83 SE 16th Ave Unit E101 Gainesville, FL 32601

Kirkwood NeighborhoodEstimated Value: $108,893 - $134,000

2

Beds

2

Baths

874

Sq Ft

$136/Sq Ft

Est. Value

About This Home

This home is located at 83 SE 16th Ave Unit E101, Gainesville, FL 32601 and is currently estimated at $118,723, approximately $135 per square foot. 83 SE 16th Ave Unit E101 is a home located in Alachua County with nearby schools including Idylwild Elementary School, Abraham Lincoln Middle School, and Eastside High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 31, 2006

Sold by

Heine Raymond D and Heine Tatia A

Bought by

Thomas Annemarie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,520

Outstanding Balance

$50,588

Interest Rate

6.68%

Mortgage Type

Unknown

Estimated Equity

$68,135

Purchase Details

Closed on

Jul 20, 2005

Sold by

Levin Nichole Rae and Levin Paula Marie

Bought by

Heine Raymond D and Heine Tatia A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,800

Interest Rate

5.37%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 17, 2002

Sold by

Shah Radhika

Bought by

Levin Nichole Rae and Levin Paula Marie

Purchase Details

Closed on

May 8, 1993

Bought by

Thomas Annemarie

Purchase Details

Closed on

Aug 25, 1992

Bought by

Thomas Annemarie

Purchase Details

Closed on

Dec 3, 1991

Bought by

Thomas Annemarie

Purchase Details

Closed on

Sep 1, 1986

Bought by

Thomas Annemarie

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Thomas Annemarie | $106,900 | Pcs Title | |

| Heine Raymond D | $101,000 | -- | |

| Levin Nichole Rae | $44,500 | -- | |

| Thomas Annemarie | $100 | -- | |

| Thomas Annemarie | $21,300 | -- | |

| Thomas Annemarie | $20,300 | -- | |

| Thomas Annemarie | $56,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Thomas Annemarie | $85,520 | |

| Previous Owner | Heine Raymond D | $80,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,246 | $103,000 | -- | $103,000 |

| 2024 | $1,895 | $108,000 | -- | $108,000 |

| 2023 | $1,895 | $88,000 | $0 | $88,000 |

| 2022 | $1,640 | $79,000 | $0 | $79,000 |

| 2021 | $1,580 | $78,500 | $0 | $78,500 |

| 2020 | $1,358 | $59,500 | $0 | $59,500 |

| 2019 | $1,312 | $59,500 | $0 | $59,500 |

| 2018 | $1,131 | $52,000 | $0 | $52,000 |

| 2017 | $1,035 | $44,000 | $0 | $44,000 |

| 2016 | $966 | $40,000 | $0 | $0 |

| 2015 | $985 | $40,000 | $0 | $0 |

| 2014 | $955 | $37,400 | $0 | $0 |

| 2013 | -- | $34,000 | $0 | $34,000 |

Source: Public Records

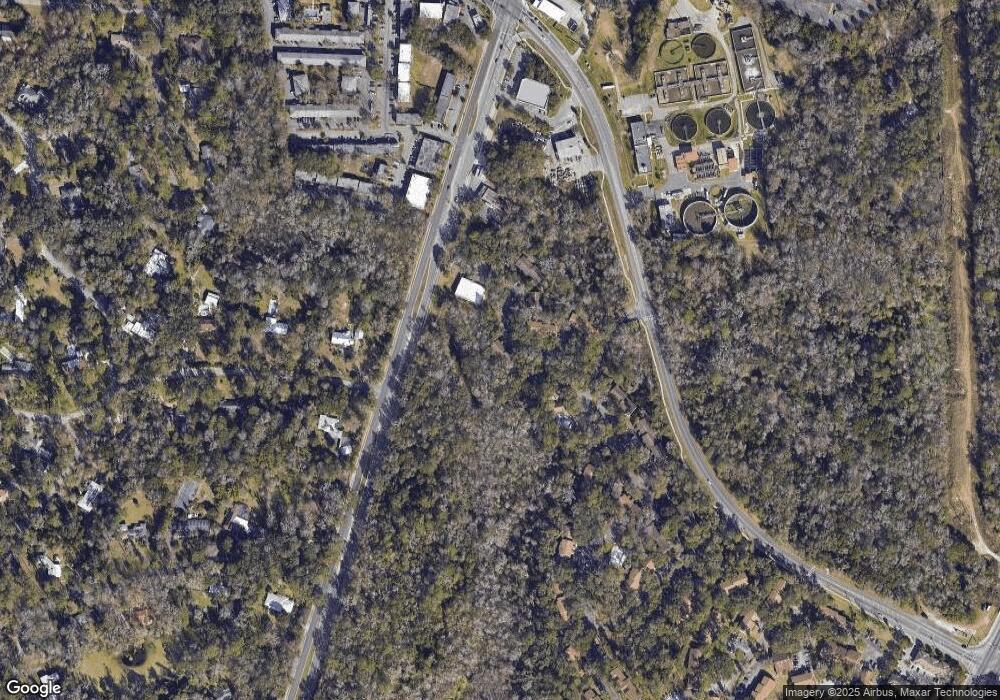

Map

Nearby Homes

- 111 SE 16th Ave Unit O302

- 109 SE 16th Ave Unit Q301

- 105 SE 16th Ave Unit N101

- 127 SE 16th Ave Unit S105

- 235 SE 16th Ave Unit 5

- 2901 SW 4th Ct

- 1110 SW 19th Place

- 3108 SW 2nd Ct

- 983 SW 25th Place

- 205 SE 3rd St

- 208 SE 3rd St

- 215 SE 3rd St

- 111 SE 3rd St

- 109 SE 3rd St

- Lot 7 SE 2nd St

- 0 SE 2nd St

- 1715 SE 4th St

- 1119 SW 11th Ave

- 2212 SW 13th St

- 1015 SW 9th St Unit D21

- 83 SE 16th Ave Unit E302

- 83 SE 16th Ave Unit 304

- 83 SE 16th Ave Unit F101

- 83 SE 16th Ave Unit E303

- 83 SE 16th Ave Unit E301

- 83 SE 16th Ave Unit E202

- 83 SE 16th Ave Unit E201

- 83 SE 16th Ave Unit E304

- 83 SE 16th Ave Unit E102

- 83 SE 16th Ave Unit E302

- 83 SE 16th Ave Unit E204

- 83 SE 16th Ave Unit E203

- 83 SE 16th Ave Unit E103

- 83 SE 16th Ave Unit E104

- 83 SE 16th Ave

- 83 SE 16th Ave

- 83 SE 16th Ave Unit E204

- 83 SE 16th Ave Unit E-30

- 83 SE 16th Ave Unit E-20

- 83 SE 16th Ave Unit E-10