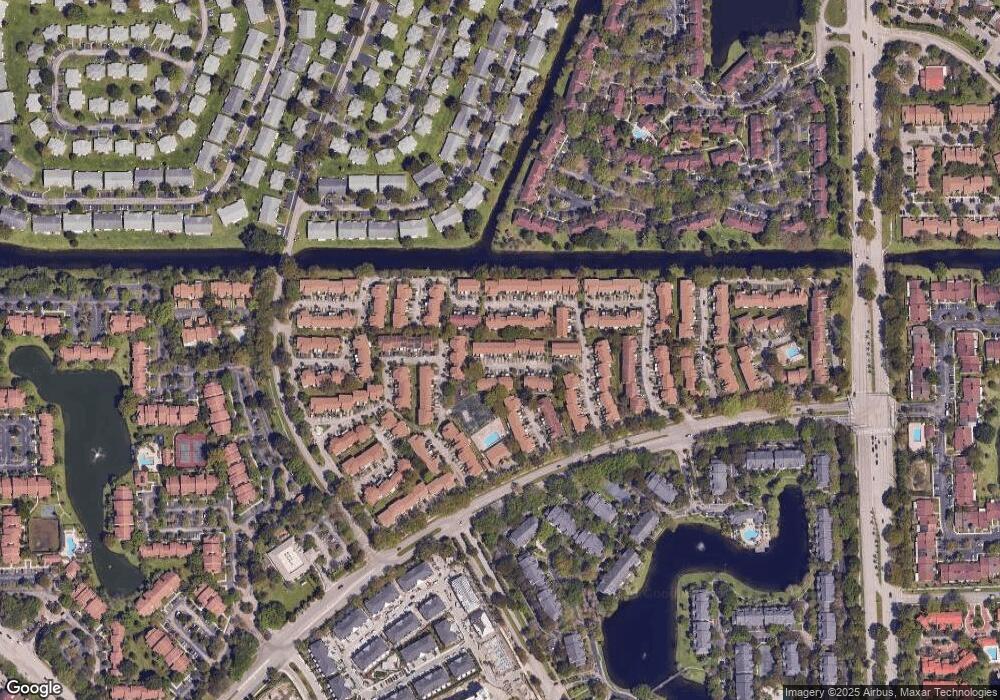

Map

Nearby Homes

- 879 NW 81st Way Unit 4

- 8183 NW 8th Manor Unit 9

- 8203 NW 9th Ct Unit 2

- 841 NW 82nd Ave Unit 2

- 862 NW 81st Terrace Unit 6

- 835 NW 81st Terrace

- 8216 NW 8th St Unit 3

- 8226 NW 8th Place Unit 6

- 8223 NW 8th St Unit 11

- 8248 NW 9th St Unit 6

- 8233 NW 8th Ct

- 8256 NW 9th Ct Unit 2

- 8239 NW 8th St Unit 3

- 865 NW 80th Terrace Unit 6

- 1084 NW 83rd Ave Unit B63

- 8367 NW 7th Place

- 1152 NW 83rd Ave Unit D66

- 8447 NW 12th St Unit A69

- 7940 NW 10th St

- 851 NW 79th Terrace

- 8191 NW 8th Manor Unit 5

- 8187 NW 8th Manor Unit 7

- 8195 NW 8th Manor Unit 3

- 8189 NW 8th Manor Unit 6

- 8189 NW 8th Place Unit 6

- 8199 NW 8th Manor Unit 1

- 885 NW 81st Way

- 885 NW 81st Way Unit 1

- 8185 NW 8th Manor Unit 8

- 8196 NW 8th Manor Unit 2

- 8198 NW 8th Manor Unit 1

- 8192 NW 8th Manor Unit 4

- 8194 NW 8th Manor Unit 318

- 8190 NW 8th Manor Unit 5

- 8190 NW 8th Manor Unit 18-05

- 8200 NW 9th Ct Unit 4

- 873 NW 81st Way Unit 7

- 877 NW 81st Way Unit 5

- 883 NW 81st Way Unit 2

- 8207 NW 8th Place Unit 3