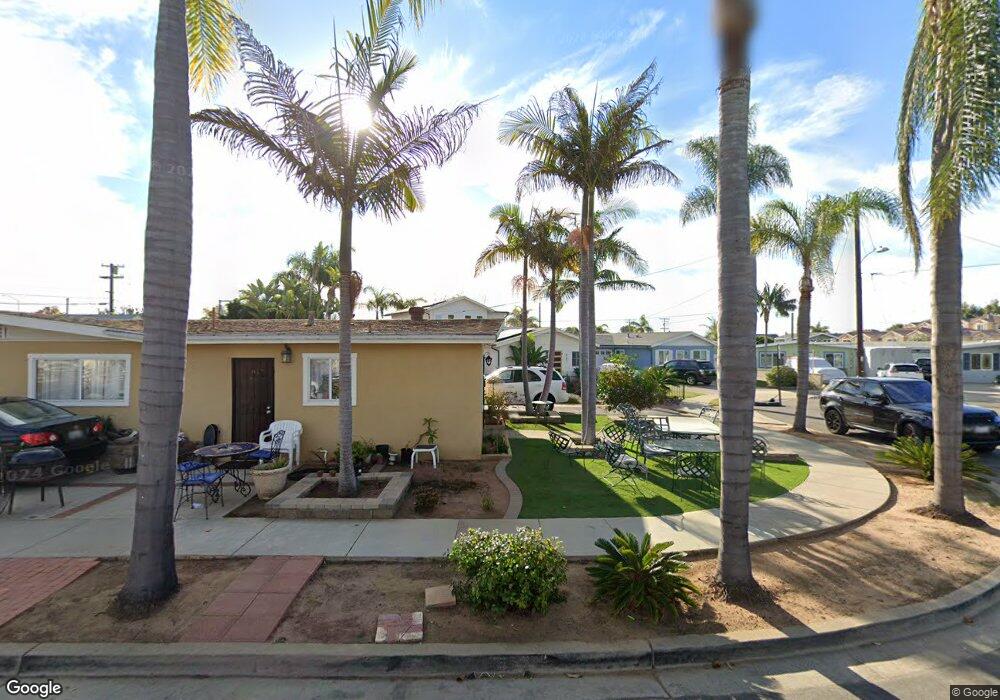

841 Camellia Place Carlsbad, CA 92008

North Beach NeighborhoodEstimated Value: $726,923 - $1,156,000

2

Beds

2

Baths

900

Sq Ft

$1,024/Sq Ft

Est. Value

About This Home

This home is located at 841 Camellia Place, Carlsbad, CA 92008 and is currently estimated at $921,731, approximately $1,024 per square foot. 841 Camellia Place is a home located in San Diego County with nearby schools including Carlsbad High School, Sage Creek High, and St. Patrick Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 23, 2010

Sold by

Dike Stephen O

Bought by

Bogard Susan M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

4.93%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 28, 2003

Sold by

Pope James A and Lorenzo Pope C

Bought by

Dike Stephen O

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$290,000

Interest Rate

7.5%

Mortgage Type

Stand Alone First

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bogard Susan M | $330,000 | Lawyers Title Company | |

| Dike Stephen O | $305,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Bogard Susan M | $200,000 | |

| Previous Owner | Dike Stephen O | $290,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,422 | $425,956 | $309,791 | $116,165 |

| 2024 | $4,422 | $417,605 | $303,717 | $113,888 |

| 2023 | $4,398 | $409,417 | $297,762 | $111,655 |

| 2022 | $4,329 | $401,390 | $291,924 | $109,466 |

| 2021 | $4,295 | $393,520 | $286,200 | $107,320 |

| 2020 | $4,266 | $389,486 | $283,266 | $106,220 |

| 2019 | $4,188 | $381,850 | $277,712 | $104,138 |

| 2018 | $4,010 | $374,364 | $272,267 | $102,097 |

| 2017 | $3,943 | $367,025 | $266,929 | $100,096 |

| 2016 | $3,783 | $359,830 | $261,696 | $98,134 |

| 2015 | $3,767 | $354,426 | $257,766 | $96,660 |

| 2014 | $3,704 | $347,484 | $252,717 | $94,767 |

Source: Public Records

Map

Nearby Homes

- 3575 Madison St

- 3747-51 Adams St Plan at Adam Street Homes - Adams Street Homes

- 3755-59 Adams St Plan at Adam Street Homes - Adams Street Homes

- 3747 Adams St

- 3731-35 Adams St Plan at Adam Street Homes - Adams Street Homes

- 3739-43 Adams St Plan at Adam Street Homes - Adams Street Homes

- 3739 Adams St

- 3755 Adams St

- 385 Juniper Ave

- 378 Acacia Ave

- 3341 Tyler St

- 368 Hemlock Ave

- 370 Tamarack Ave

- 3258 Tyler St

- 256 Juniper Ave Unit B6

- 1199 Tamarack Ave

- 4007 Bluff View Way

- 324 Chinquapin Ave

- 320 Chinquapin Ave

- 314 Chinquapin Ave

- 843 Camellia Place

- 861 Camellia Place Unit 63

- 863 Camellia Place

- 860 Magnolia Ave

- 850 Magnolia Ave

- 840 Magnolia Ave

- 830 Magnolia Ave

- 3665 Harding St Unit 75

- 823 Camellia Place

- 821 Camellia Place

- 880 Magnolia Ave

- 893 Camellia Place

- 3685 Harding St

- 810 Magnolia Ave

- 808 Magnolia Ave

- 811 Camellia Place

- 813 Camellia Place

- 860 Camellia Place

- 862 Camellia Place

- 788 Magnolia Ave