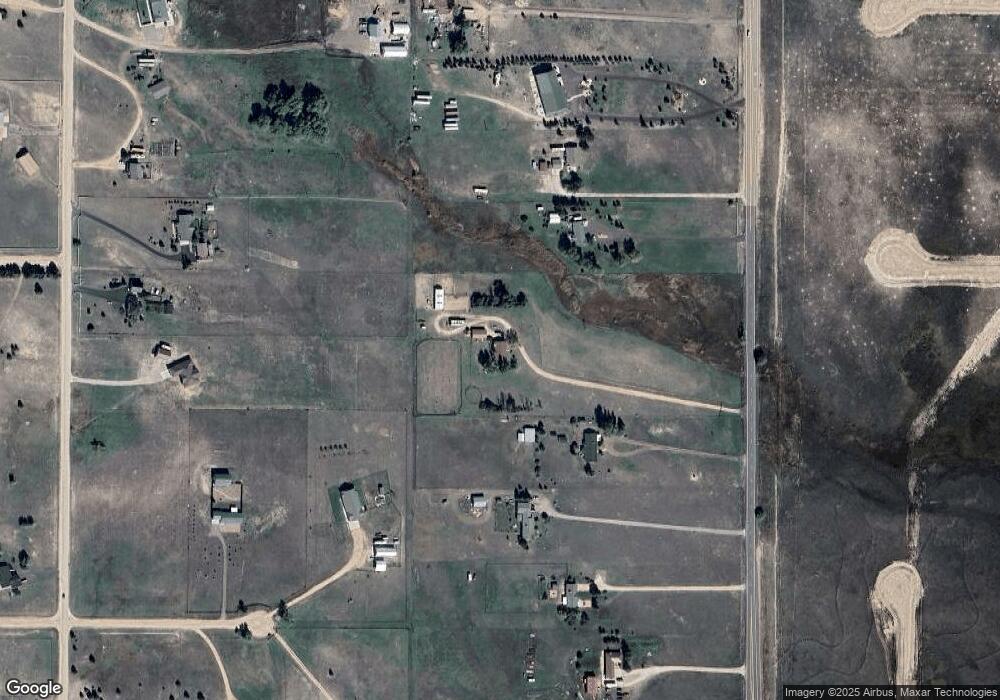

8230 Curtis Rd Peyton, CO 80831

Falcon NeighborhoodEstimated Value: $604,980 - $702,000

3

Beds

2

Baths

1,608

Sq Ft

$410/Sq Ft

Est. Value

About This Home

This home is located at 8230 Curtis Rd, Peyton, CO 80831 and is currently estimated at $659,995, approximately $410 per square foot. 8230 Curtis Rd is a home located in El Paso County with nearby schools including Falcon Elementary School Of Technology, Falcon Middle School, and Falcon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 20, 2018

Sold by

Carter Chandra A

Bought by

Carter Chandra A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$292,500

Outstanding Balance

$248,031

Interest Rate

4.04%

Mortgage Type

New Conventional

Estimated Equity

$411,964

Purchase Details

Closed on

Oct 23, 2015

Sold by

Mikkelsen Leslie E

Bought by

Carter Christopher and Carter Chandra A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$323,000

Interest Rate

3.94%

Mortgage Type

VA

Purchase Details

Closed on

May 15, 2001

Sold by

Barhite Dwight M

Bought by

Barhite Dwight M and Pauly Linda

Purchase Details

Closed on

Oct 8, 1985

Bought by

Carter Christopher

Purchase Details

Closed on

Jun 5, 1985

Bought by

Carter Christopher

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carter Chandra A | -- | Capital Title | |

| Carter Christopher | $337,000 | Heritage Title Co | |

| Barhite Dwight M | -- | -- | |

| Carter Christopher | -- | -- | |

| Carter Christopher | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Carter Chandra A | $292,500 | |

| Closed | Carter Christopher | $323,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,477 | $36,480 | -- | -- |

| 2024 | $2,367 | $38,590 | $16,350 | $22,240 |

| 2023 | $2,367 | $38,590 | $16,350 | $22,240 |

| 2022 | $2,379 | $34,270 | $13,100 | $21,170 |

| 2021 | $2,474 | $35,250 | $13,470 | $21,780 |

| 2020 | $2,139 | $30,330 | $10,440 | $19,890 |

| 2019 | $2,119 | $30,330 | $10,440 | $19,890 |

| 2018 | $1,215 | $24,300 | $9,430 | $14,870 |

| 2017 | $1,113 | $24,300 | $9,430 | $14,870 |

| 2016 | $945 | $22,290 | $9,950 | $12,340 |

| 2015 | $1,472 | $22,290 | $9,950 | $12,340 |

| 2014 | $1,402 | $20,840 | $9,160 | $11,680 |

Source: Public Records

Map

Nearby Homes

- 14470 Seminole Ln

- 8071 Estacado Place

- 8815 Jae Lynn Dr

- 7776 Truchas Trail

- 7698 Truchas Trail

- 7621 Truchas Trail

- 7464 Truchas Trail

- 15150 Del Cerro Trail

- 15381 Oscuro Trail

- 14891 Oscuro Trail

- 14961 Oscuro Trail

- 15101 Oscuro Trail

- 14550 U S 24

- 0 E Judge Orr Rd Unit 2955069

- 7055 Buckboard Dr

- 9647 Vistas Park Dr

- 6525 Connie Lee Ct

- 9735 Vistas Park Dr

- 13260 Cottontail Dr

- 6545 Connie Lee Ct

- 8190 Curtis Rd

- 8320 Curtis Rd

- 8150 Curtis Rd

- 8370 Curtis Rd

- 14510 Seminole Ln

- 8280 Curtis Rd

- 8110 Curtis Rd

- 8225 Aerostar Dr

- 8450 Curtis Rd

- 8070 Curtis Rd

- 8325 Aerostar Dr

- 8275 Aerostar Dr

- 8030 Curtis Rd

- 8030 Curtis Rd

- 8125 Aerostar Dr

- 14775 Judge Orr Rd

- 8375 Aerostar Dr

- 14515 Seminole Ln

- 7990 Curtis Rd

- 14475 Seminole Ln

Your Personal Tour Guide

Ask me questions while you tour the home.