Estimated Value: $135,000 - $369,000

Studio

--

Bath

--

Sq Ft

5.75

Acres

About This Home

This home is located at 8411 Harris Rd, Lodi, OH 44254 and is currently estimated at $215,311. 8411 Harris Rd is a home located in Medina County with nearby schools including Cloverleaf Elementary School, Cloverleaf Middle School, and Cloverleaf High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 27, 2017

Sold by

Spitzer Mary

Bought by

Andras Jason M and Andras Ruth A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$118,000

Outstanding Balance

$26,321

Interest Rate

3.91%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$188,990

Purchase Details

Closed on

Sep 20, 2011

Sold by

Brodwolf Douglas R and Brodwolf Madelyn M

Bought by

Spitzer Mary E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$158,570

Interest Rate

4.14%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 14, 2011

Sold by

Brodwolf Douglas R and Brodwolf Madelyn M

Bought by

Spitzer Mary E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$158,570

Interest Rate

4.14%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Andras Jason M | $298,000 | None Available | |

| Spitzer Mary E | $247,000 | -- | |

| Spitzer Mary E | -- | Barristers Of Ohio |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Andras Jason M | $118,000 | |

| Previous Owner | Spitzer Mary E | $158,570 | |

| Previous Owner | Spitzer Mary E | $158,570 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,327 | $26,550 | $18,060 | $8,490 |

| 2023 | $1,050 | $26,550 | $18,060 | $8,490 |

| 2022 | $1,080 | $26,550 | $18,060 | $8,490 |

| 2021 | $876 | $20,910 | $14,220 | $6,690 |

| 2020 | $893 | $20,910 | $14,220 | $6,690 |

| 2019 | $898 | $20,910 | $14,220 | $6,690 |

| 2018 | $832 | $18,520 | $14,590 | $3,930 |

| 2017 | $833 | $18,520 | $14,590 | $3,930 |

| 2016 | $847 | $18,520 | $14,590 | $3,930 |

| 2015 | $800 | $17,150 | $13,510 | $3,640 |

| 2014 | $771 | $17,150 | $13,510 | $3,640 |

| 2013 | $712 | $17,150 | $13,510 | $3,640 |

Source: Public Records

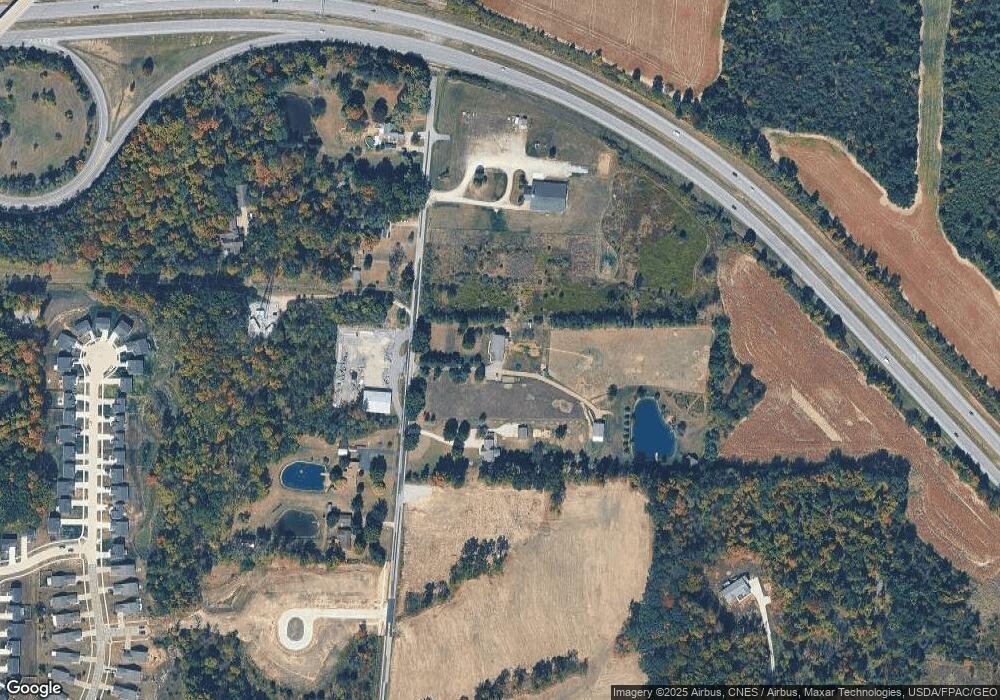

Map

Nearby Homes

- 501 Creek Bend Trail

- 516 Creek Bend Trail

- 8504 Lafayette Rd

- 720 Medina St

- 8123 Vandemark Rd

- 106 Anderson Cove Unit 206

- 0 Greenwich Rd Unit 5170888

- 312 Elyria St

- 108 River St

- 125 Bank St

- 134 S Market St

- 7595 Kings Creek Dr

- 37 Buffham Rd

- 7101 Greenwich Rd

- 8975 Highland Dr

- 6739 Mcvay Dr

- 8849 Concord Dr

- 8525 Broxton Ct

- 0 Cemetery Rd

- 0 Shaw Rd Unit 5168184

- 8411 Harris Rd

- 8433 Harris Rd

- 8368 Harris Rd

- 8436 Harris Rd

- 8456 Harris Rd

- 8334 Harris Rd

- 8334 Harris Rd

- 8350 Harris Rd

- 1028 Whisper Creek Ln

- 1020 Whisper Creek Ln

- 1024 Whisper Creek Ln

- 1023 Whisper Creek Ln

- 1027 Whisper Creek Ln

- 1026 Whisper Creek Ln

- 1022 Whisper Creek Ln

- 1021 Whisper Creek Ln

- 1025 Whisper Creek Ln

- 1016 Whisper Creek Ln

- 1036 Whisper Creek Ln

- 1039 Whisper Creek Ln

Your Personal Tour Guide

Ask me questions while you tour the home.