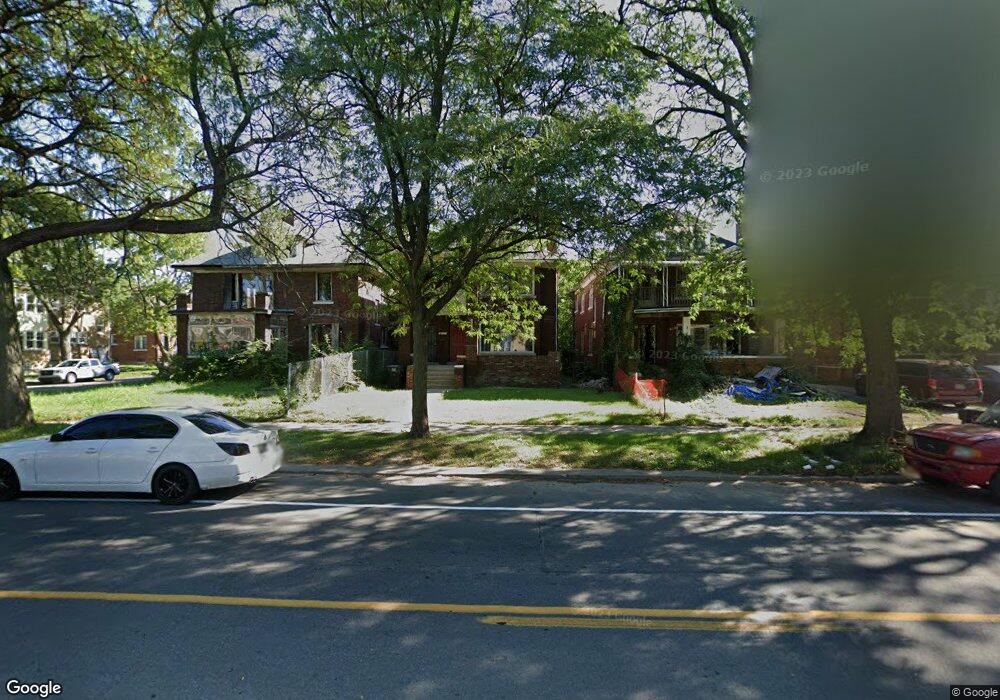

8430 Dexter Ave Detroit, MI 48206

Jamison NeighborhoodEstimated Value: $54,000 - $136,000

--

Bed

2

Baths

2,604

Sq Ft

$40/Sq Ft

Est. Value

About This Home

This home is located at 8430 Dexter Ave, Detroit, MI 48206 and is currently estimated at $104,612, approximately $40 per square foot. 8430 Dexter Ave is a home located in Wayne County with nearby schools including Thirkell Elementary School, Charles L. Spain Elementary-Middle School, and Edward 'Duke' Ellington Conservatory of Music and Art.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 17, 2020

Sold by

Humphries Salim and Gunter Candice

Bought by

Humphries Salim

Current Estimated Value

Purchase Details

Closed on

Jun 22, 2016

Sold by

The Detroit Land Bank Authority

Bought by

Humphries Salim

Purchase Details

Closed on

Jan 23, 2014

Sold by

Wayne County Treasurer

Bought by

Detroit Landbank Authority

Purchase Details

Closed on

Aug 15, 2006

Sold by

Lee Deante

Bought by

Jackson Sophia

Purchase Details

Closed on

Jun 18, 2002

Sold by

Jones Tanya

Bought by

Lee Deante

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$45,500

Interest Rate

6.22%

Purchase Details

Closed on

Sep 18, 2000

Sold by

Obrien Elizabeth

Bought by

Lee Deante

Purchase Details

Closed on

Jan 31, 2000

Sold by

Contimortgage Corp

Bought by

King Clarence

Purchase Details

Closed on

Sep 2, 1998

Sold by

Shrf Rodney Griffin Pr

Bought by

Trott Pc

Purchase Details

Closed on

Aug 8, 1997

Sold by

Solom Garland and Solom Michelle

Bought by

Griffin Rodney

Purchase Details

Closed on

Apr 21, 1995

Sold by

Bralen Inc

Bought by

Michelle Garland and Michelle Solomon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Humphries Salim | -- | None Available | |

| Humphries Salim | -- | None Listed On Document | |

| Humphries Salim | $1,000 | None Available | |

| Detroit Landbank Authority | -- | None Available | |

| Jackson Sophia | $90,000 | Metro Title Corp | |

| Lee Deante | $70,000 | -- | |

| Lee Deante | $25,000 | -- | |

| Jones Tanya | $20,000 | -- | |

| King Clarence | $22,000 | -- | |

| Trott Pc | $35,428 | -- | |

| Griffin Rodney | $29,900 | -- | |

| Michelle Garland | $21,422 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lee Deante | $45,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $174 | $6,800 | $0 | $0 |

| 2024 | $174 | $5,200 | $0 | $0 |

| 2023 | $460 | $4,300 | $0 | $0 |

| 2022 | $617 | $2,700 | $0 | $0 |

| 2021 | $502 | $2,100 | $0 | $0 |

| 2020 | $502 | $2,500 | $0 | $0 |

| 2019 | $499 | $1,800 | $0 | $0 |

| 2018 | $479 | $1,800 | $0 | $0 |

| 2017 | $40 | $2,100 | $0 | $0 |

| 2016 | $340 | $5,500 | $0 | $0 |

| 2015 | $1,472 | $0 | $0 | $0 |

| 2013 | $1,472 | $14,720 | $0 | $0 |

| 2010 | -- | $21,090 | $876 | $20,214 |

Source: Public Records

Map

Nearby Homes

- 3272 W Euclid St

- 3764 W Euclid St

- 3759 W Euclid St

- 3254 W Philadelphia St

- 8625 Dexter Ave

- 3757 Blaine St

- 3738 Vicksburg St

- 3785 Blaine St

- 3744 Blaine St

- 3791 Blaine St

- 3772 Blaine St

- 3813 Blaine St

- 8768 Dexter Ave

- 3738 Montgomery Ave

- 8776 Dexter Ave

- 3299 Montgomery St

- 3810 Carter St

- 4019 Carter St

- 2981 W Euclid St

- 3793 Gladstone St

- 8424 Dexter Ave

- 8438 Dexter Ave

- 8416 Dexter Ave

- 3347 W Philadelphia St

- 8408 Dexter Ave

- 3339 W Philadelphia St

- 8500 Dexter Ave

- 3331 W Philadelphia St

- 8400 Dexter Ave

- 3346 W Euclid St

- 3338 W Euclid St

- 3346 W Philadelphia St

- 8508 Dexter Ave

- 3327 W Philadelphia St

- 3334 W Euclid St

- 8439 Dexter Ave

- 8425 Dexter Ave

- 3324 W Euclid St

- 8518 Dexter Ave

- 3315 W Philadelphia St