8408 Abingdon Ct Bradenton, FL 34201

Estimated Value: $759,000 - $1,140,000

2

Beds

2

Baths

2,244

Sq Ft

$388/Sq Ft

Est. Value

About This Home

This home is located at 8408 Abingdon Ct, Bradenton, FL 34201 and is currently estimated at $869,711, approximately $387 per square foot. 8408 Abingdon Ct is a home located in Manatee County with nearby schools including Robert Willis Elementary School, Braden River Middle School, and Braden River High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 18, 2016

Sold by

Zysko Edwin and Zysko Susan

Bought by

Armistead Robert T and Armistead Susan E

Current Estimated Value

Purchase Details

Closed on

Mar 29, 2006

Sold by

Neal Communities Of Southwest Fl Inc

Bought by

Zysko Edwin and Zysko Susan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Interest Rate

6.23%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Mar 27, 2006

Sold by

Channel Holdings Group Llp

Bought by

Neal Communities Of Southwest Fl Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Interest Rate

6.23%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Armistead Robert T | $556,000 | Attorney | |

| Zysko Edwin | $609,500 | Attorney | |

| Neal Communities Of Southwest Fl Inc | $167,700 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Zysko Edwin | $417,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,341 | $641,699 | $112,200 | $529,499 |

| 2024 | $10,341 | $675,711 | $112,200 | $563,511 |

| 2023 | $10,100 | $677,649 | $112,200 | $565,449 |

| 2022 | $9,211 | $592,663 | $110,000 | $482,663 |

| 2021 | $7,603 | $418,204 | $105,000 | $313,204 |

| 2020 | $7,628 | $397,433 | $105,000 | $292,433 |

| 2019 | $6,492 | $392,158 | $105,000 | $287,158 |

| 2018 | $6,748 | $403,849 | $120,000 | $283,849 |

| 2017 | $6,686 | $419,884 | $0 | $0 |

| 2016 | $6,146 | $377,023 | $0 | $0 |

| 2015 | $6,091 | $388,424 | $0 | $0 |

| 2014 | $6,091 | $363,625 | $0 | $0 |

| 2013 | $5,600 | $332,731 | $92,650 | $240,081 |

Source: Public Records

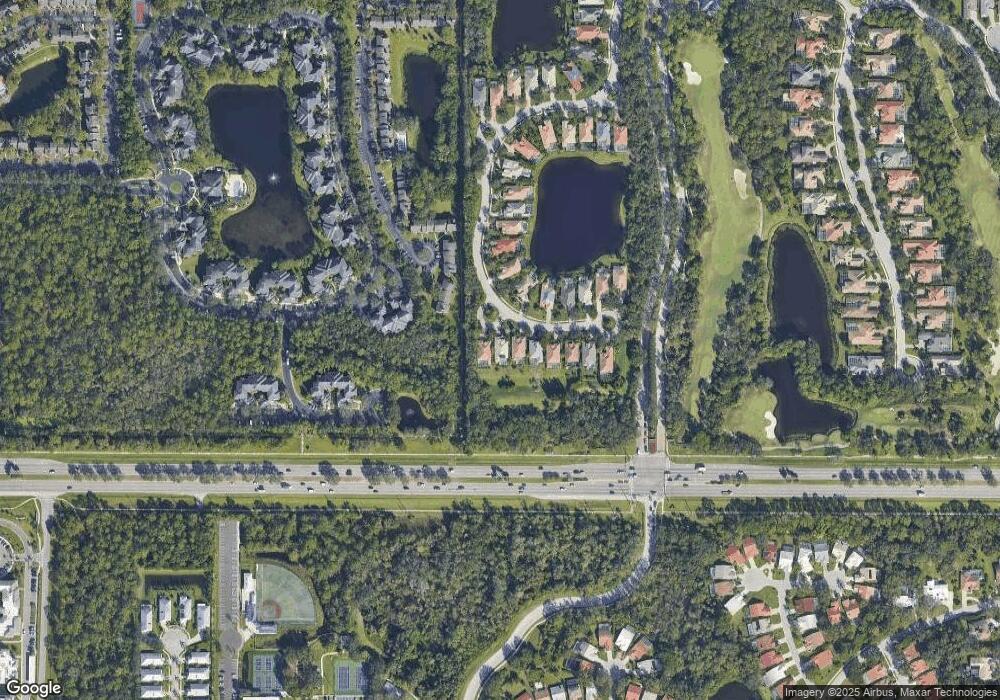

Map

Nearby Homes

- 8319 Abingdon Ct

- 8202 Abingdon Ct

- 6221 Timber Lake Dr Unit C10

- 6065 Marella Ct

- 6069 Marella Ct

- 6271 Timber Lake Dr Unit G6

- 6211 Timber Lake Dr Unit B4

- 8223 Regents Ct

- 6017 Marella Dr

- 6103 Clubside Dr

- 6261 Timber Lake Dr Unit F6

- 8173 Misty Oaks Blvd

- Vale Plan at Oasis at Longwood Run

- Glen Plan at Oasis at Longwood Run

- 4132 Gold Dust Ln

- 4128 Gold Dust Ln

- 4124 Gold Dust Ln

- 4120 Gold Dust Ln

- 4116 Gold Dust Ln

- 4112 Gold Dust Ln

- 8412 Abingdon Ct

- 8404 Abingdon Ct

- 8416 Abingdon Ct

- 8420 Abingdon Ct

- 8417 Abingdon Ct

- 8424 Abingdon Ct

- 8403 Abingdon Ct

- 8421 Abingdon Ct

- 8428 Abingdon Ct

- 8425 Abingdon Ct

- 8351 Abingdon Ct

- 8432 Abingdon Ct

- 8429 Abingdon Ct

- 8347 Abingdon Ct

- 8433 Abingdon Ct

- 8343 Abingdon Ct

- 8339 Abingdon Ct

- 8335 Abingdon Ct

- 8331 Abingdon Ct

- 8323 Abingdon Ct