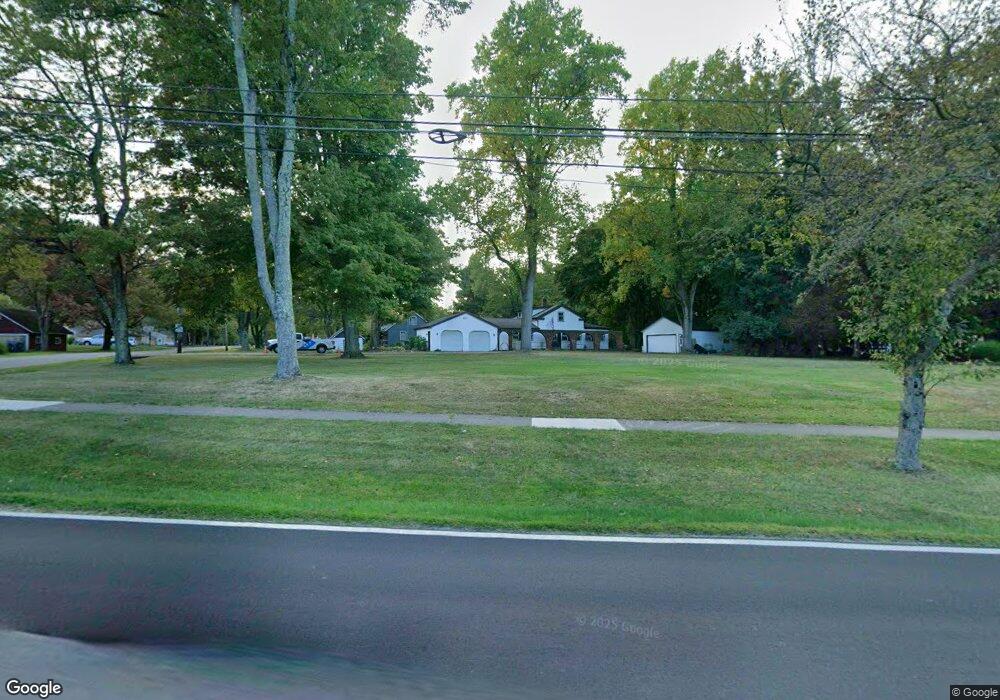

8380 Usher Rd Olmsted Falls, OH 44138

Estimated Value: $352,000 - $397,368

4

Beds

3

Baths

2,664

Sq Ft

$138/Sq Ft

Est. Value

About This Home

This home is located at 8380 Usher Rd, Olmsted Falls, OH 44138 and is currently estimated at $367,842, approximately $138 per square foot. 8380 Usher Rd is a home located in Cuyahoga County with nearby schools including Falls-Lenox Primary Elementary School, Olmsted Falls Intermediate Building, and Olmsted Falls Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 10, 2000

Sold by

Vankuren Kimberly

Bought by

Vankuren Martin and Vankuren Kimberly

Current Estimated Value

Purchase Details

Closed on

Oct 29, 1993

Sold by

Weber Ed

Bought by

Weber Anton E Aka

Purchase Details

Closed on

Mar 27, 1990

Sold by

Weber Alberta V

Bought by

Weber Ed

Purchase Details

Closed on

Jan 11, 1985

Sold by

Weber Anton E

Bought by

Weber Alberta

Purchase Details

Closed on

Aug 18, 1976

Sold by

Bauer Una M

Bought by

Weber Anton E

Purchase Details

Closed on

Jan 1, 1975

Bought by

Bauer Una M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vankuren Martin | -- | -- | |

| Weber Anton E Aka | -- | -- | |

| Weber Ed | $98,000 | -- | |

| Weber Alberta | -- | -- | |

| Weber Anton E | $39,500 | -- | |

| Bauer Una M | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,724 | $87,500 | $26,810 | $60,690 |

| 2023 | $6,723 | $85,015 | $29,505 | $55,510 |

| 2022 | $6,673 | $85,020 | $29,510 | $55,510 |

| 2021 | $7,309 | $94,470 | $29,510 | $64,960 |

| 2020 | $6,604 | $75,570 | $23,590 | $51,980 |

| 2019 | $5,864 | $215,900 | $67,400 | $148,500 |

| 2018 | $5,851 | $75,570 | $23,590 | $51,980 |

| 2017 | $6,716 | $64,930 | $22,330 | $42,600 |

| 2016 | $6,690 | $64,930 | $22,330 | $42,600 |

| 2015 | $6,429 | $64,930 | $22,330 | $42,600 |

| 2014 | $6,429 | $60,140 | $20,690 | $39,450 |

Source: Public Records

Map

Nearby Homes

- 25950 Bagley Rd

- 0

- 26535 Bayfair Dr

- V/L Columbia Rd

- Anderson Plan at Smokestack Trails

- Bramante Ranch Plan at Smokestack Trails

- Hudson Plan at Smokestack Trails

- Columbia Plan at Smokestack Trails

- Lehigh Plan at Smokestack Trails

- 8241 Lewis Rd

- 7593 Columbia Rd

- 25725 Cook Rd

- 281-12-024 River Rd

- 26685 Cranage Rd

- 281-12-007 River Rd

- 29 Carl Ln

- 26788 Skyline Dr

- Caroline Plan at Falls Landing - Villas

- Wexford Plan at Falls Landing - Villas

- Rosecliff Plan at Falls Landing - Villas