8270 Richmond Way Salinas, CA 93907

Estimated Value: $1,416,000 - $1,649,000

6

Beds

4

Baths

5,150

Sq Ft

$296/Sq Ft

Est. Value

About This Home

This home is located at 8270 Richmond Way, Salinas, CA 93907 and is currently estimated at $1,523,320, approximately $295 per square foot. 8270 Richmond Way is a home located in Monterey County with nearby schools including North Monterey County Middle School, North Monterey County High School, and Oasis Charter Public.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 27, 2024

Sold by

Ramirez Francisco and Ramirez Francisco A

Bought by

Rami-Gar Family Trust and Ramirez

Current Estimated Value

Purchase Details

Closed on

Oct 5, 2017

Sold by

Carpenter Brenda

Bought by

Ramirez Francisco and Ramirez Rosa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$786,000

Interest Rate

3.87%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Apr 14, 2016

Sold by

Carpenter Brenda and Fitzjohn Branda C

Bought by

Carpenter Brenda

Purchase Details

Closed on

Oct 24, 2008

Sold by

Fitzjohn Christopher D

Bought by

Fitzjohn Brenda C

Purchase Details

Closed on

Dec 27, 1993

Sold by

Kilian Hugo K and Kilian Carol F

Bought by

Fitzjohn Christopher D and Fitzjohn Brenda J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$251,400

Interest Rate

3.75%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rami-Gar Family Trust | -- | None Listed On Document | |

| Ramirez Francisco | $982,500 | Old Republic Title Company | |

| Carpenter Brenda | -- | Orange Coast Title Company | |

| Carpenter Brenda | -- | Orange Coast Title Company | |

| Fitzjohn Brenda C | -- | None Available | |

| Fitzjohn Christopher D | $314,500 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ramirez Francisco | $786,000 | |

| Previous Owner | Fitzjohn Christopher D | $251,400 | |

| Closed | Fitzjohn Christopher D | $31,428 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,912 | $1,117,913 | $398,238 | $719,675 |

| 2024 | $11,912 | $1,095,994 | $390,430 | $705,564 |

| 2023 | $11,693 | $1,074,505 | $382,775 | $691,730 |

| 2022 | $11,629 | $1,053,437 | $375,270 | $678,167 |

| 2021 | $11,186 | $1,032,782 | $367,912 | $664,870 |

| 2020 | $11,242 | $1,022,193 | $364,140 | $658,053 |

| 2019 | $10,984 | $1,002,150 | $357,000 | $645,150 |

| 2018 | $10,801 | $982,500 | $350,000 | $632,500 |

| 2017 | $6,689 | $632,178 | $212,324 | $419,854 |

| 2016 | $6,962 | $619,783 | $208,161 | $411,622 |

| 2015 | $6,691 | $610,475 | $205,035 | $405,440 |

| 2014 | $6,573 | $598,517 | $201,019 | $397,498 |

Source: Public Records

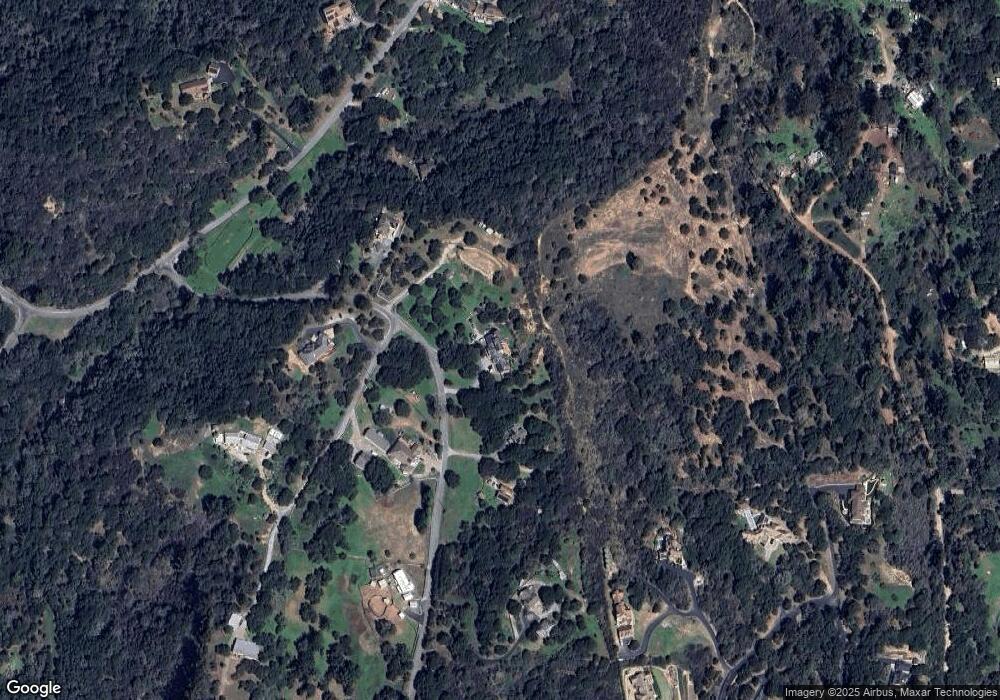

Map

Nearby Homes

- 19225 Reavis Way

- 18221 Berta Canyon Rd

- 7571 Via Guiseppe Ln

- 20210 Wilder Ct

- 19705 Moonglow Rd

- 9247 Holly Hill Dr

- 9086 Coker Rd

- 18101 Berta Canyon Rd

- 18530 Berta Ridge Place

- 2646 El Camino Real N

- 17920 Berta Canyon Rd

- 9395 King Rd

- 9070 Hidden Canyon Rd

- 9065 Hidden Canyon Rd

- 9055 Hidden Canyon Rd

- 11 Montclair Place

- 18810 Moro Rd

- 18751 Moro Rd

- 9020 Hidden Canyon Rd

- 9010 Hidden Canyon Rd

- 8300 Richmond Way

- 8275 Richmond Way

- 8250 Richmond Way Unit 1

- 8255 Richmond Way

- 19240 Reavis Way

- 8305 Richmond Way

- 8640 Woodland Heights Ct

- 19205 Quinn Place Unit 1

- 8320 Richmond Way

- 8650 Woodland Heights Ct

- 8650 Woodland Heights Ct

- 8630 Woodland Heights Ct

- 8711 Woodland Heights Ln

- 19235 Reavis Way

- 19190 Quinn Place

- 8621 Woodland Heights Ct

- 8350 Richmond Way

- 19260 Reavis Way

- 8355 Richmond Way

- 19245 Reavis Way