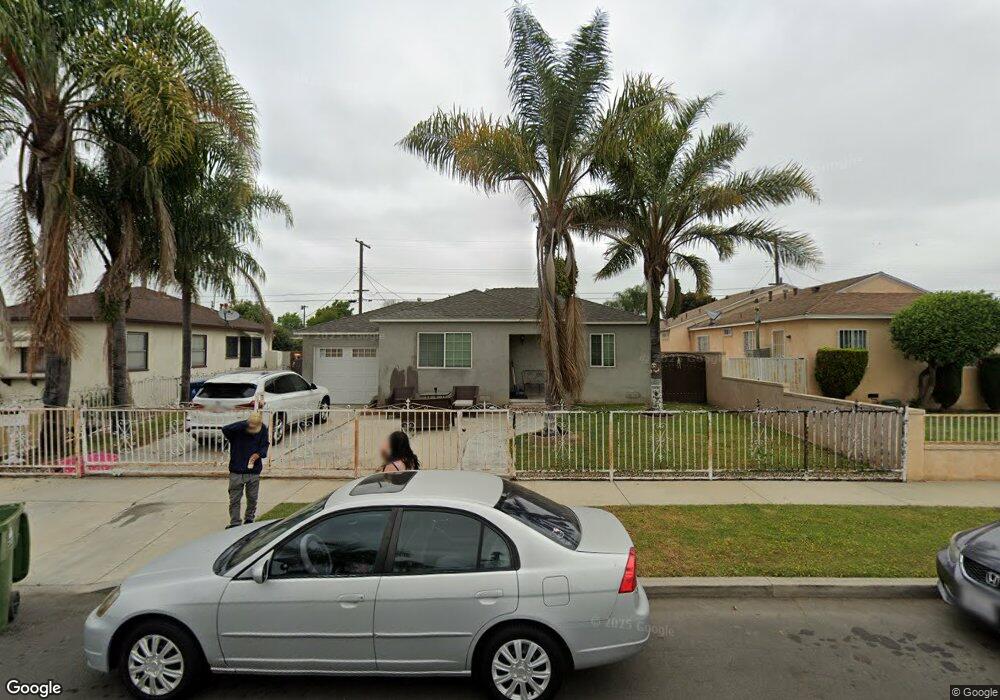

825 W 148th Place Gardena, CA 90247

Harbor Gateway NeighborhoodEstimated Value: $584,000 - $666,000

2

Beds

1

Bath

814

Sq Ft

$784/Sq Ft

Est. Value

About This Home

This home is located at 825 W 148th Place, Gardena, CA 90247 and is currently estimated at $637,820, approximately $783 per square foot. 825 W 148th Place is a home located in Los Angeles County with nearby schools including Amestoy Elementary School, Robert E. Peary Middle School, and Gardena Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 2, 2010

Sold by

Federal National Mortgage Association

Bought by

Lopez Patricia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$217,442

Interest Rate

4.31%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 1, 2009

Sold by

Gutierrez Armando

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Jun 13, 2003

Sold by

Padilla Feliz

Bought by

Gutierrez Armando and Gutierrez Esther M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,000

Interest Rate

5.26%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 8, 1997

Sold by

Zamora Alvaro

Bought by

Padilla Efliz and Gutierrez Esther M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lopez Patricia | $214,000 | Stewart Title Of California | |

| Federal National Mortgage Association | $301,350 | First American Title Ins Co | |

| Gutierrez Armando | -- | New Century Title | |

| Padilla Efliz | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lopez Patricia | $217,442 | |

| Previous Owner | Gutierrez Armando | $119,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,544 | $274,159 | $219,330 | $54,829 |

| 2024 | $3,544 | $268,784 | $215,030 | $53,754 |

| 2023 | $3,476 | $263,514 | $210,814 | $52,700 |

| 2022 | $3,319 | $258,348 | $206,681 | $51,667 |

| 2021 | $3,274 | $253,283 | $202,629 | $50,654 |

| 2020 | $3,302 | $250,687 | $200,552 | $50,135 |

| 2019 | $3,177 | $245,772 | $196,620 | $49,152 |

| 2018 | $3,140 | $240,954 | $192,765 | $48,189 |

| 2016 | $2,995 | $231,600 | $185,281 | $46,319 |

| 2015 | $2,949 | $228,122 | $182,498 | $45,624 |

| 2014 | $2,959 | $223,655 | $178,924 | $44,731 |

Source: Public Records

Map

Nearby Homes

- 749 W 147th St

- 14700 S Berendo Ave Unit 20

- 14734 Berendo Ave

- 14821 S Denver Ave

- 14100 S Ainsworth St

- 1236 Cottage Place Unit 26

- 15205 S Budlong Ave Unit 7

- 15205 S Budlong Ave Unit 1

- 15205 S Budlong Ave Unit 9

- 15116 S Raymond Ave Unit 104

- 1239 W Rosecrans Ave

- 1239 W Rosecrans Ave Unit 31

- 15214 S Raymond Ave Unit 105

- 14526 S Normandie Ave

- 15505 S Budlong Place

- 15534 S Budlong Place

- 15120 Normandie Ave

- 14919 S Normandie Ave Unit 18

- 13713 S Vermont Ave Unit 2

- 13713 S Vermont Ave Unit 24

- 819 W 148th Place

- 829 W 148th Place

- 824 W 148th St

- 835 W 148th Place

- 813 W 148th Place

- 818 W 148th St

- 828 W 148th St

- 812 W 148th St

- 834 W 148th St

- 824 W 148th Place

- 828 W 148th Place

- 809 W 148th Place

- 818 W 148th Place

- 834 W 148th Place

- 806 W 148th St

- 840 W 148th St

- 812 W 148th Place

- 845 W 148th Place

- 840 W 148th Place

- 803 W 148th Place