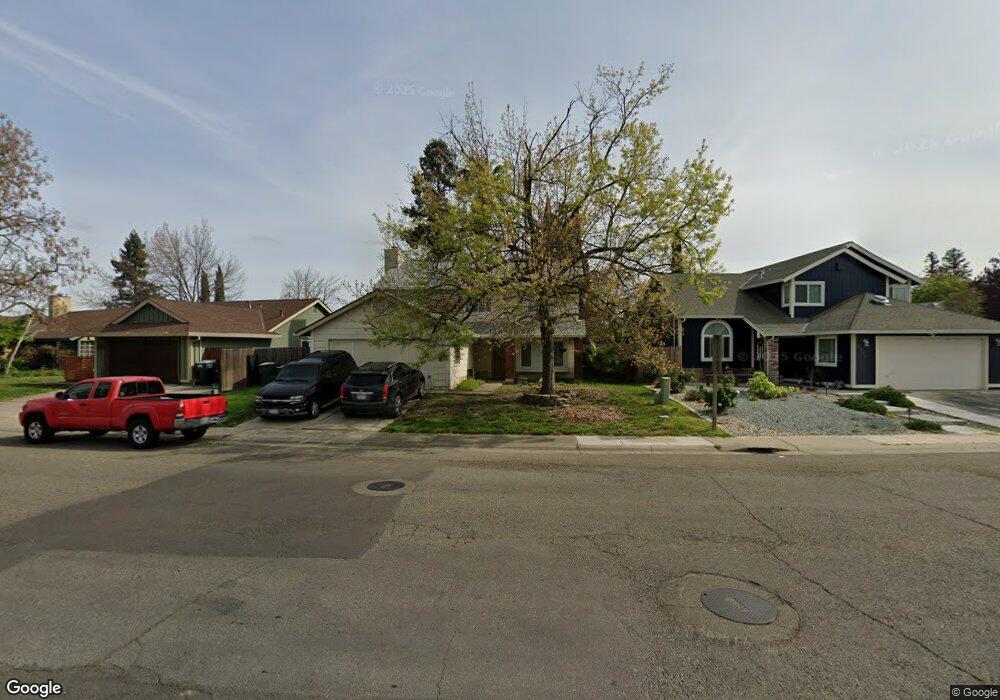

8308 Cutler Way Sacramento, CA 95828

Estimated Value: $355,000 - $535,000

4

Beds

3

Baths

1,656

Sq Ft

$288/Sq Ft

Est. Value

About This Home

This home is located at 8308 Cutler Way, Sacramento, CA 95828 and is currently estimated at $477,385, approximately $288 per square foot. 8308 Cutler Way is a home located in Sacramento County with nearby schools including Isabelle Jackson Elementary School, James Rutter Middle School, and Florin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 16, 2025

Sold by

Galindo Kerri

Bought by

Morrow Joy K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Outstanding Balance

$79,573

Interest Rate

6.65%

Mortgage Type

Credit Line Revolving

Estimated Equity

$397,812

Purchase Details

Closed on

Apr 9, 2015

Sold by

Morrow Joy K and Bekoff Morrow Joy

Bought by

Morrow Joy K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,677

Interest Rate

3.75%

Mortgage Type

FHA

Purchase Details

Closed on

Dec 18, 2014

Sold by

Bekoff Mark W

Bought by

Bekoff Morrow Joy

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Morrow Joy K | -- | Placer Title | |

| Morrow Joy K | -- | First American Title | |

| Bekoff Morrow Joy | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Morrow Joy K | $80,000 | |

| Previous Owner | Morrow Joy K | $155,677 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,759 | $277,879 | $76,620 | $201,259 |

| 2024 | $4,759 | $272,431 | $75,118 | $197,313 |

| 2023 | $4,307 | $267,091 | $73,646 | $193,445 |

| 2022 | $3,965 | $261,854 | $72,202 | $189,652 |

| 2021 | $3,865 | $256,721 | $70,787 | $185,934 |

| 2020 | $6,145 | $254,090 | $70,062 | $184,028 |

| 2019 | $4,298 | $249,109 | $68,689 | $180,420 |

| 2018 | $4,208 | $244,226 | $67,343 | $176,883 |

| 2017 | $4,154 | $239,438 | $66,023 | $173,415 |

| 2016 | $4,227 | $234,744 | $64,729 | $170,015 |

| 2015 | $2,607 | $232,456 | $67,524 | $164,932 |

| 2014 | $3,787 | $227,904 | $66,202 | $161,702 |

Source: Public Records

Map

Nearby Homes

- 8336 Cutler Way

- 8251 Apple Cove Ct

- 8437 Yermo Way

- 8317 Honeycomb Way

- 8186 Gustine Way

- 8346 Floxtree Ct

- 8329 Spengler Dr

- 7905 Springarden Way

- 8077 Goran Ct

- 8233 Short Rd

- 8266 Summer Sunset Dr

- 8336 Summer Sunset Dr

- 8510 Cavendish Way

- 8282 Union Creek Way

- 7901 Stevenson Ave

- 8216 Exbourne Cir

- 8159 Morgan Hill Way

- 4.13 ACR Lenhart Rd

- 8095 E Stockton Blvd

- 8548 Whitby Ct

- 8312 Cutler Way

- 8304 Cutler Way

- 8316 Cutler Way

- 8331 Herndon Ct

- 8327 Herndon Ct

- 8305 Auberry Dr

- 8301 Auberry Dr

- 8356 Boron Way

- 8309 Auberry Dr

- 8335 Herndon Ct

- 8320 Cutler Way

- 8313 Auberry Dr

- 8277 Auberry Dr

- 8352 Boron Way

- 8154 Tecopa Way

- 8324 Cutler Way

- 8158 Tecopa Way

- 8273 Auberry Dr

- 8348 Boron Way

- 8328 Herndon Ct