8370 Oconnell Rd El Cajon, CA 92021

Bostonia NeighborhoodEstimated Value: $950,000 - $1,478,104

4

Beds

4

Baths

4,199

Sq Ft

$298/Sq Ft

Est. Value

About This Home

This home is located at 8370 Oconnell Rd, El Cajon, CA 92021 and is currently estimated at $1,253,276, approximately $298 per square foot. 8370 Oconnell Rd is a home located in San Diego County with nearby schools including Pepper Drive Elementary School, Santana High School, and St. Kieran Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 26, 2011

Sold by

Anderson Fred K and Anderson Elissa

Bought by

Anderson Fredrick K and Linden Anderson Elissa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$350,000

Outstanding Balance

$228,352

Interest Rate

3.37%

Mortgage Type

New Conventional

Estimated Equity

$1,024,924

Purchase Details

Closed on

Aug 29, 2000

Sold by

Linden Elissa A

Bought by

Anderson Fredrick K and Linden Anderson Elissa

Purchase Details

Closed on

Jul 30, 1993

Sold by

Linden John B

Bought by

Linden Elissa Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

7.09%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jul 7, 1993

Sold by

Linden Beatrice A

Bought by

Linden Elissa A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

7.09%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Anderson Fredrick K | -- | Accommodation | |

| Anderson Fred K | -- | First American Title Company | |

| Anderson Fredrick K | -- | -- | |

| Linden Elissa Ann | -- | -- | |

| Linden Elissa A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Anderson Fred K | $350,000 | |

| Previous Owner | Linden Elissa Ann | $50,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,831 | $758,989 | $32,339 | $726,650 |

| 2024 | $8,831 | $744,107 | $31,705 | $712,402 |

| 2023 | $8,558 | $729,518 | $31,084 | $698,434 |

| 2022 | $8,499 | $715,215 | $30,475 | $684,740 |

| 2021 | $8,388 | $701,192 | $29,878 | $671,314 |

| 2020 | $8,286 | $694,003 | $29,572 | $664,431 |

| 2019 | $7,994 | $680,396 | $28,993 | $651,403 |

| 2018 | $7,828 | $667,056 | $28,425 | $638,631 |

| 2017 | $7,725 | $653,977 | $27,868 | $626,109 |

| 2016 | $7,489 | $641,155 | $27,322 | $613,833 |

| 2015 | $7,380 | $631,525 | $26,912 | $604,613 |

| 2014 | $7,228 | $619,155 | $26,385 | $592,770 |

Source: Public Records

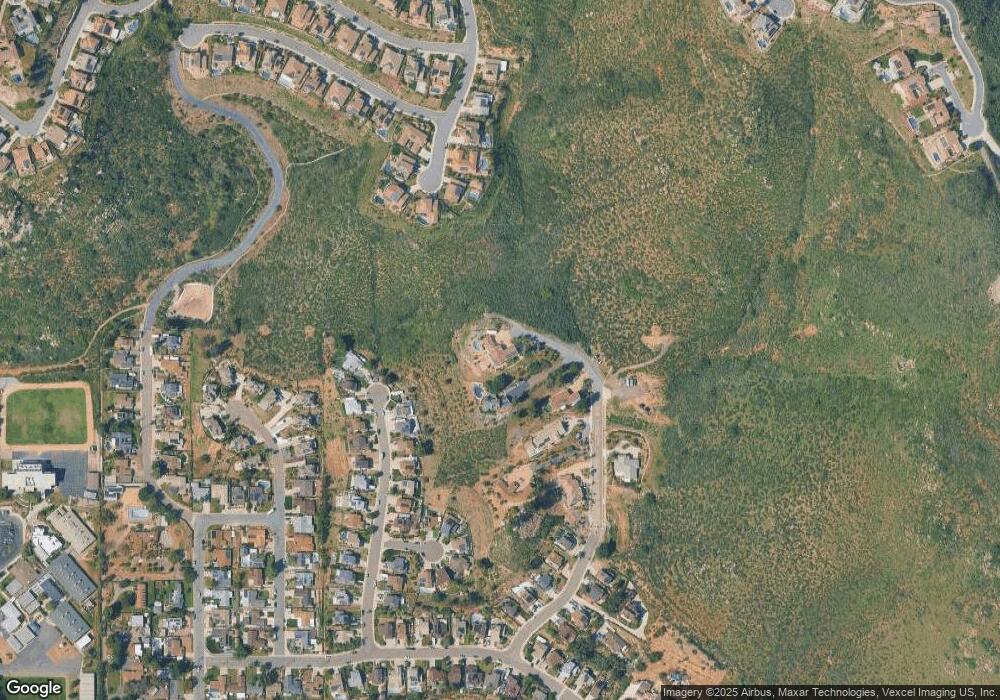

Map

Nearby Homes

- 6301 Triana St

- 5120 Sevilla St

- 1120 Pepper Dr Unit 2

- 1120 Pepper Dr Unit 17

- 1120 Pepper Dr Unit SPC 86

- 1120 Pepper Dr Unit 73

- 1120 Pepper Dr Unit 79

- 1120 Pepper Dr Unit 84

- 1120 Pepper Dr Unit 11

- 1407 Cascade Place

- 11825 Taia Ln

- 450 E Bradley Ave Unit 115

- 450 E Bradley Ave Unit 127

- 450 E Bradley Ave Unit 36

- 450 E Bradley Ave Unit 144

- 450 E Bradley Ave Unit 157

- 450 E Bradley Ave Unit 80

- 450 E Bradley Ave Unit 106

- 450 E Bradley Ave Unit 18

- 450 E Bradley Ave Unit 116

- 8368 Oconnell Rd

- 8366 Oconnell Rd

- 8407 Solomon Ave

- 8352 Oconnell Rd

- 8401 Solomon Ave

- 8361 Solomon Ave

- 8355 Solomon Ave

- 8348 Oconnell Rd

- 6105 Cala Lily St

- 8420 Solomon Ave

- 8346 Oconnell Rd

- 8349 Solomon Ave

- 8414 Solomon Ave

- 8408 Solomon Ave

- 8402 Solomon Ave

- 11412 Ming Ct

- 6099 Cala Lily St

- 8360 Solomon Ave

- 8343 Solomon Ave

- 11418 Ming Ct