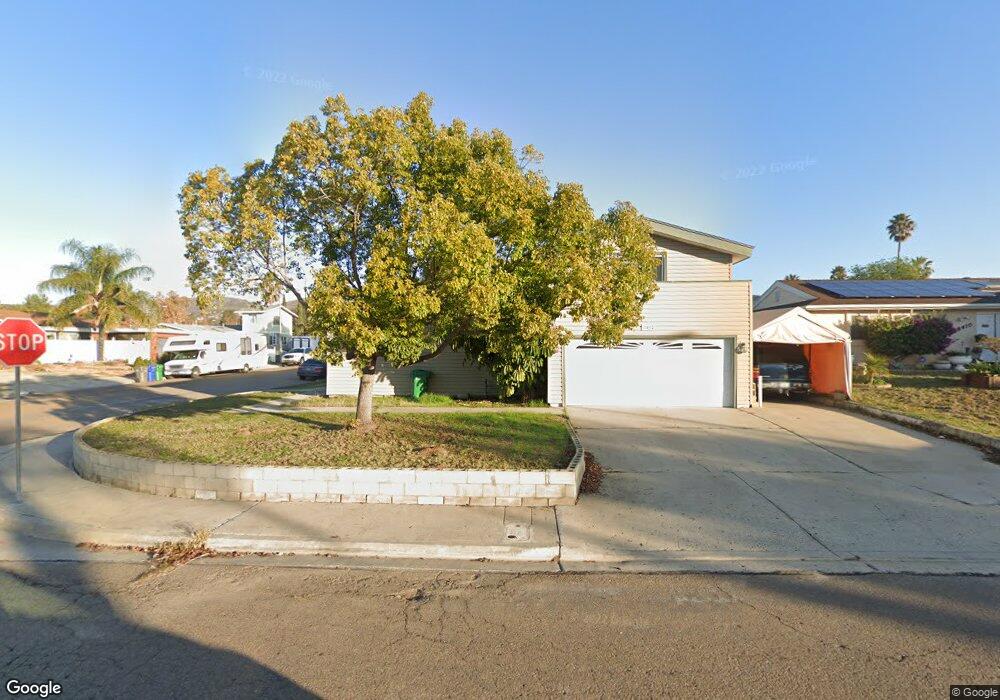

8402 Kreiner Way Santee, CA 92071

East Elliott NeighborhoodEstimated Value: $839,154 - $887,000

4

Beds

3

Baths

1,550

Sq Ft

$560/Sq Ft

Est. Value

About This Home

This home is located at 8402 Kreiner Way, Santee, CA 92071 and is currently estimated at $867,789, approximately $559 per square foot. 8402 Kreiner Way is a home located in San Diego County with nearby schools including Carlton Oaks Elementary School and West Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 29, 2003

Sold by

Vicker Bruce W and Vicker Rhonda S

Bought by

Vicker Rhonda S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$229,000

Outstanding Balance

$97,359

Interest Rate

5.85%

Estimated Equity

$770,430

Purchase Details

Closed on

Apr 16, 1997

Sold by

Invest Corp

Bought by

Vicker Bruce W and Vicker Rhonda S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$163,098

Interest Rate

7.86%

Mortgage Type

VA

Purchase Details

Closed on

Jan 10, 1997

Sold by

Chiariello George Frank and Chiariello Hortense P

Bought by

Invest Corp

Purchase Details

Closed on

Jun 22, 1996

Sold by

Chiariello George F and Chiariello Hortense P

Bought by

Chiariello Charlie

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vicker Rhonda S | -- | Diversified Title & Escrow S | |

| Vicker Bruce W | $160,000 | Commonwealth Land Title Co | |

| Invest Corp | $39,316 | Old Republic Title Company | |

| Chiariello Charlie | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vicker Rhonda S | $229,000 | |

| Closed | Vicker Bruce W | $163,098 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,097 | $260,398 | $97,706 | $162,692 |

| 2024 | $3,097 | $255,293 | $95,791 | $159,502 |

| 2023 | $3,000 | $250,288 | $93,913 | $156,375 |

| 2022 | $2,975 | $245,381 | $92,072 | $153,309 |

| 2021 | $2,931 | $240,570 | $90,267 | $150,303 |

| 2020 | $2,895 | $238,104 | $89,342 | $148,762 |

| 2019 | $2,794 | $233,437 | $87,591 | $145,846 |

| 2018 | $2,735 | $228,861 | $85,874 | $142,987 |

| 2017 | $2,698 | $224,375 | $84,191 | $140,184 |

| 2016 | $2,615 | $219,977 | $82,541 | $137,436 |

| 2015 | $2,580 | $216,674 | $81,302 | $135,372 |

| 2014 | $2,527 | $212,431 | $79,710 | $132,721 |

Source: Public Records

Map

Nearby Homes

- 9256 Allano Way

- 8339 Carlton Oaks Dr

- 9058 Inverness Rd

- 8609 Dunwoodie Rd

- 45 Via Sovana Unit 45

- 36 Via Sovana Unit 36

- 120 Via Sovana

- 8069 Mission George Rd Unit 1

- 8732 Crossway Ct Unit 33

- 8732 Crossway Ct Unit 36

- 19 Carribean Way

- 8301 Mission Gorge Rd

- 8301 Mission Gorge Rd Unit 169

- 8301 Mission Gorge Rd Unit 208

- 8301 Mission Gorge Rd Unit 282

- 8301 Mission Gorge Rd Unit 248

- 8301 Mission Gorge Rd Unit 325

- 8301 Mission Gorge Rd Unit 382

- 8301 Mission Gorge Rd Unit 351

- 8301 Mission Gorge Rd Unit 331

- 8410 Kreiner Way

- 8411 Rumson Dr

- 8417 Rumson Dr

- 8418 Kreiner Way

- 9462 Kaschube Way

- 9468 Kaschube Way

- 8403 Kreiner Way

- 8423 Rumson Dr

- 9456 Kaschube Way

- 8411 Kreiner Way

- 8426 Kreiner Way

- 9474 Kaschube Way

- 9450 Kaschube Way

- 8419 Kreiner Way

- 8429 Rumson Dr

- 9435 Kaschube Way

- 9444 Kaschube Way

- 8434 Kreiner Way

- 8449 Amino Dr

- 8427 Kreiner Way