8437 Samra Dr Canoga Park, CA 91304

Canoga Park NeighborhoodEstimated Value: $917,118 - $1,090,000

4

Beds

2

Baths

1,894

Sq Ft

$528/Sq Ft

Est. Value

About This Home

This home is located at 8437 Samra Dr, Canoga Park, CA 91304 and is currently estimated at $1,000,030, approximately $527 per square foot. 8437 Samra Dr is a home located in Los Angeles County with nearby schools including Christopher Columbus Middle School, Justice Street Academy Charter, and Pomelo Community Charter.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 2, 2025

Sold by

Weber William S and Weber Susan J

Bought by

Weber Family Trust and Weber

Current Estimated Value

Purchase Details

Closed on

Jan 17, 1995

Sold by

Bank Of America National Tr & Svgs Assn

Bought by

Weber William S and Weber Susan J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$132,000

Interest Rate

8.37%

Purchase Details

Closed on

Feb 4, 1994

Sold by

Resolution Trust Corp

Bought by

Bank Of America National Tr & Svgs Assn

Purchase Details

Closed on

Jan 20, 1994

Sold by

G S L Financial Corp

Bought by

Guardian Fed Svgs Assn Fa and Guardian S&L Assn

Purchase Details

Closed on

Jan 8, 1993

Sold by

Grant Harry and Grant Ida

Bought by

Grant Harry and Grant Ida

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Weber Family Trust | -- | None Listed On Document | |

| Weber William S | $165,000 | World Title Company | |

| Bank Of America National Tr & Svgs Assn | -- | World Title Company | |

| Guardian Fed Svgs Assn Fa | $142,488 | North American Title Company | |

| Grant Harry | -- | -- | |

| Grant Harry | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Weber William S | $132,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,834 | $304,032 | $155,020 | $149,012 |

| 2024 | $3,834 | $298,072 | $151,981 | $146,091 |

| 2023 | $3,763 | $292,228 | $149,001 | $143,227 |

| 2022 | $3,593 | $286,499 | $146,080 | $140,419 |

| 2021 | $3,540 | $280,882 | $143,216 | $137,666 |

| 2019 | $3,436 | $272,553 | $138,969 | $133,584 |

| 2018 | $3,329 | $267,210 | $136,245 | $130,965 |

| 2016 | $3,163 | $256,836 | $130,955 | $125,881 |

| 2015 | $3,117 | $252,979 | $128,988 | $123,991 |

| 2014 | $3,135 | $248,025 | $126,462 | $121,563 |

Source: Public Records

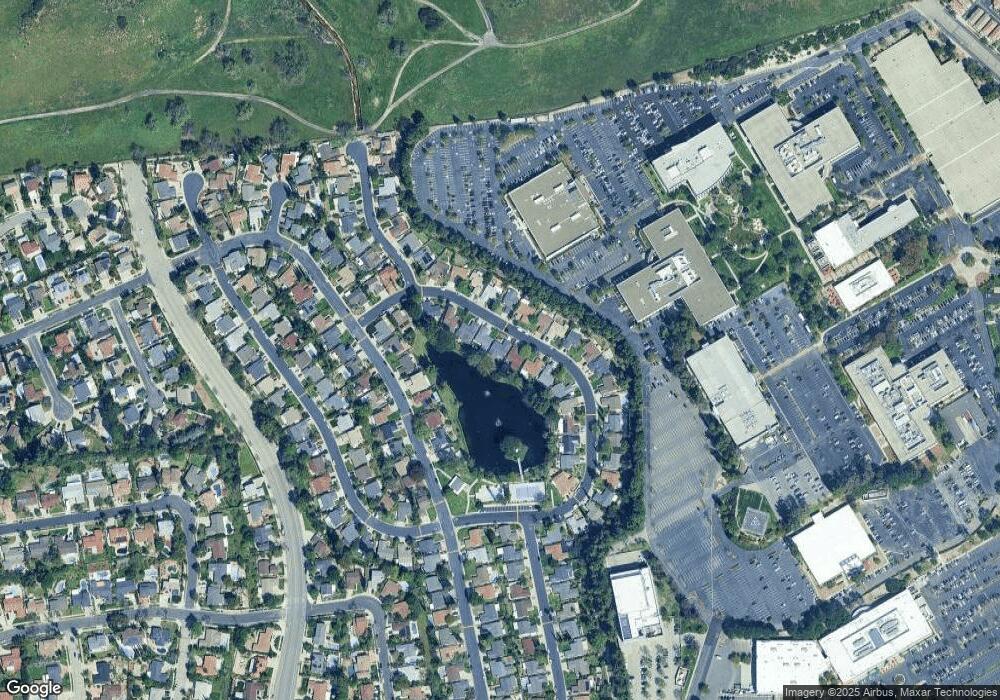

Map

Nearby Homes

- 8373 Denise Ln

- 8404 Joan Ln

- 22824 W Olive Way

- 8324 Joan Ln

- 8565 N Walnut Way

- 8108 Royer Ave

- 8225 Fallbrook Ave

- 22906 Lanark St

- 8208 Fallbrook Ave

- 23200 Justice St

- 23546 Community St

- 7925 Royer Ave

- 22700 Baltar St

- 7839 Lena Ave

- 8510 Capistrano Ave

- 7729 Sedan Ave

- 23676 Justice St

- 7957 Sausalito Ave

- 22345 Cantara St

- 23774 Burton St