823 823 Morningside-Loop- St. Joseph, MN 56374

Estimated Value: $412,975 - $439,000

4

Beds

4

Baths

1,578

Sq Ft

$272/Sq Ft

Est. Value

About This Home

This home is located at 823 823 Morningside-Loop-, St. Joseph, MN 56374 and is currently estimated at $428,744, approximately $271 per square foot. 823 823 Morningside-Loop- is a home located in Stearns County with nearby schools including Kennedy Community School, Apollo Senior High School, and St. Joseph Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 9, 2025

Sold by

Mason Elizabeth and Trujillo Victor

Bought by

Ramlakhan Stephanie and Ramlakhan Joel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$320,250

Outstanding Balance

$319,699

Interest Rate

6.77%

Mortgage Type

New Conventional

Estimated Equity

$109,045

Purchase Details

Closed on

Jun 8, 2023

Sold by

Grote Emily and Grote Kyle

Bought by

Trujillo Victor and Mason Elizabeth

Purchase Details

Closed on

Apr 28, 2021

Sold by

Merdan Chad and Mueller Sarah

Bought by

Grote Kyle and Grote Emily

Purchase Details

Closed on

Jan 18, 2018

Sold by

Mckenzie Patrick and Mckenzie Jillian

Bought by

Merdan Chad

Purchase Details

Closed on

Jan 23, 2012

Sold by

Simon Scott M and Simon Holly N

Bought by

Mckenzie Patrick

Purchase Details

Closed on

Jan 12, 2007

Sold by

Kremers Dale L

Bought by

Simon Scott M and Simon Holly N

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ramlakhan Stephanie | $427,000 | -- | |

| Ramlakhan Stephanie | $427,000 | Key Title & Closing Services | |

| Trujillo Victor | $391,000 | -- | |

| Grote Kyle | $310,000 | First American Title | |

| Merdan Chad | $238,500 | -- | |

| Mckenzie Patrick | $215,000 | -- | |

| Simon Scott M | $221,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ramlakhan Stephanie | $320,250 | |

| Closed | Ramlakhan Stephanie | $320,250 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $922 | $371,800 | $46,800 | $325,000 |

| 2024 | $644 | $368,000 | $46,800 | $321,200 |

| 2023 | $4,434 | $348,900 | $46,800 | $302,100 |

| 2022 | $3,860 | $276,700 | $43,000 | $233,700 |

| 2021 | $3,430 | $276,700 | $43,000 | $233,700 |

| 2020 | $3,466 | $253,000 | $43,000 | $210,000 |

| 2019 | $2,966 | $243,300 | $43,000 | $200,300 |

| 2018 | $2,846 | $201,000 | $43,000 | $158,000 |

| 2017 | $2,674 | $191,200 | $43,000 | $148,200 |

| 2016 | $2,516 | $0 | $0 | $0 |

| 2015 | $2,476 | $0 | $0 | $0 |

| 2014 | -- | $0 | $0 | $0 |

Source: Public Records

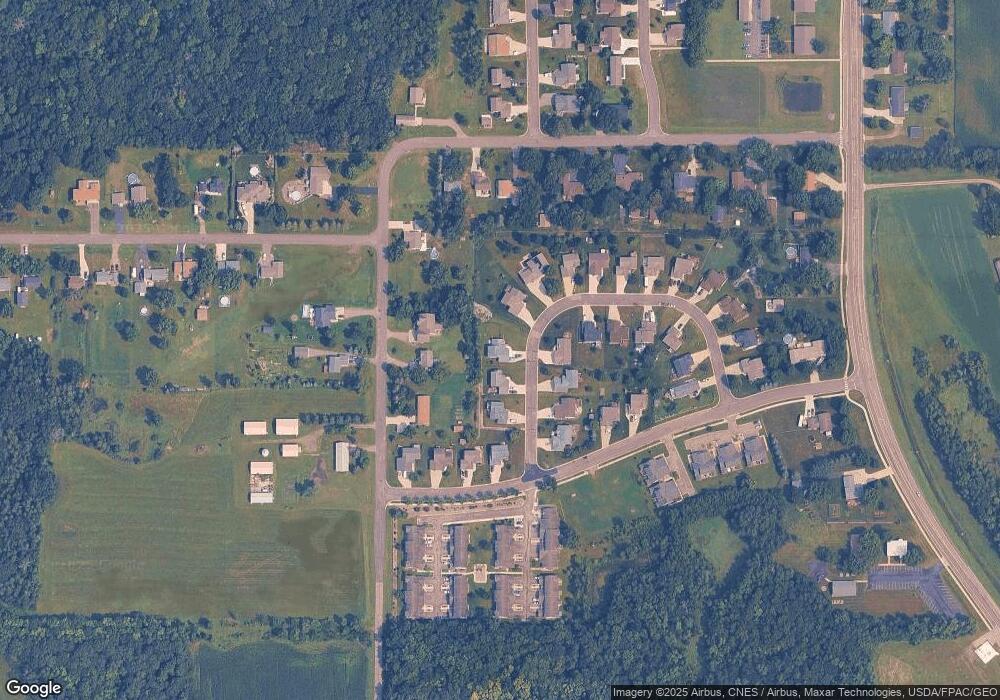

Map

Nearby Homes

- 823 823 Morningside Loop

- 825 Morningside Loop

- 825 825 Morningside Loop

- 821 Morningside Loop

- 821 821 Morningside Loop

- 820 820 Morningside Loop

- 820 Morningside Loop

- 814 3rd Ave SW

- 827 Morningside Loop

- 827 827 Morningside Loop

- 818 3rd Ave SW

- 819 Morningside Loop

- 824 Morningside Loop

- 810 3rd Ave SW

- 816 816 Morningside-Loop-

- 816 816 Morningside Loop

- 816 Morningside Loop

- 826 826 Morningside Loop

- 826 826 Morningside-Loop-

- 826 Morningside Loop