839 Acorn Way Napa, CA 94558

Silverado Resort NeighborhoodEstimated Value: $1,882,897 - $2,107,000

3

Beds

2

Baths

1,301

Sq Ft

$1,527/Sq Ft

Est. Value

About This Home

This home is located at 839 Acorn Way, Napa, CA 94558 and is currently estimated at $1,987,224, approximately $1,527 per square foot. 839 Acorn Way is a home located in Napa County with nearby schools including Vichy Elementary School, Silverado Middle School, and Vintage High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 8, 2025

Sold by

Perell Laura Ann

Bought by

Laura Perell California Property Trust and Perell

Current Estimated Value

Purchase Details

Closed on

May 28, 2024

Sold by

Victor And Clotilde Goria 2001 Revocable and Perell Laura Ann

Bought by

Perell Laura Ann

Purchase Details

Closed on

Jun 11, 2014

Sold by

Goria Clotilde E and Perell Laura Ann

Bought by

Goria Clotilde E and Victor & Clotilde Gloria 2001

Purchase Details

Closed on

Jun 22, 2012

Sold by

Goria Clotilde E and Perell Laura Ann

Bought by

Goria Clotilde E and Perell Laura Ann

Purchase Details

Closed on

May 21, 2012

Sold by

Wynne Karyn D and The Richard & Gail Orgell Fami

Bought by

Goria Clotilde E and Perell Laura Ann

Purchase Details

Closed on

May 19, 2012

Sold by

Perell Howard Frederick

Bought by

Perell Laura Ann

Purchase Details

Closed on

Mar 9, 1996

Sold by

Orgell Richard E and Orgell Gail K

Bought by

Orgell Richard E and Orgell Gail K

Purchase Details

Closed on

Nov 16, 1993

Sold by

Wallace Charlotte P

Bought by

Orgell Richard and Orgell Gail

Purchase Details

Closed on

Oct 22, 1993

Sold by

T D Service Company

Bought by

The P & C Lacelaw Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Laura Perell California Property Trust | -- | None Listed On Document | |

| Perell Laura Ann | -- | None Listed On Document | |

| Perell Laura Ann | -- | None Listed On Document | |

| Goria Clotilde E | -- | None Available | |

| Goria Clotilde E | -- | None Available | |

| Goria Clotilde E | $675,000 | First American Title Company | |

| Perell Laura Ann | -- | None Available | |

| Orgell Richard E | -- | -- | |

| Orgell Richard | $288,000 | First American Title | |

| The P & C Lacelaw Trust | $382,421 | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $20,513 | $1,834,964 | $1,018,159 | $816,805 |

| 2024 | $20,513 | $1,799,270 | $998,196 | $801,074 |

| 2023 | $20,513 | $1,013,597 | $314,491 | $699,106 |

| 2022 | $11,811 | $994,008 | $308,325 | $685,683 |

| 2021 | $11,667 | $974,803 | $302,280 | $672,523 |

| 2020 | $11,603 | $964,957 | $299,181 | $665,776 |

| 2019 | $11,383 | $946,321 | $293,315 | $653,006 |

| 2018 | $11,248 | $928,051 | $287,564 | $640,487 |

| 2017 | $9,754 | $796,644 | $281,926 | $514,718 |

| 2016 | $9,575 | $781,309 | $276,399 | $504,910 |

| 2015 | $8,321 | $710,398 | $272,248 | $438,150 |

| 2014 | $8,143 | $691,268 | $266,916 | $424,352 |

Source: Public Records

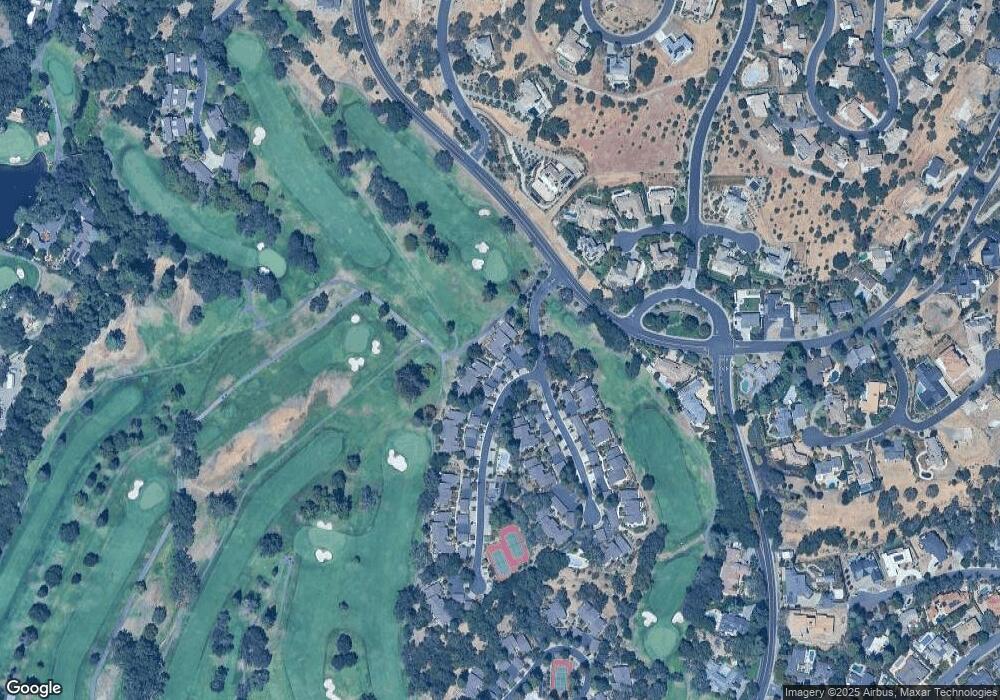

Map

Nearby Homes

- 523 Westgate Dr

- 808 Augusta Cir

- 1166 Castle Oaks Dr

- 833 Augusta Cir Unit 34

- 346 Deer Hollow Dr

- 540 Westgate Dr

- 421 Bear Creek Cir

- 113 Bonnie Brook Dr

- 23 Saint Michael Cir

- 117 Milliken Creek Dr

- 2186 Monticello Rd

- 42 Fairways Dr

- 2277 Monticello Rd

- 2134 Monticello Rd

- 87 Fairways Dr

- 145 Canyon Ct

- 170 Westgate Dr

- 416 Troon Dr

- 2863 Atlas Peak Rd

- 1860 Mckinley Rd

- 840 Acorn Way

- 838 Acorn Way Unit 35

- 837 Acorn Way Unit 34

- 841 Acorn Way

- 842 Acorn Way

- 844 Acorn Way

- 843 Acorn Way

- 899 Oak Leaf Way

- 898 Oak Leaf Way

- 868 Oak Leaf Way

- 846 Acorn Way

- 896 Oak Leaf Way

- 870 Oak Leaf Way

- 869 Oak Leaf Way Unit 2

- 847 Acorn Way Unit 44

- 849 Acorn Way Unit 46

- 871 Oak Leaf Way

- 851 Acorn Way

- 872 Oak Leaf Way Unit 5