83 Glen Side Wilton, CT 06897

Estimated Value: $520,000 - $559,000

1

Bed

2

Baths

1,127

Sq Ft

$478/Sq Ft

Est. Value

About This Home

This home is located at 83 Glen Side, Wilton, CT 06897 and is currently estimated at $538,588, approximately $477 per square foot. 83 Glen Side is a home located in Fairfield County with nearby schools including Miller-Driscoll School, Cider Mill School, and Middlebrook School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 25, 2005

Sold by

Seely Walter C

Bought by

Smeriglio Kathleen O

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$302,000

Outstanding Balance

$154,011

Interest Rate

5.5%

Estimated Equity

$384,577

Purchase Details

Closed on

Oct 31, 2002

Sold by

Jones Valerie B

Bought by

Seely Walter C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$249,600

Interest Rate

6.09%

Purchase Details

Closed on

Jun 29, 2001

Sold by

Carey Eugene and Carey Mary

Bought by

Jones Valerie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$262,200

Interest Rate

7.14%

Purchase Details

Closed on

Jun 25, 1990

Sold by

Godfrey Patrick

Bought by

Carey Eugene

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Smeriglio Kathleen O | $403,000 | -- | |

| Seely Walter C | $312,000 | -- | |

| Jones Valerie | $276,000 | -- | |

| Carey Eugene | $164,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Carey Eugene | $302,000 | |

| Previous Owner | Carey Eugene | $249,600 | |

| Previous Owner | Carey Eugene | $262,200 | |

| Previous Owner | Carey Eugene | $105,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,320 | $299,880 | $0 | $299,880 |

| 2024 | $7,179 | $299,880 | $0 | $299,880 |

| 2023 | $6,472 | $221,200 | $0 | $221,200 |

| 2022 | $6,244 | $221,200 | $0 | $221,200 |

| 2021 | $6,165 | $221,200 | $0 | $221,200 |

| 2020 | $6,074 | $221,200 | $0 | $221,200 |

| 2019 | $6,313 | $221,200 | $0 | $221,200 |

| 2018 | $5,993 | $212,590 | $0 | $212,590 |

| 2017 | $5,904 | $212,590 | $0 | $212,590 |

| 2016 | $5,812 | $212,590 | $0 | $212,590 |

| 2015 | $5,704 | $212,590 | $0 | $212,590 |

| 2014 | $5,636 | $212,590 | $0 | $212,590 |

Source: Public Records

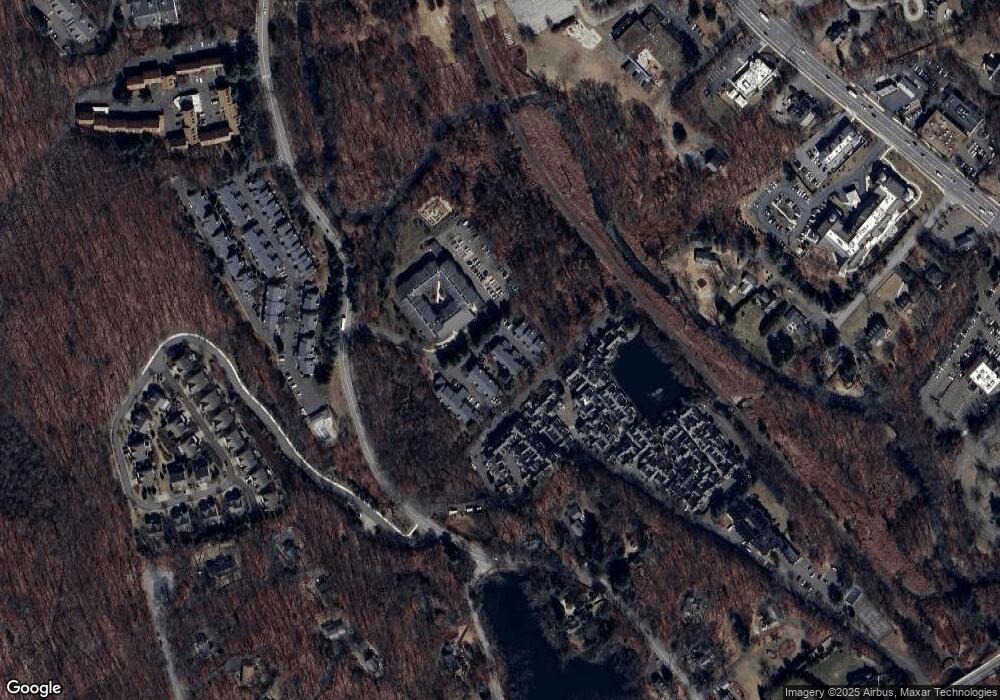

Map

Nearby Homes

- 85 Glen Side Unit 85

- 5 Village Walk

- 20 Wilton Crest Unit 20

- 15 River Rd Unit STE 210

- 84 Wilton Crest Rd Unit 84

- 124 Wolfpit Rd

- 110 Dudley Rd

- 332 Belden Hill Rd

- 90 Drum Hill Rd

- 51 Chessor Ln

- 88 Drum Hill Rd

- 55 Liberty St

- 33 Middlebrook Farm Rd

- 128 Grumman Hill Rd

- 126 Heather Ln

- 76 Sturges Ridge Rd

- 30 Freshwater Ln

- 113 Rivergate Dr

- 76 Fawn Ridge Ln

- 20 Pheasant Run Rd

- 97 Glen Side

- 95 Glen Side

- 93 Glen Side

- 91 Glen Side

- 90 Glen Side

- 89 Glen Side

- 88 Glen Side

- 87 Glen Side

- 85 Glen Side

- 84 Glen Side

- 82 Glen Side

- 81 Glen Side

- 84 Glen Side Unit 84

- 91 Glen Side Unit 91

- 97 Glen Side Unit 97

- 235 Danbury Rd

- 230 Danbury Rd

- 228 Danbury Rd Unit 2B

- 228 Danbury Rd Unit 2A

- 228 Danbury Rd Unit 2FL