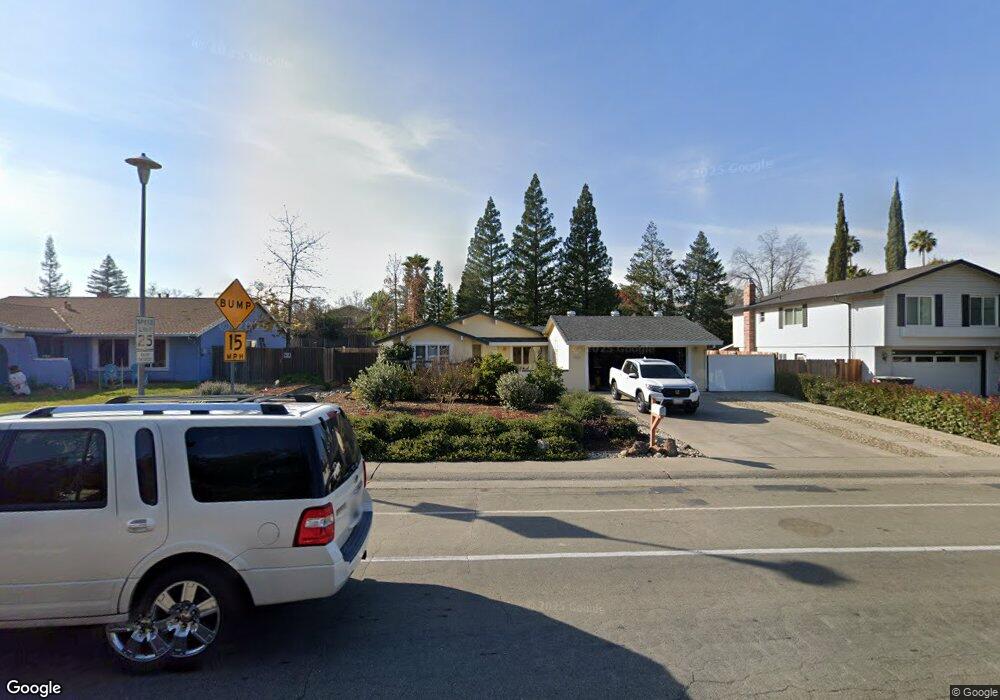

8204 Twin Oaks Ave Citrus Heights, CA 95610

Estimated Value: $555,363 - $585,000

3

Beds

2

Baths

1,631

Sq Ft

$347/Sq Ft

Est. Value

About This Home

This home is located at 8204 Twin Oaks Ave, Citrus Heights, CA 95610 and is currently estimated at $565,841, approximately $346 per square foot. 8204 Twin Oaks Ave is a home located in Sacramento County with nearby schools including Woodside K-8, San Juan High School, and Country Hill Montessori School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 30, 2021

Sold by

Kistler Carl John

Bought by

Kistler Carl John and Carl John Kistler Trust

Current Estimated Value

Purchase Details

Closed on

Jul 6, 2020

Sold by

Kistler Carl John

Bought by

Kistler Carl John

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$163,000

Outstanding Balance

$115,163

Interest Rate

3.1%

Mortgage Type

New Conventional

Estimated Equity

$450,678

Purchase Details

Closed on

Feb 4, 2013

Sold by

Duncan Tammy Lynn

Bought by

Kistler Carl John

Purchase Details

Closed on

Mar 1, 2010

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Kistler Carl John and Duncan Tammy Lynn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$219,688

Interest Rate

4.94%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 30, 2009

Sold by

Deluz Robert

Bought by

Federal Home Loan Mortgage Corp

Purchase Details

Closed on

May 16, 2006

Sold by

Deluz Karen

Bought by

Deluz Robert

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

6.52%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

May 2, 2006

Sold by

Scott Daniel C and Scott Michelle

Bought by

Deluz Robert

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

6.52%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Apr 5, 2000

Sold by

Mcdonough Robert M and Mcdonough Catherine C

Bought by

Scott Daniel C and Scott Michelle

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,000

Interest Rate

8.24%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kistler Carl John | -- | None Available | |

| Kistler Carl John | -- | None Available | |

| Kistler Carl John | -- | First American Title Company | |

| Kistler Carl John | -- | None Available | |

| Kistler Carl John | $240,000 | Ticor Title Redlands | |

| Federal Home Loan Mortgage Corp | $219,000 | Accommodation | |

| Deluz Robert | -- | First American Title Co | |

| Deluz Robert | $400,000 | First American Title Co | |

| Scott Daniel C | $180,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kistler Carl John | $163,000 | |

| Closed | Kistler Carl John | $219,688 | |

| Previous Owner | Deluz Robert | $80,000 | |

| Previous Owner | Deluz Robert | $320,000 | |

| Previous Owner | Scott Daniel C | $171,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,588 | $309,781 | $129,073 | $180,708 |

| 2024 | $3,588 | $303,708 | $126,543 | $177,165 |

| 2023 | $3,495 | $297,754 | $124,062 | $173,692 |

| 2022 | $3,475 | $291,917 | $121,630 | $170,287 |

| 2021 | $3,417 | $286,195 | $119,246 | $166,949 |

| 2020 | $3,352 | $283,262 | $118,024 | $165,238 |

| 2019 | $3,283 | $277,709 | $115,710 | $161,999 |

| 2018 | $3,244 | $272,265 | $113,442 | $158,823 |

| 2017 | $3,297 | $266,927 | $111,218 | $155,709 |

| 2016 | $3,080 | $261,694 | $109,038 | $152,656 |

| 2015 | $3,028 | $257,764 | $107,401 | $150,363 |

| 2014 | $2,965 | $252,716 | $105,298 | $147,418 |

Source: Public Records

Map

Nearby Homes

- 8206 Peregrine Way

- 8232 Garry Oak Dr

- 1527 Crestmont Ave

- 8058 Mesa Oak Way

- 1814 Vista Creek Dr

- 0 Charlotte Ave

- 1529 Pine Valley Cir

- 8149 Glen Canyon Ct

- 1501 Crestmont Ave

- 1309 Hedgerow Ct

- 7812 Auburn Woods Dr

- 8204 Conover Dr

- 7836 Wintergreen Dr

- 1421 Champion Oaks Dr

- 8007 Creekfront Ln

- 8000 Aspen Ln

- 8024 Glen Briar Dr

- 1817 Woodacre Way

- 8324 Sunrise Blvd

- 1812 Wildwood Way

- 8200 Twin Oaks Ave

- 8208 Twin Oaks Ave

- 8145 Holm Oak Way

- 8212 Twin Oaks Ave

- 8198 Twin Oaks Ave

- 8141 Holm Oak Way

- 8149 Holm Oak Way

- 8300 Crestmont Ave

- 8201 Coast Oak Way

- 8153 Holm Oak Way

- 8137 Holm Oak Way

- 8216 Twin Oaks Ave

- 8190 Twin Oaks Ave

- 8304 Crestmont Ave

- 8301 Crestmont Ave

- 8205 Coast Oak Way

- 8157 Holm Oak Way

- 8220 Twin Oaks Ave

- 8182 Twin Oaks Ave

- 8144 Holm Oak Way