8289 Delaney Dr Unit 24 Inver Grove Heights, MN 55076

Estimated Value: $231,000 - $239,000

2

Beds

2

Baths

1,156

Sq Ft

$203/Sq Ft

Est. Value

About This Home

This home is located at 8289 Delaney Dr Unit 24, Inver Grove Heights, MN 55076 and is currently estimated at $234,417, approximately $202 per square foot. 8289 Delaney Dr Unit 24 is a home located in Dakota County with nearby schools including Pine Bend Elementary School, Inver Grove Heights Middle School, and Simley Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 25, 2021

Sold by

Mcguire Caitlin I and Steingraeber Robert H

Bought by

Arabadji Alyssa M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$216,310

Outstanding Balance

$196,447

Interest Rate

2.96%

Mortgage Type

New Conventional

Estimated Equity

$37,970

Purchase Details

Closed on

Jun 29, 2016

Sold by

Scherping Mandee and Scherping Kristopher

Bought by

Mcguier Caitlin I and Steingraeber Robert H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,850

Interest Rate

3.48%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 13, 2005

Sold by

Hansen Shawna M and Ogarek Ryan K

Bought by

Checkalski Mandee Jo

Purchase Details

Closed on

Jan 20, 2004

Sold by

Sunset Homes Corp

Bought by

Hansen Shawna M and Ogorek Ryan K

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Arabadji Alyssa M | $223,000 | Edina Realty Title Inc | |

| Mcguier Caitlin I | $143,000 | Edina Realty Title Inc | |

| Checkalski Mandee Jo | $167,000 | -- | |

| Hansen Shawna M | $150,700 | -- | |

| Arabadji Alyssa Alyssa | $223,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Arabadji Alyssa M | $216,310 | |

| Previous Owner | Mcguier Caitlin I | $135,850 | |

| Closed | Arabadji Alyssa Alyssa | $211,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,758 | $200,700 | $33,400 | $167,300 |

| 2023 | $1,758 | $188,100 | $33,600 | $154,500 |

| 2022 | $1,614 | $189,300 | $33,600 | $155,700 |

| 2021 | $1,514 | $164,600 | $29,200 | $135,400 |

| 2020 | $1,426 | $154,000 | $27,800 | $126,200 |

| 2019 | $1,366 | $146,600 | $26,500 | $120,100 |

| 2018 | $1,295 | $133,900 | $24,500 | $109,400 |

| 2017 | $1,236 | $127,100 | $22,700 | $104,400 |

| 2016 | $1,167 | $120,900 | $21,600 | $99,300 |

| 2015 | $1,039 | $89,200 | $15,841 | $73,359 |

| 2014 | -- | $74,485 | $13,734 | $60,751 |

| 2013 | -- | $70,888 | $12,434 | $58,454 |

Source: Public Records

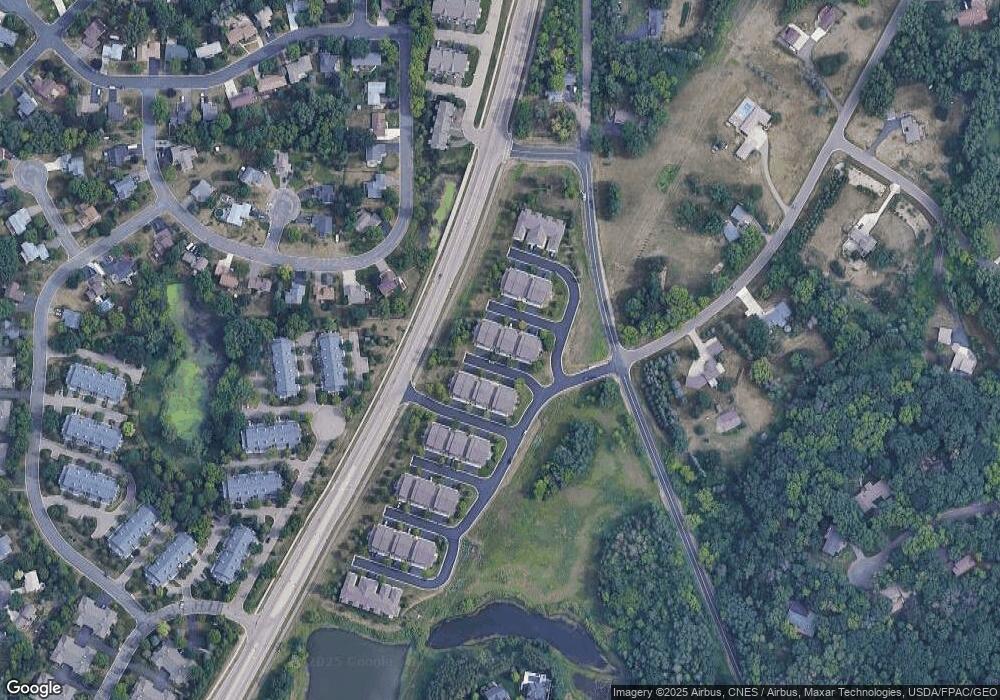

Map

Nearby Homes

- 8381 Corcoran Cir Unit 49

- 8104 Dana Path

- 8086 Dana Path

- 8550 Corcoran Path

- 8590 Corcoran Path

- 7996 Corey Path

- 8336 Cloman Ave

- 3750 80th St E

- 3853 90th St E

- 8124 Clifford Cir

- 3901 Conroy Trail

- 3944 76th Way E

- 3861 Conroy Trail

- 8827 Coffman Path

- 7944 Charles Way

- 8361 Carew Ct

- 3617 76th Ln E

- 3295 80th St E Unit 508

- 4049 75th St E

- 7614 Connie Ln

- 8289 Delaney Dr

- 8291 Delaney Dr

- 8279 Delaney Dr

- 8287 Delaney Dr

- 8281 Delaney Dr

- 8281 Delaney Dr Unit 19

- 8275 Delaney Dr

- 8275 Delaney Dr Unit 16

- 8285 Delaney Dr

- 8285 Delaney Dr Unit 26

- 8293 Delaney Dr

- 8293 Delaney Dr Unit 22

- 8273 Delaney Dr

- 8283 Delaney Dr Unit 20

- 8283 Delaney Dr

- 8295 Delaney Dr

- 8301 Delaney Dr

- 8301 Delaney Dr Unit 29

- 8303 Delaney Dr Unit 30

- 8299 Delaney Dr