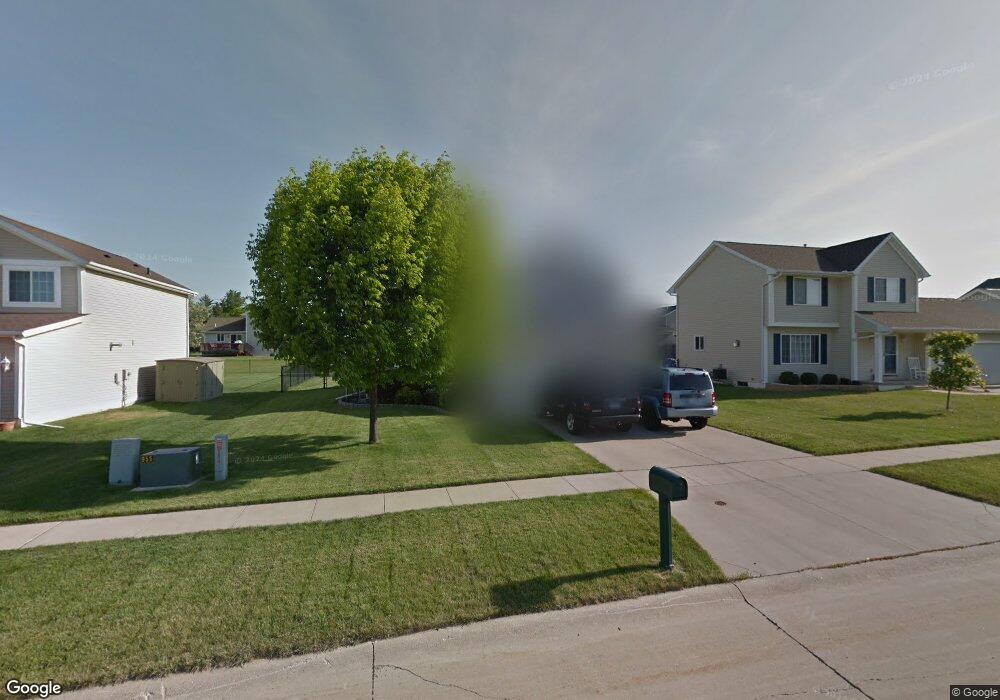

822 73rd St NE Cedar Rapids, IA 52402

Estimated Value: $279,000 - $299,000

3

Beds

3

Baths

1,494

Sq Ft

$192/Sq Ft

Est. Value

About This Home

This home is located at 822 73rd St NE, Cedar Rapids, IA 52402 and is currently estimated at $286,731, approximately $191 per square foot. 822 73rd St NE is a home located in Linn County with nearby schools including Westfield Elementary School, Oak Ridge School, and Linn-Mar High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 16, 2008

Sold by

Dory Dean M and Dory Jill C

Bought by

Cortez Lester Tyrus A and Cortez Lester Persida

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$167,500

Outstanding Balance

$111,591

Interest Rate

6.3%

Mortgage Type

VA

Estimated Equity

$175,140

Purchase Details

Closed on

Dec 20, 2006

Sold by

Zhao Jingan

Bought by

Dory Dean M and Dory Jill C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$154,900

Interest Rate

6.24%

Mortgage Type

VA

Purchase Details

Closed on

Nov 9, 2000

Sold by

Jerrys Homes Inc

Bought by

Zhao Jingan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

7.91%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cortez Lester Tyrus A | $167,000 | None Available | |

| Dory Dean M | $154,500 | None Available | |

| Zhao Jingan | $143,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cortez Lester Tyrus A | $167,500 | |

| Previous Owner | Dory Dean M | $154,900 | |

| Previous Owner | Zhao Jingan | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,548 | $258,500 | $54,100 | $204,400 |

| 2024 | $69 | $243,300 | $54,100 | $189,200 |

| 2023 | $69 | $232,100 | $50,700 | $181,400 |

| 2022 | $105 | $212,600 | $47,300 | $165,300 |

| 2021 | $4,208 | $189,800 | $43,900 | $145,900 |

| 2020 | $117 | $179,200 | $35,500 | $143,700 |

| 2019 | $3,980 | $166,000 | $35,500 | $130,500 |

| 2018 | $3,692 | $166,000 | $35,500 | $130,500 |

| 2017 | $3,666 | $163,900 | $35,500 | $128,400 |

| 2016 | $3,666 | $163,900 | $35,500 | $128,400 |

| 2015 | $3,604 | $160,923 | $27,030 | $133,893 |

| 2014 | $3,604 | $160,923 | $27,030 | $133,893 |

| 2013 | $3,484 | $160,923 | $27,030 | $133,893 |

Source: Public Records

Map

Nearby Homes

- 803 73rd St NE

- 7502 Summerset Ave NE

- 935 74th St NE Unit 1

- 7599 Summerset Ave NE

- 7415 Pin Tail Dr NE

- 1055 74th St NE Unit 1055

- 7701 Westfield Dr NE

- 7104 Doubletree Rd NE

- 1229 Honey Creek Way NE

- 1027 Acacia Dr NE

- 6965 Doubletree Rd NE Unit 6965

- 1241 74th St NE Unit 1241

- 1008 Doubletree Ct NE Unit 1008

- 929 Messina Dr NE

- 1127 Tiara Dr NE

- 923 Messina Dr NE

- 7128 Summerland Ridge Rd NE

- 1226 Prairieview Dr NE

- 733 Broderick Dr NE Unit B

- 1215 Prairieview Dr NE

- 816 73rd St NE

- 823 74th St NE

- 810 73rd St NE

- 817 74th St NE

- 829 74th St NE

- 811 74th St NE

- 821 73rd St NE

- 827 73rd St NE

- 804 73rd St NE

- 815 73rd St NE

- 833 73rd St NE

- 809 73rd St NE

- 901 74th St NE

- 805 74th St NE

- 726 73rd St NE

- 1138 White Ivy Place NE

- 1132 White Ivy Place NE

- 1126 White Ivy Place NE

- 729 74th St NE

- 907 74th St NE