8409 Western Trail Place Unit A Rancho Cucamonga, CA 91730

Estimated Value: $479,000 - $518,503

3

Beds

3

Baths

1,339

Sq Ft

$374/Sq Ft

Est. Value

About This Home

This home is located at 8409 Western Trail Place Unit A, Rancho Cucamonga, CA 91730 and is currently estimated at $500,626, approximately $373 per square foot. 8409 Western Trail Place Unit A is a home located in San Bernardino County with nearby schools including Cucamonga Elementary, Rancho Cucamonga Middle, and Chaffey High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 16, 2007

Sold by

Johnston Michael J

Bought by

Johnston Michael J and The Michael J Johnston Revocab

Current Estimated Value

Purchase Details

Closed on

Oct 18, 1999

Sold by

Hazelton David Ralph

Bought by

Johnston Michael J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,000

Outstanding Balance

$18,366

Interest Rate

6.62%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$482,260

Purchase Details

Closed on

Mar 20, 1999

Sold by

Stanton Richard M

Bought by

Hazelton David Ralph

Purchase Details

Closed on

May 16, 1994

Sold by

Stanton Richard M

Bought by

Stanton Richard M and Stanton Dianna H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$92,700

Interest Rate

8.3%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johnston Michael J | -- | None Available | |

| Johnston Michael J | $87,000 | First Southwestern Title Co | |

| Hazelton David Ralph | -- | -- | |

| Stanton Richard M | -- | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Johnston Michael J | $67,000 | |

| Previous Owner | Stanton Richard M | $92,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,413 | $133,621 | $41,499 | $92,122 |

| 2024 | $1,413 | $131,001 | $40,685 | $90,316 |

| 2023 | $1,382 | $128,432 | $39,887 | $88,545 |

| 2022 | $1,357 | $125,914 | $39,105 | $86,809 |

| 2021 | $1,344 | $123,445 | $38,338 | $85,107 |

| 2020 | $1,321 | $122,179 | $37,945 | $84,234 |

| 2019 | $1,313 | $119,783 | $37,201 | $82,582 |

| 2018 | $1,281 | $117,435 | $36,472 | $80,963 |

| 2017 | $1,236 | $115,132 | $35,757 | $79,375 |

| 2016 | $1,220 | $112,875 | $35,056 | $77,819 |

| 2015 | $1,211 | $111,179 | $34,529 | $76,650 |

| 2014 | $1,176 | $109,002 | $33,853 | $75,149 |

Source: Public Records

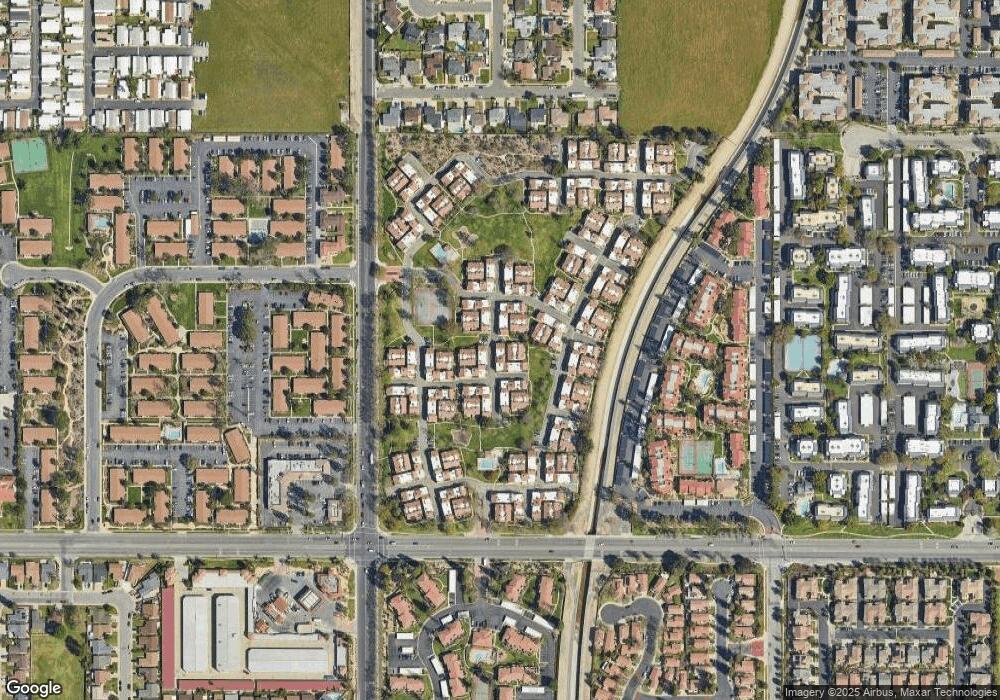

Map

Nearby Homes

- 8426 Western Trail Place Unit E

- 8430 Spring Desert Place Unit B

- 8401 Sunset Trail Place Unit E

- 8541 Creekside Place

- 10312 Sparkling Dr Unit 3

- 10382 Sparkling Dr Unit 1

- 10349 Cooks Dr Unit 2

- 8530 Willow Dr

- 8656 Harvest Place Unit 75

- 9999 Foothill Blvd Unit 160

- 9999 Foothill Blvd Unit 94

- 1 Hoffman Rd

- 10026 10026 Foothill Blvd

- 10108 24th St

- 10353 25th St

- 10312 24th St

- 10322 24th St

- 10113 Dorset St

- 10288 Effen St

- 9973 Ashford Ct

- 8409 Western Trail Place

- 8409 Western Trail Place Unit E

- 8409 Western Trail Place Unit 149

- 8409 Western Trail Place Unit B

- 8409 Western Trail Place Unit H

- 8409 Western Trail Place Unit G

- 8409 Western Trail Place Unit F

- 8409 Western Trail Place Unit D

- 8409 Western Trail Place Unit C

- 8421 Western Trail Place Unit A

- 8412 Western Trail Place Unit C

- 8412 Western Trail Place

- 8412 Western Trail Place Unit 141

- 8412 Western Trail Place Unit H

- 8412 Western Trail Place Unit G

- 8412 Western Trail Place Unit F

- 8412 Western Trail Place Unit D

- 8412 Western Trail Place Unit 139

- 8412 Western Trail Place Unit B

- 8385 Western Trail Place Unit E