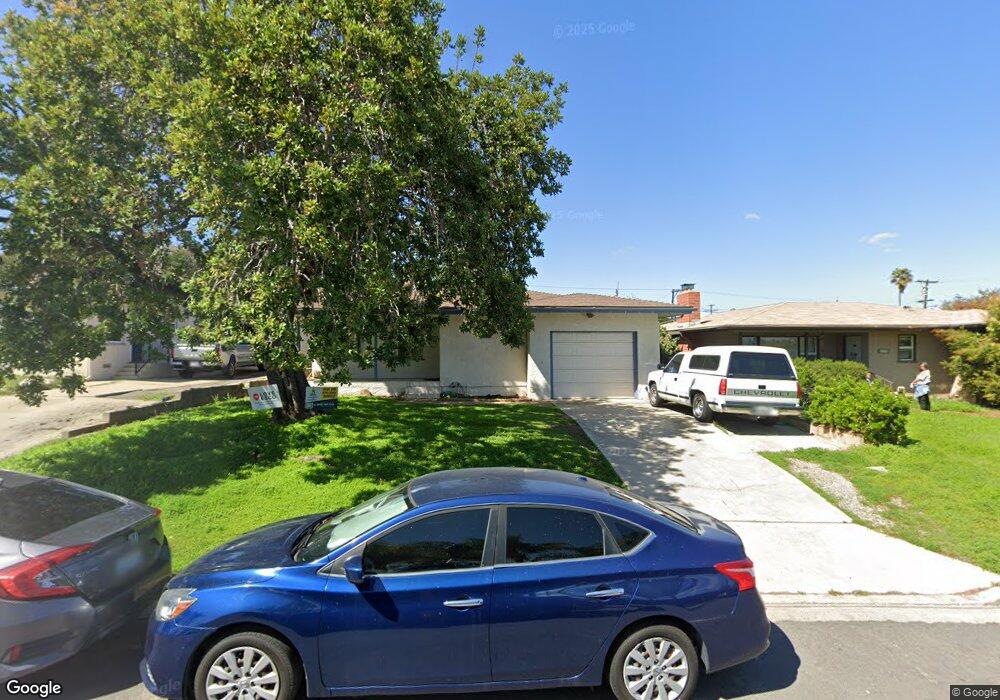

826 W 8th Ave Escondido, CA 92025

Central Escondido NeighborhoodEstimated Value: $744,000 - $778,476

3

Beds

2

Baths

1,559

Sq Ft

$488/Sq Ft

Est. Value

About This Home

This home is located at 826 W 8th Ave, Escondido, CA 92025 and is currently estimated at $761,369, approximately $488 per square foot. 826 W 8th Ave is a home located in San Diego County with nearby schools including Felicita Elementary, Del Dios Academy of Arts & Sciences, and San Pasqual High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 10, 2001

Sold by

Kucharek Wieslaw and Kucharek Krystyna

Bought by

Della Rocco Daniel L and Della Rocco Anita M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,000

Outstanding Balance

$61,525

Interest Rate

7.6%

Estimated Equity

$699,844

Purchase Details

Closed on

May 22, 1998

Sold by

Tyree James R

Bought by

Kucharek Wieslaw and Kucharek Krystyna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$136,800

Interest Rate

7.17%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Della Rocco Daniel L | $215,000 | Chicago Title Co | |

| Kucharek Wieslaw | $161,000 | Southland Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Della Rocco Daniel L | $160,000 | |

| Previous Owner | Kucharek Wieslaw | $136,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,573 | $323,949 | $113,000 | $210,949 |

| 2024 | $3,573 | $317,598 | $110,785 | $206,813 |

| 2023 | $3,491 | $311,371 | $108,613 | $202,758 |

| 2022 | $3,452 | $305,267 | $106,484 | $198,783 |

| 2021 | $3,395 | $299,283 | $104,397 | $194,886 |

| 2020 | $3,374 | $296,215 | $103,327 | $192,888 |

| 2019 | $3,292 | $290,407 | $101,301 | $189,106 |

| 2018 | $3,199 | $284,714 | $99,315 | $185,399 |

| 2017 | $3,146 | $279,132 | $97,368 | $181,764 |

| 2016 | $3,084 | $273,659 | $95,459 | $178,200 |

| 2015 | $3,057 | $269,550 | $94,026 | $175,524 |

| 2014 | $2,930 | $264,271 | $92,185 | $172,086 |

Source: Public Records

Map

Nearby Homes

- 819 W 7th Ave

- 752 W 9th Ave

- 759 W 10th Ave

- 308 S Tulip St

- 1001 Ontario St

- 514 W 10th Ave

- 1049 W 5th Ave

- 880 La Terraza Blvd

- 936 W 3rd Ave

- 967 W 2nd Ave

- 401 S Vine St

- 320 W 8th Ave

- 509 W 2nd Ave

- 215 Antoni Glen Unit 1112

- 225 Royal Glen Unit 408

- 335 W 3rd Ave

- 26 Bahama Dr

- 118 W 8th Ave

- 340 W 15th Ave Unit 5

- 118 W 11th Ave