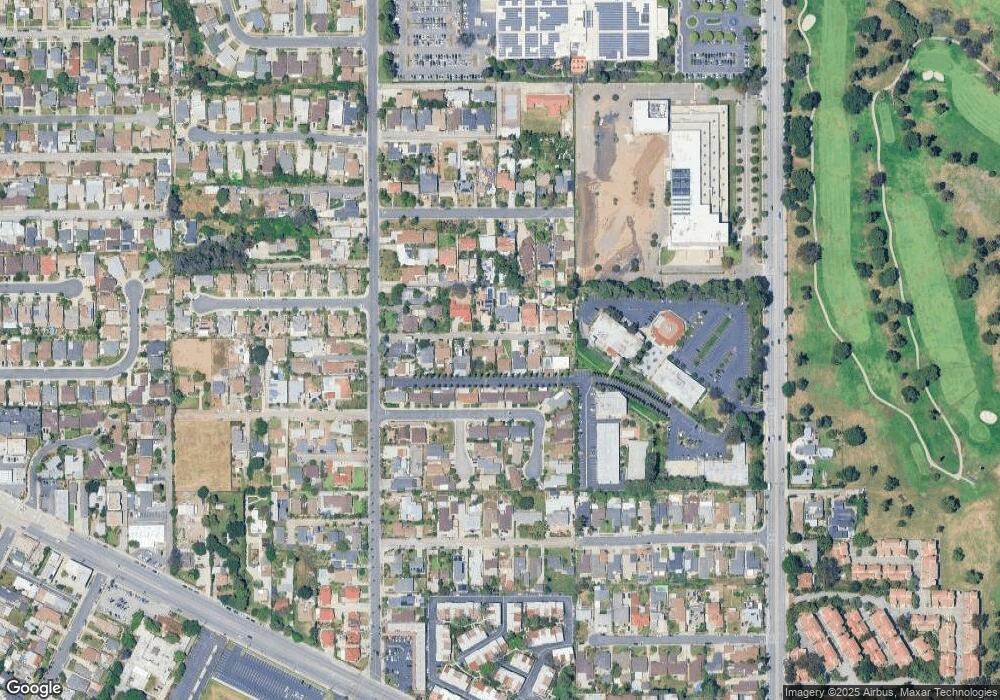

8436 Sarah St Rosemead, CA 91770

South San Gabriel NeighborhoodEstimated Value: $782,842 - $883,000

3

Beds

2

Baths

1,296

Sq Ft

$659/Sq Ft

Est. Value

About This Home

This home is located at 8436 Sarah St, Rosemead, CA 91770 and is currently estimated at $853,461, approximately $658 per square foot. 8436 Sarah St is a home located in Los Angeles County with nearby schools including Potrero Heights Elementary School, Macy Intermediate School, and Schurr High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 27, 2015

Sold by

Reams Lee E

Bought by

Reams Lee E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$157,031

Interest Rate

3.98%

Mortgage Type

New Conventional

Estimated Equity

$696,430

Purchase Details

Closed on

Jun 22, 2015

Sold by

Reams Lee E

Bought by

Reams Lee E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$157,031

Interest Rate

3.98%

Mortgage Type

New Conventional

Estimated Equity

$696,430

Purchase Details

Closed on

Jun 22, 2000

Sold by

Reams Lee E

Bought by

Reams Lee E and Reams Vivian

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Reams Lee E | -- | Title 365 | |

| Reams Lee E | -- | None Available | |

| Reams Lee E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Reams Lee E | $200,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,376 | $77,650 | $17,125 | $60,525 |

| 2024 | $1,376 | $76,129 | $16,790 | $59,339 |

| 2023 | $1,367 | $74,637 | $16,461 | $58,176 |

| 2022 | $1,327 | $73,175 | $16,139 | $57,036 |

| 2021 | $1,282 | $71,741 | $15,823 | $55,918 |

| 2019 | $3,890 | $69,614 | $15,354 | $54,260 |

| 2018 | $3,833 | $68,250 | $15,053 | $53,197 |

| 2016 | $3,770 | $65,601 | $14,469 | $51,132 |

| 2015 | $1,072 | $64,616 | $14,252 | $50,364 |

| 2014 | $1,067 | $63,351 | $13,973 | $49,378 |

Source: Public Records

Map

Nearby Homes

- 8315 Sierra Bonita Ave

- 1188 Walnut Grove Ave Unit A

- 8580 Village Ln

- 1045 Walnut Grove Ave

- 1525 San Gabriel Blvd

- 8340 Rush St Unit 41

- 1914 Rosebrook Ln

- 8338 Rush St

- 8341 Amber Rose Ln

- 8531 El Camino Dr

- 1070 Walnut Grove Ave Unit F

- 185 Orchid Ct

- 598 Alder Way

- 1604 N Jerseydale Ave

- 824 Muscatel Ave

- 0 Montebello Blvd

- 774 Muscatel Ave

- 1765 Neil Armstrong St Unit 202

- 1725 Neil Armstrong St Unit 103

- 1728 Mountain Terrace Ln